S&P 500, Nasdaq 100 React to Strong US Data as Rate Cut Outlook Shifts

2025.01.08 04:05

- Stronger-than-expected US economic data (JOLTs job openings and ISM Services Index) weigh on US Indices.

- Markets exhibited sensitivity to monetary policy expectations and potential volatility, with sector performance varying.

- Technical analysis of the S&P 500 suggests a range-bound market with key support and resistance levels identified.

- Upcoming non-farm payrolls and Fed meeting minutes releases are expected to further influence market volatility.

US Indices and stocks are on course to end two consecutive days of gains following a batch of strong US data. The data fueled speculation that any potential rate cuts in 2025 would come later in the year, evidenced by the fact that traders no longer fully price in a Fed rate cut before July.

US ISM Services and JOLTs Data Smash Estimates

The US Labor Department reported 8.098 million job openings in November, higher than the 7.7 million economists surveyed by Reuters had expected.

Additionally, an survey showed that services activity in December remained strong with a reading of 54.1, beating the expected 53.3 and improving from the previous month.

The robust data has added to expectations around rate cuts from the Federal Reserve this year.

Markets Remain Sensitive to Monetary Policy Expectations

If today’s data confirmed anything it is that markets will remain sensitive to changes in monetary policy expectations moving forward. There is also the belief that extremely high valuations have left markets and US stocks more sensitive to volatility shocks.

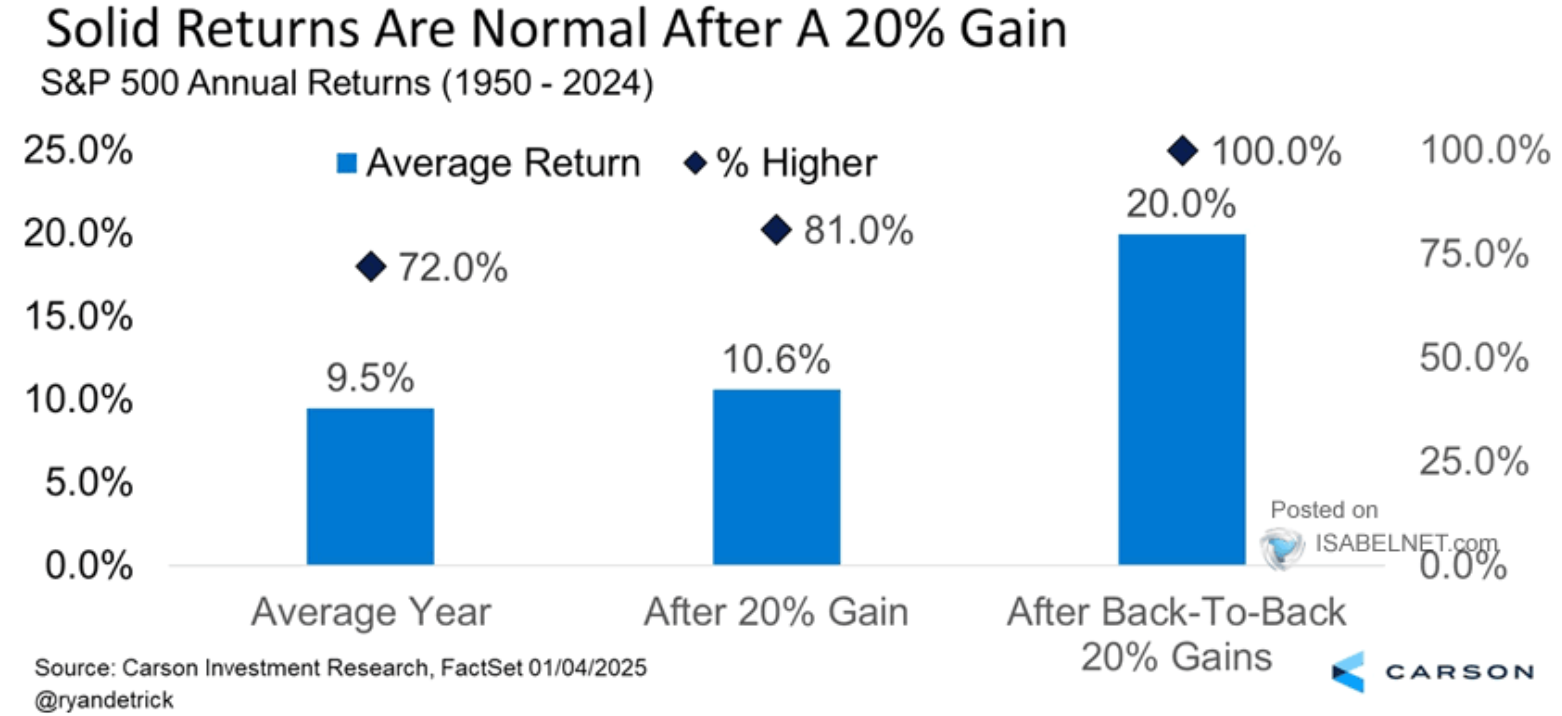

However, despite these high valuations and a stellar 2024, the election of Donald Trump as well as historical data appear to support further gains.

