S&P 500, Nasdaq and Russell 2000 Shift Net Bearish in Technical Strength

2025.01.15 02:57

There were early signs of recovery for some markets, but now all lead markets are showing net bearish technicals.

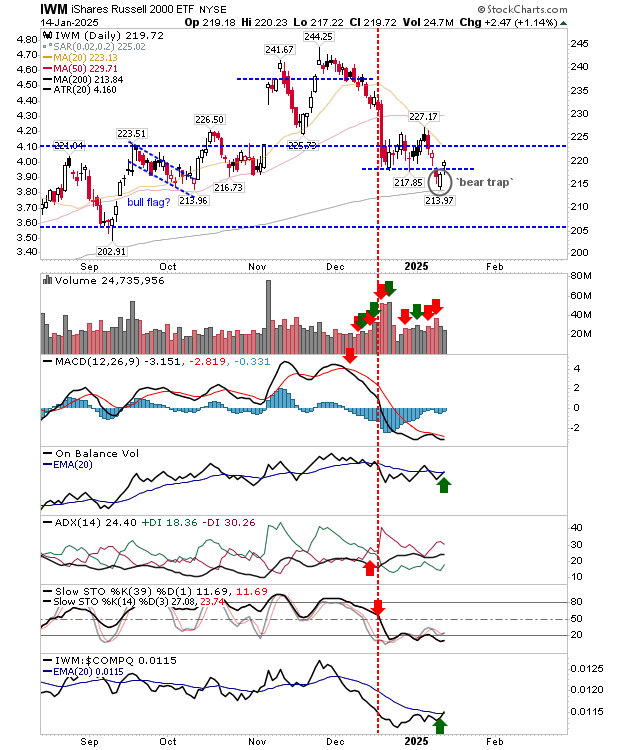

If you are a trading bull looking for silver linings, the () successfully tested its 200-day MA yesterday and left with a ‘bear trap’ yesterday.

There was a ‘bull’ cross in On-Balance-Volume and in relative performance against the .

But I wouldn’t be buying the Porsche on this. The 20-day MA was resistance for the Santa Rally and could prove to be resistance again by the end of week.

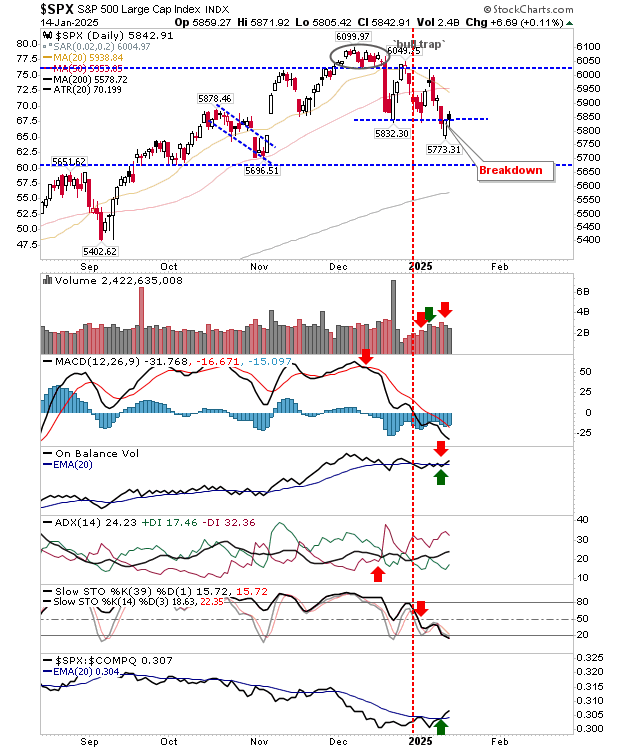

The may also come away with a ‘bear trap’ but yesterday’s ‘black’ candlestick finished on the deciding line. There was a new ‘buy’ signal in On-Balance-Volume along with a relative performance uptick against the Nasdaq.

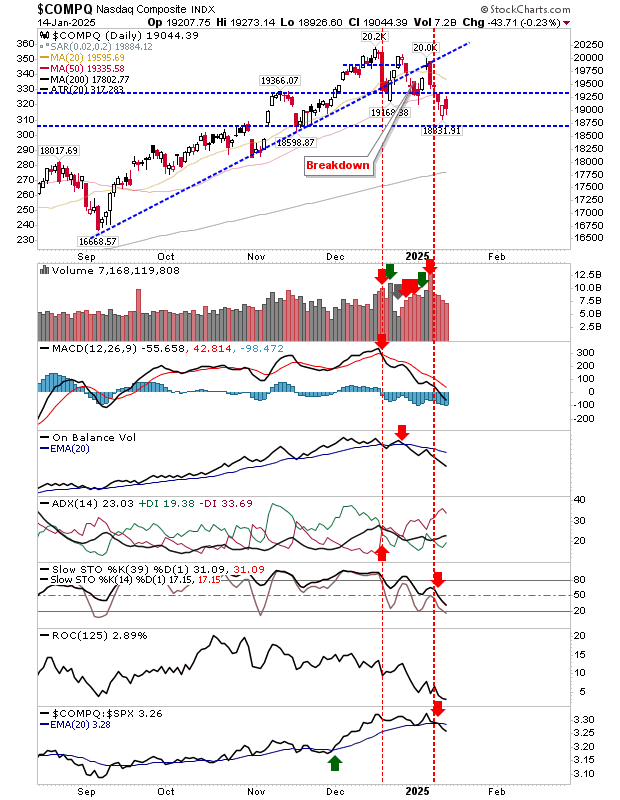

The is on a clear breakdown with net bearish technicals, but it’s not oversold, so further losses are likely.

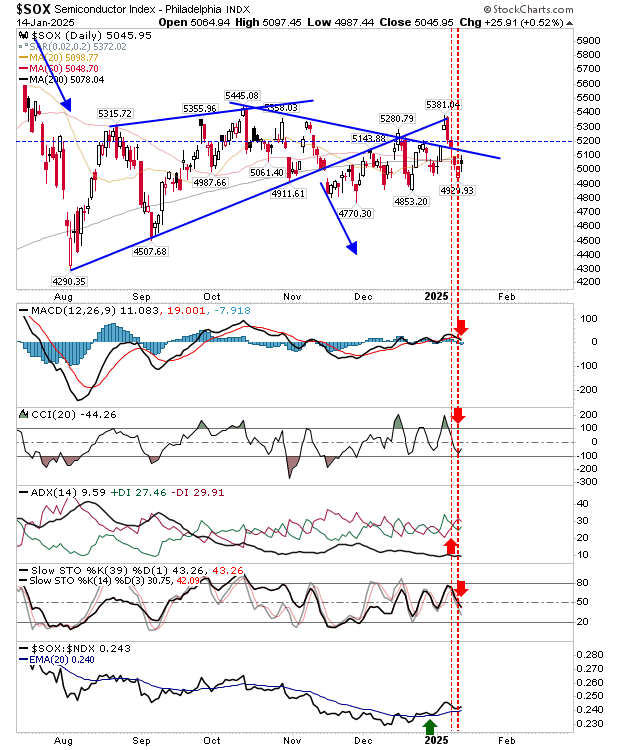

The canary in the coal mine is the .

It did a combination break of trend and moving average support in November, and it has been meandering below these moving averages since the break. Technicals are net bearish but like the Nasdaq are not oversold.

The ‘bear traps’ in the Russell 2000 and S&P will be vulnerable to any losses today; ‘bear traps’ should remain distinct relative to support and not get challenged. If markets do rally today then look for 20-day MAs as end-of-week targets.