S&P 500: More Uncertainty for Stock Market, Which Direction Next?

2024.10.08 10:27

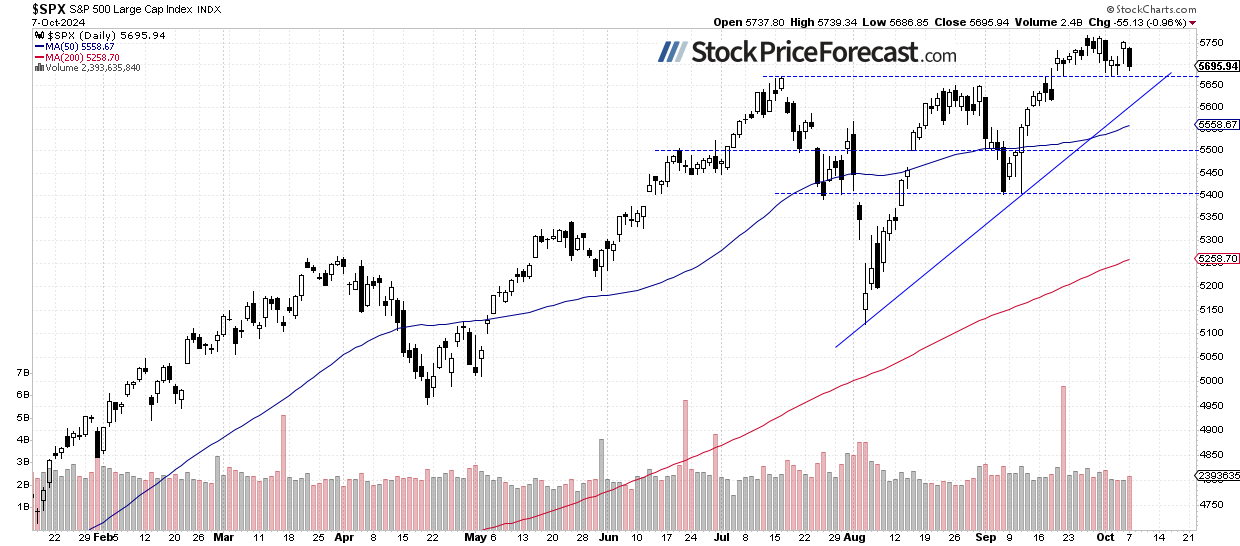

Stock prices retraced Friday’s gains on Monday as tensions surrounding the Middle East conflict increased. The lost 0.96%, but it remained within its recent trading range. This morning, it is expected to open 0.4% higher, further extending its sideways movement.

I still think the market is forming a top, and the seasonal pattern suggests the low of the correction may occur in October.

Investor sentiment slightly worsened last week, as shown by last Wednesday’s AAII Investor Sentiment Survey, which reported that 45.5% of individual investors are bullish, while 27.3% of them are bearish, up from 23.7% last week.

The S&P 500 continues to trade within a consolidation, as we can see on the daily chart.

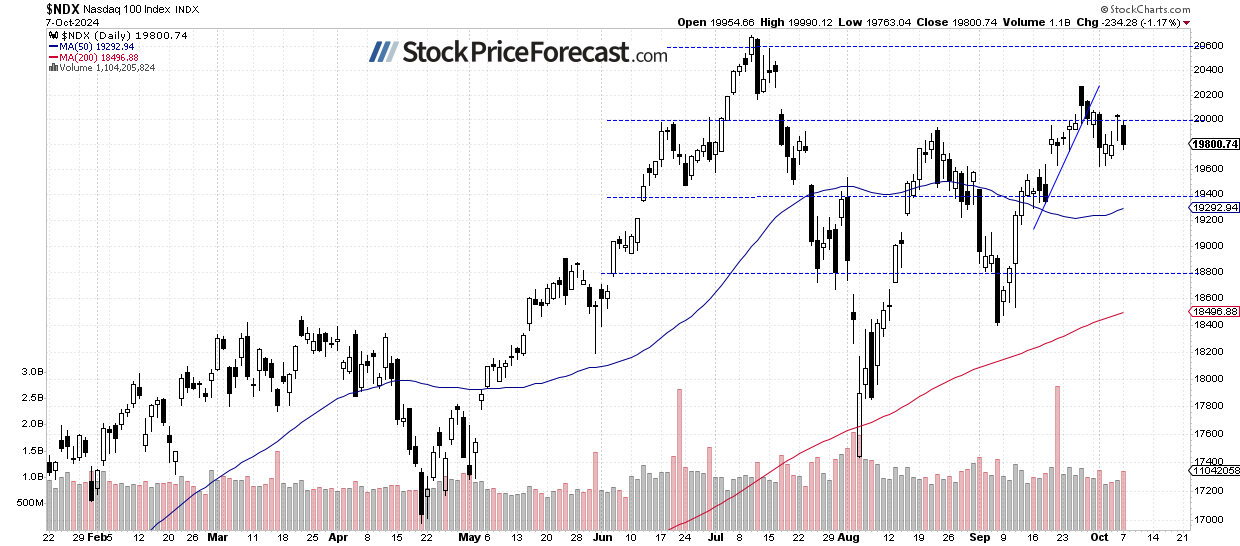

Nasdaq 100 Pulled Back Below 20,000 Again

The lost 1.17% on Monday, after gaining 1.2% on Friday. The market remains in consolidation around the 20,000 level, but it pulled back below that mark yesterday. This morning, the Nasdaq 100 is expected to open 0.4% higher, as indicated by futures contracts. Resistance remains at 20,250.