Bulls rejoice when the posts a 20% annual return. Historically, the following year has seen positive returns 81% of the time, with an average gain of 10.6% since 1950.

Source: Isabelnet, Carson Research

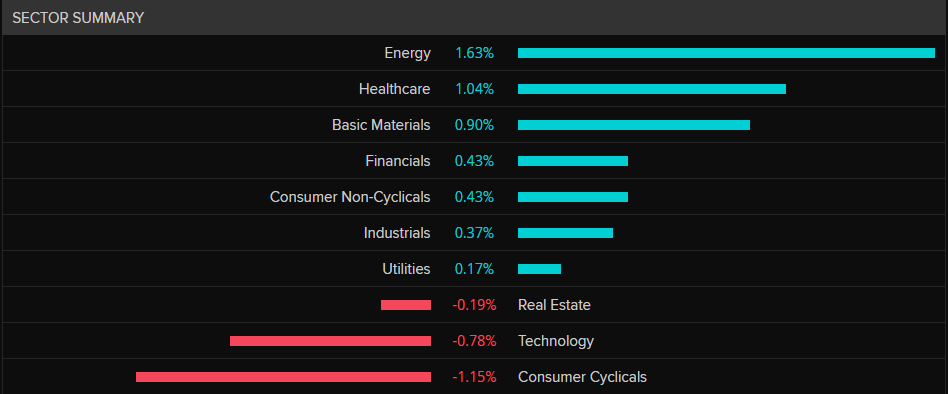

Winners and Losers

Looking at the sector performance today as well as individual winners and losers thus far, stocks saw a 1% rise, leading gains in the S&P 500 sectors. Vaccine makers like Moderna (NASDAQ:), Novavax (NASDAQ:), and Pfizer (NYSE:) jumped due to rising worries about bird flu.

Tesla (NASDAQ:) shares fell 2.9% after BofA Global Research downgraded the stock from “buy” to “neutral,” which also impacted the consumer discretionary sector.

Micron Technology (NASDAQ:) rose 5% following comments from Nvidia’s CEO, Jensen Huang, that the company is supplying memory for Nvidia’s new GeForce RTX 50 Blackwell gaming chips.

Big banks performed well, with Citigroup (NYSE:) increasing by 0.3% after positive coverage from Truist Securities, and Bank of America gaining 0.6% thanks to favorable ratings from several analysts.

Source: LSEG

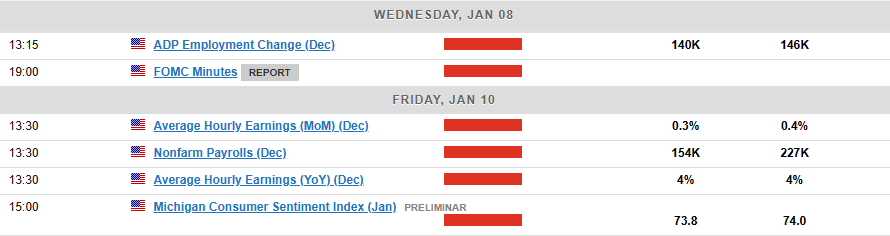

The Week Ahead

This week, the main highlights are the important non-farm payrolls report and the release of the Fed’s December meeting minutes due on Wednesday and Friday respectively.

Judging by today’s reaction, volatility seems to be a given. The bigger question right now is whether any moves to the downside remain sustainable or are they just opportunities for potential longs to get involved?

Technical Analysis

S&P 500

From a technical standpoint, the S&P 500 remains in somewhat of a range having broken the previous bullish structure that was in play.

The overall price action picture does remain bearish following the daily candle close on December 18, 2024. Since then the Index has printed a lower high but failed to print a lower low.

This could be seen as a sign of the bullish pressure and overall buoyant mood toward US stocks in general.

More recently the index has failed to break the 6025 swing high or the 5828 swing low, keeping it confined in a +- 100 point range.

A break of the swing high at 6025 could facilitate a move toward the all time just above and potentially the next key area on the upside around 6170. (based on a triangle pattern breakout yet to be fulfilled).

A continuation of today’s bearish move may find support at 5910 and 5828 which rests just above the 100-day MA, making this a key area of support.

A break of this key support level could pave the way for a deeper retracement toward the 5700 swing low from October 31, 2024.

S&P 500 Daily Chart, January 7, 2025

Source: TradingView

Support

Resistance

Original Post