S&P 500 Keeps Eking Out Gains but Market Internals Are Flashing a Warning Sign

2024.06.27 02:54

The edged higher, managing to advance by around 16 bps yesterday. Elsewhere, stocks finished mostly lower, with the dropping by 20 basis points and the S&P 500 EQUAL Weight ETF (NYSE:) dropping by 40 bps. That’s because the S&P 500 saw 327 declining stocks versus only 173 advancers.

The dispersion between the S&P 500, the , and the RSP is not quite wide, with the S&P 500 up 14.8%, the RSP up 3.9%, and the IWM up just 0.3% year to date.

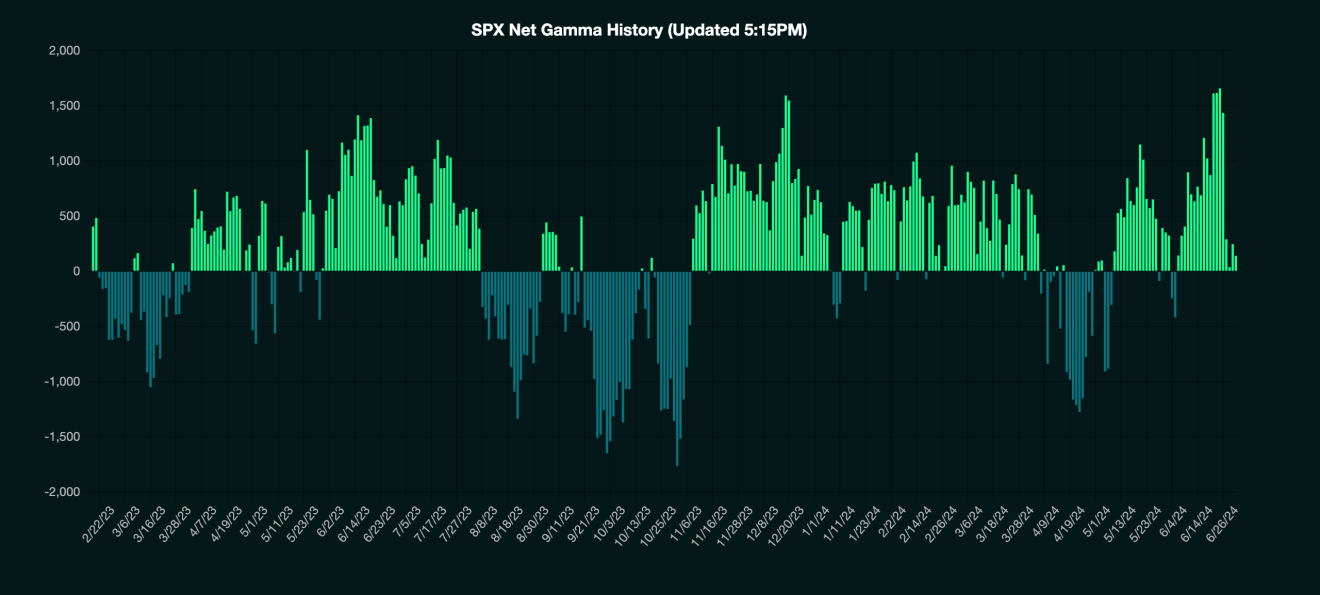

At least for yesterday, the zero gamma level at 5,450 was a big help to prop the S&P 500 up. That level will need to break to see the gamma levels turn negative and potentially see volatility expand in the S&P 500 market cap weight index. For now, the level held on a couple of occasions over the last few days.

Data from GammaLab shows a collapse in gamma levels, which normally leads to a great deal of volatility in the market. When gamma levels are very high, we tend to see very tight trading ranges, which really makes the price action the first three days of this week beyond strange.

(GAMMALAB)

Additionally, the last few days have seen a huge drop in reserve balance, as noted by the rising reverse repo facility. When coupling the changes in the reserve balance with the volumes traded in the overnight funding market, liquidity is lower, and typically, the S&P 500 trends with these liquidity flows.

