S&P 500: Hidden Risks Lurk in Overreliance on Tech Titans

2023.09.06 03:53

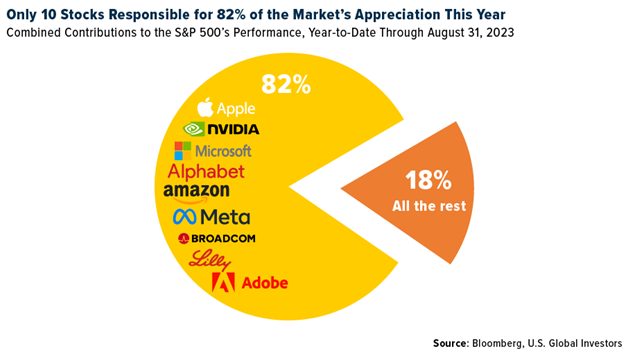

Stocks are up 18.7% year-to-date, which is good news for portfolios and 401(k)s, but did you know that most of the heavy lifting has been done by a very small number of stocks?

You may be surprised to learn that more than 80% of gains so far in 2023 are due to the performance of only 10 companies, starting with Apple (NASDAQ:). The iPhone maker, valued at just under $3 trillion, contributed a not insignificant 15.6% to the market’s moves.

Top 10 Stocks Market Cap

Apple was followed by a who’s who of mostly Silicon Valley and artificial intelligence (AI) companies. These include, in descending order, graphics card manufacturer NVIDIA (NASDAQ:) (responsible for 15.4% of the gains), Microsoft (NASDAQ:) (12.0%), Google parent Alphabet (NASDAQ:) (9.6%, combining Class A and Class C shares), Amazon (NASDAQ:) (8.6%), Facebook parent Meta Platforms (NASDAQ:) (7.0%), Tesla (NASDAQ:) (6.5%), semiconductor firm Broadcom (NASDAQ:) (2.7%), drugmaker Eli Lilly (NYSE:) (2.7%) and Adobe (NASDAQ:) (1.8%).

There are a number of implications here that investors should be aware of, the most important being a lack of diversification. Investors who own an S&P 500 index mutual fund or ETF may be more exposed to concentration risk than they realize. Because the S&P is capitalization-weighted, superstar companies like Apple and Microsoft have a disproportionately massive impact on the index’s performance.

Also, consider vulnerabilities to sector-specific risks. Most of the S&P 500’s gains in 2023 came courtesy of a single sector: technology. Any regulatory changes, economic shifts or other potential risks affecting tech will, once again, have a disproportionate influence on the index and any portfolios tracking it.

The Case for Sector Rotation

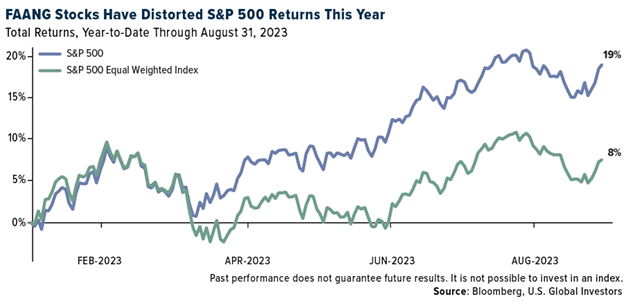

This may be easier to visualize if we compare the year-to-date performances of the S&P 500—which is weighted by market cap, remember—and the (EWI). As the name implies, the EWI includes the same 500 names as the original recipe index, but each company is given a fixed weight of 0.2%. Apple, then, has the same allocation as much smaller companies like Ralph Lauren (NYSE:) (market cap: $7.65 billion) and Alaska Air (NYSE:) ($5.74 billion).

As you can see, the market cap-weighted index significantly outperformed the EWI, 19% to 8%.

FAANG Stocks Returns This Year

Given the current tech-sector focus, a sector rotation strategy may make sense for some investors. Historically, leadership among sectors changes over time due to various factors such as interest rates, economic cycles, consumer sentiment, and more. In a different economic environment, the next sector to lead the market could be financials or health care.