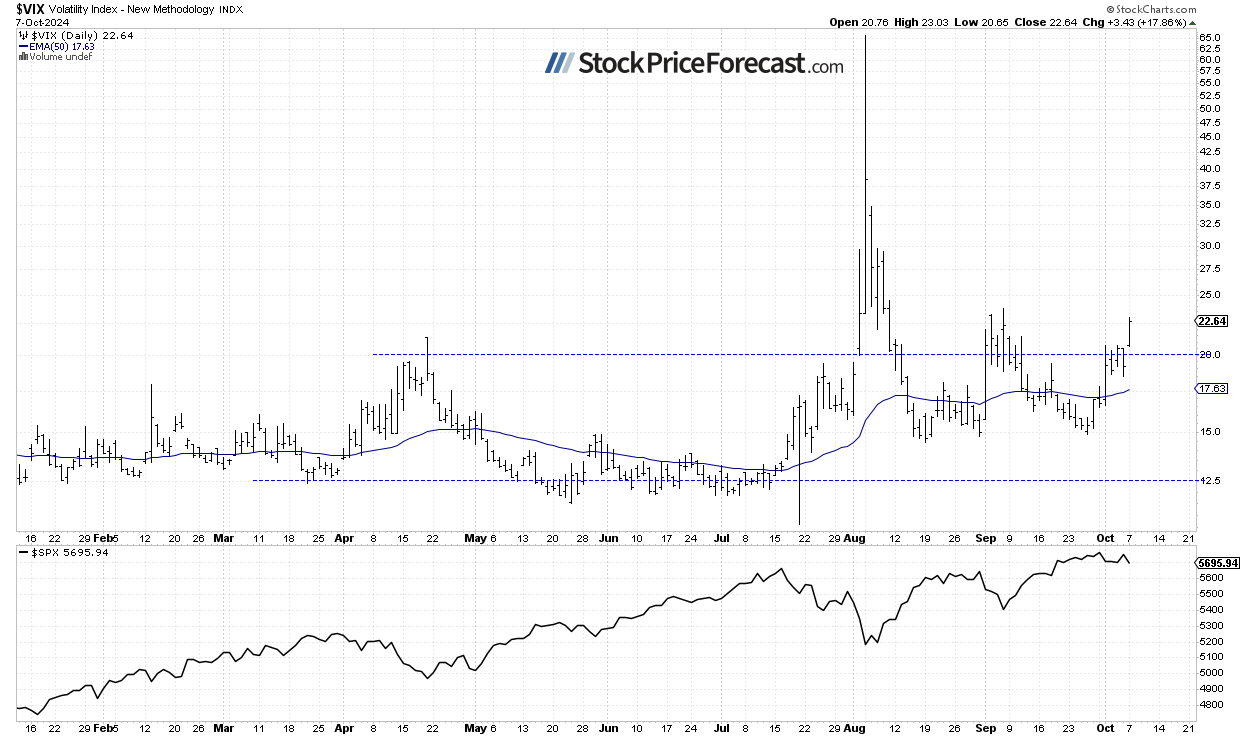

VIX Moved Higher

On September 6, the , a measure of market fear, reached a local high of 23.76. It was indicating elevated fear among investors. However, a stock rebound followed by a record-breaking rally pushed the VIX lower. On the previous Thursday, it fell to 14.90, its lowest level since late August. However, yesterday it climbed again, reaching 23.03, signaling rising investor fear.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

Futures Contract Continues Moving Sideways

Let’s take a look at the hourly chart of the contract. Yesterday, it pulled back to the support level around 5,725, but this morning, it’s trading around the 5,750-5,770 level again. Resistance remains at 5,800, and the market’s direction appears inconclusive.

Conclusion

Today’s session is likely to open on a positive note, with the S&P 500 rebounding after yesterday’s nearly 1% decline. Will the market approach its recent highs and the 5,800 level again? For now, it seems likely to continue its consolidation.

Investors are awaiting Thursday’s release and the upcoming quarterly earnings season.

Last Tuesday, I wrote:

“The key question is whether the uptrend will continue despite overbought conditions. While no clear negative signals have appeared, the rally seems overstretched.”

The question remains: is this a topping pattern before some more meaningful downward correction or just a consolidation before another leg up?

I opened a speculative short position in the S&P 500 futures contract on September 16.

In my Stock Price Forecast for October 2024, I wrote:

“The market extended its uptrend in September after rebounding from the early August low. No clear negative signals have surfaced; however, a correction could still occur. Historically, October is a seasonally weak month, especially during its first weeks. Will the stock market sell off soon? Although monetary policy easing supports the bulls, uncertainty surrounding geopolitical risks and the upcoming presidential election may still weaken sentiment.”

For now, my short-term outlook remains bearish.

Here’s the breakdown:

- The S&P 500 is likely to rebound after yesterday’s pullback, extending consolidation.

- The market may still be forming a topping pattern before a downward correction.

- In my opinion, the short-term outlook is bearish.