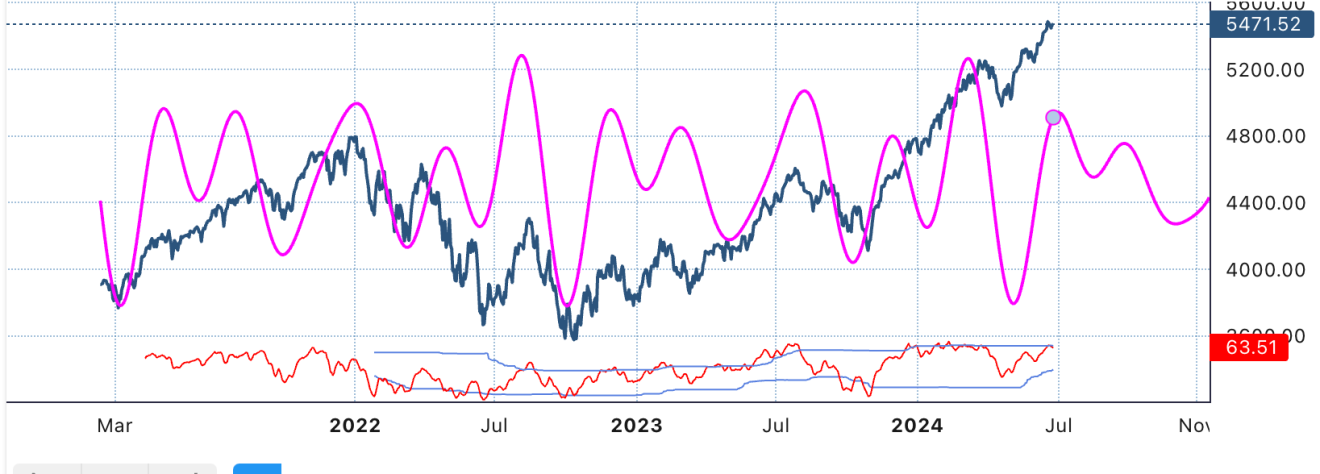

So, conditions are in place, which were fully expected late last week, and the S&P 500 should be on shaky ground, but to this point, those conditions have not been shown. Even the cycles suggest that the index could be turning here at this point with an overbought cyclic RSI.

(Cycles.org)

US Dollar Keeps Moving Higher Ahead of PCE

Meanwhile, the has been ripping lately, nearly breaking the upper side of a symmetrical triangle.

This was driven partially by the exploding to levels not seen since 1986 and the risk of the USD/JPY going even higher.