Though (tech) equities have been the star performers this year, it may be wise for investors to reconsider the role of other asset classes, including bonds, commodities, real estate, and . Many of these assets often have low correlations with stocks and could offer a cushion in times of volatility.

As loyal readers know, I recommend a 10% weighting in gold, with 5% in physical bullion and jewelry and the other 5% in high-quality gold mining stocks and funds.

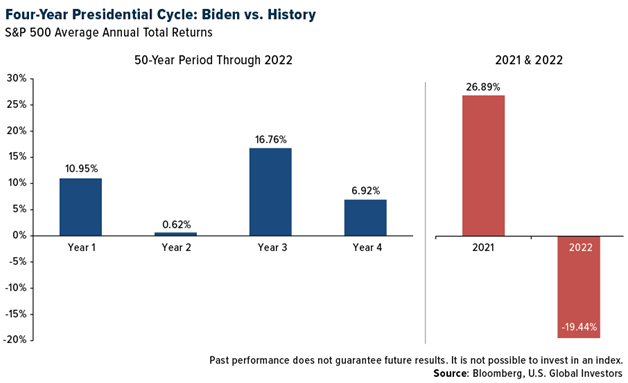

The Four-Year Presidential Cycle

Another factor for investors to keep in mind is seasonality—specifically, the four-year presidential election cycle, something I’ve written about many times before. The third year of a president’s term has historically performed better than the other three years, the reason being perhaps that he’s looking ahead to reelection at the end of year four and is focused on market-friendly policies to support the economy.

Biden vs History

Whether that’s the case with Joe Biden is up for debate, but the market’s respectable performance so far this year—the third of Biden’s four-year term—is in line with historical precedent.

Of course, none of this accounts for the risk factors I already mentioned, like geopolitical tensions, inflation, or unexpected economic downturns. Although it doesn’t guarantee positive returns, a diversified portfolio is still preferred for risk mitigation.

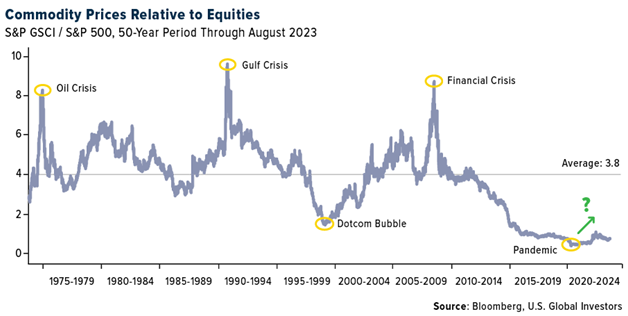

The Dawn of a New Commodities Bull Market?

Speaking of diversification. We could be on the cusp of another structural bull market in commodities if Stifel analysts’ projections are correct. In a report published last week, the financial services company suggests that metals and minerals are gearing up to dominate the market for the next decade after 13 years of underperforming stocks and fixed income. Indeed, commodity prices have not been keeping pace with equities, but that may be soon to change.

Commodity Prices vs Equities

As Stifel sees it, a “perfect storm” of factors is stirring the pot, including the emergence of ESG (environmental, social, and governance) investing, which has hiked up capital costs in the commodities sector, making higher returns imminent. Policies leaning toward the electrification of everything—think electric vehicles (EVs) and smart grids—are also going to tighten supply elasticity while increasing demand.

BRICS+ nations (Brazil, Russia, India, China, and South Africa) are adding inflationary pressure to the mix by ramping up commodity demand. Western countries, meanwhile, are in debt up to their eyeballs, meaning the current monetary tightening cycle may be followed by a prolonged period of loose policymaking—good news for real, non-interest-bearing assets like commodities, gold, and other minerals.

Besides gold, I prefer metals that will increasingly see higher demand as a result of decarbonization and electrification efforts. These include , lithium, nickel, cobalt, and .

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The S&P GSCI provides investors with a reliable and publicly available benchmark for investment performance in the commodity markets.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2023): Alaska Air Group Inc.

Disclosure: All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate for every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.