S&P 500: Medium-Term Trends Remain Bullish

2024.09.26 04:17

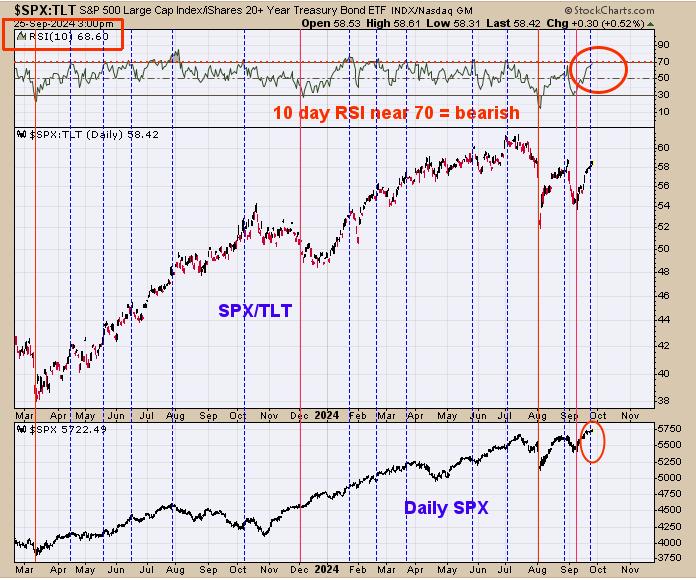

We are up over 28% this year so far; up around 20%. The middle window on the chart above is the SPX/ ratio and the top window is the RSI for this ratio. Short-term highs can be found on the SPX when the RSI for this ratio reaches near 70 and higher (current RSI stands at 68.60).

We noted on the chart above when the RSI of this ratio reached near 70 and higher with blue dotted lines. Combining this indicator with the indicator on page two suggest the market will have limited upside if not start a pullback.

The market is getting frothy. The bottom window is the 10-day average of the equity put/call ratio and next higher window is the 5-day average. Both timeframes hit in the bearish territory over the last several days. We circled in red the times on the SPX window when both timeframes hit bearish territory.

At a minimum the upside on the SPX was limited and in most case, a pullback started. Bigger trends remain bullish and new higher highs later this year is possible but the next month or so could be choppy.

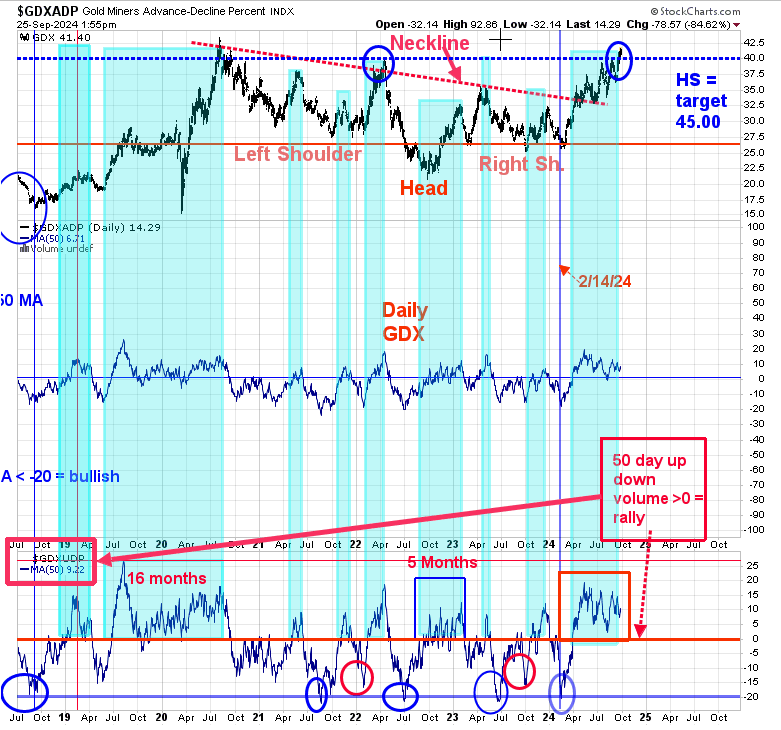

The top window is the GDX and the bottom window is the 50-day average of the up-down volume percent for GDX. Uptrend in GDX is in force when the 50-day average of the up-down volume is above “0” (current reading is +9.22). The 50-day up-down volume indicators are signals that may last several months. There will be consolidation along the way in the current bull market but may last a couple of months or so, but higher highs and higher lows will be expected.

We noted on the chart above is shaded green when this indicator is above “0”. The weekly and monthly charts for GDX remain bullish and signals of these types last for 1 ½ years to as long as four years.

- Monitoring purposes;Sold long 9/13/24 at 5626.02= gain 2.23%; Long SPX on 9/5/24 at 5503.41.

- Sold SPX on 8/19/24 at 5608.25 = Gain 8.14%gain; Long SPX on 8/5/24 at 5186.33.

- Our Gain 1/1/23 to 12/31/23 SPX= 28.12%; SPX gain 23.38%

- Monitoring purposes : Long on 10/9/20 at 40.78.