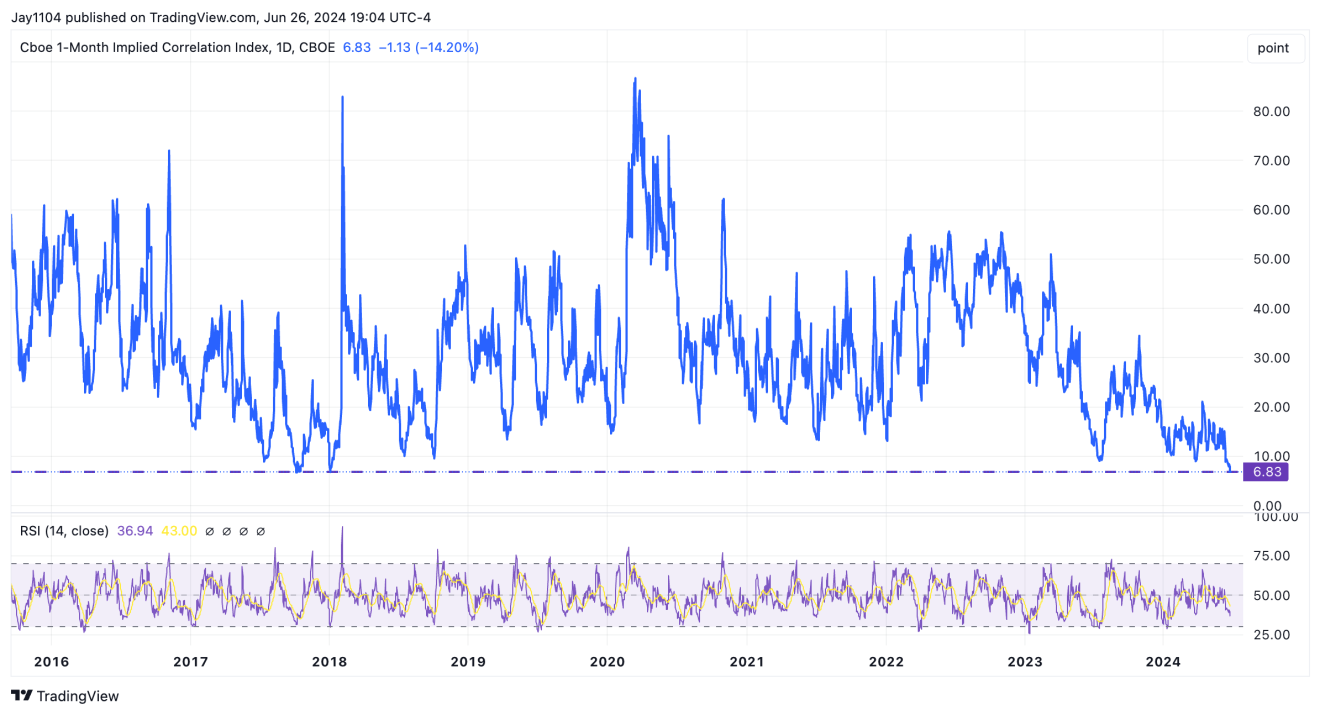

The 1-month implied correlation index came within a whisker of making a new all-time closing low yesterday, likely due to an implied volatility dispersion trade taking place at the moment.

Meanwhile, the has this giant ascending broadening wedge that has formed.

We will see if Micron’s only slightly better 3Q results and in-line 4Q guidance, along with a conference call that seemed to hold promise but was lacking in the details, will lead to the lower bound of the trend line in the SMH breaking.

Micron (NASDAQ:) is trading down by around 7% after hours. As that nearly 170% IV for the options expiring on Friday comes crashing down, and all the calls above $140 burn premium today, that $130 level is very important.

But remember, whatever AI can’t achieve, chickens can because the factory is still working hard as the stock continues to hug the uptrend, which forms a rising wedge and approaches a potential apex.

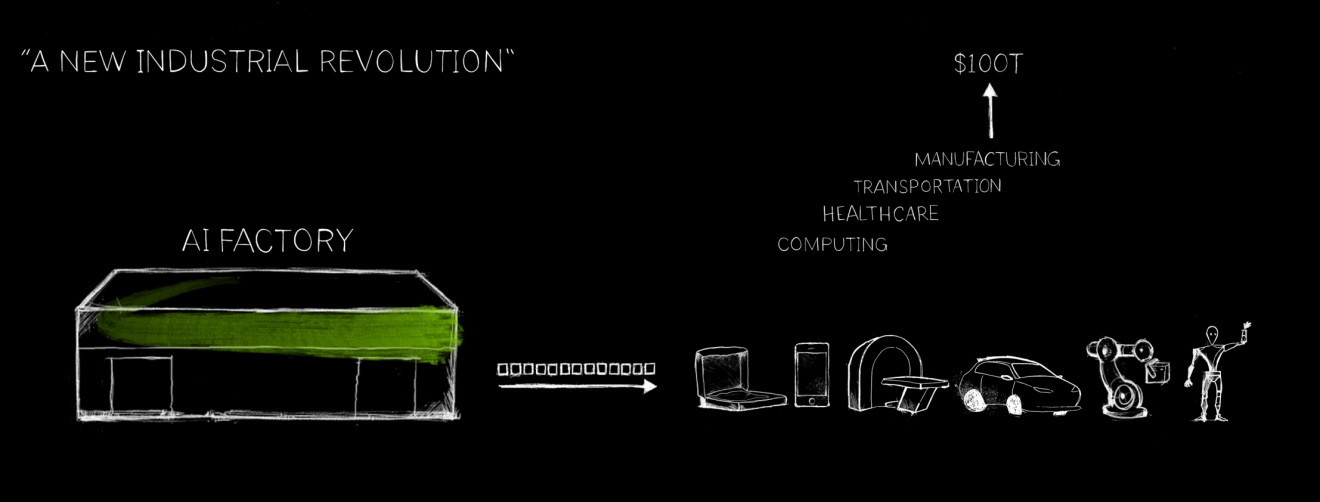

Meanwhile, Nvidia (NASDAQ:) noted $100 trillion in opportunities with the AI factory of the future. These opportunities will engulf the entire global GDP with it. According to Statista, Global GDP is expected to be about $110 trillion in 2024 and almost $130 trillion by 2029.

So, will these $100 trillion be minted in the future? Is the Fed doing a giant QE program? Maybe the Treasury plans to issue a $100 trillion bill, or perhaps the AI factories will take all industry away from every corner of the globe like the Matrix took over the earth from the humans? I guess we will find out. Does anyone stop to think about what these numbers mean? How does one even quantify that type of number?

(Nvidia)

Original Post