S&P 500 Futures Hit Buy Levels – Bounce in the Offing Now?

2024.10.01 05:39

have been mostly sideways over the past seven sessions, with a tight range between 5756 and 5820, reflecting a lack of momentum.

Emini Nasdaq December hit my target zone and presented a buying opportunity at 42350/250. The session range was between 20056 and 20287.

Emini Dow Jones December longs at 42350/250 worked out perfectly, reaching both targets before the close. The session high and low were 42245 and 42715.

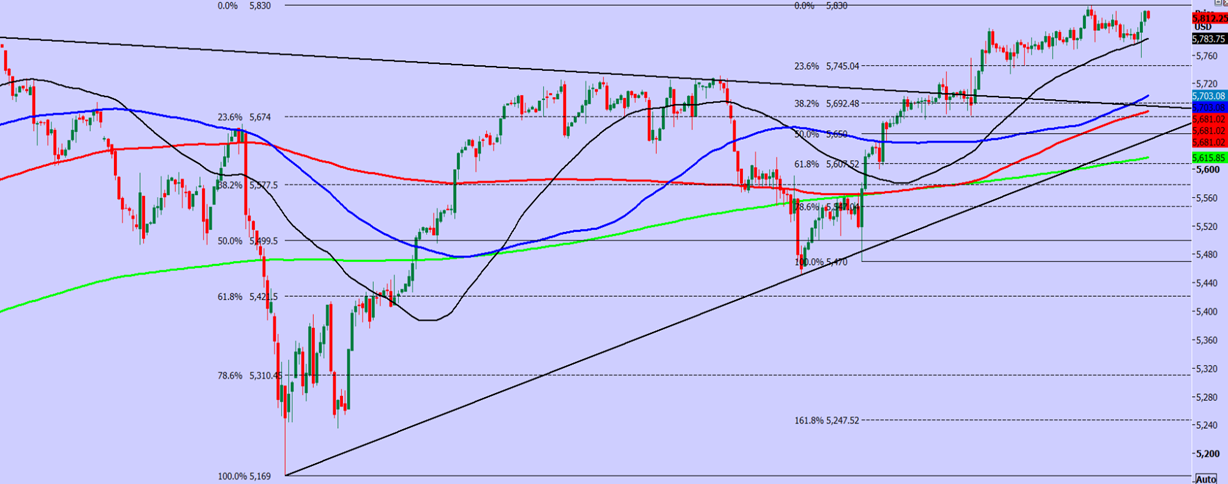

Emini September Futures The Emini S&P held within a narrow 85-point range last week, struggling to push higher in overbought conditions. Short positions remain risky without a confirmed sell signal in this strong long-term bull trend.

Although I don’t have strong signals, if we continue to climb, look for resistance around 5875/85, and possibly as high as 5900/05. My recommendation in this low-volatility market is to buy at support and take profits quickly.

However, we overshot the next support level at 5775/5770, dropping to 5756 before rebounding as expected.

If we move lower today, look for solid support at 5745/35, with long positions needing stops below 5730. Potential upside targets include 5755 and 5765.

If we break lower this week, the next target could be 5695/90, with further support at 5680/70. Longs should place stops below 5660 in this scenario.

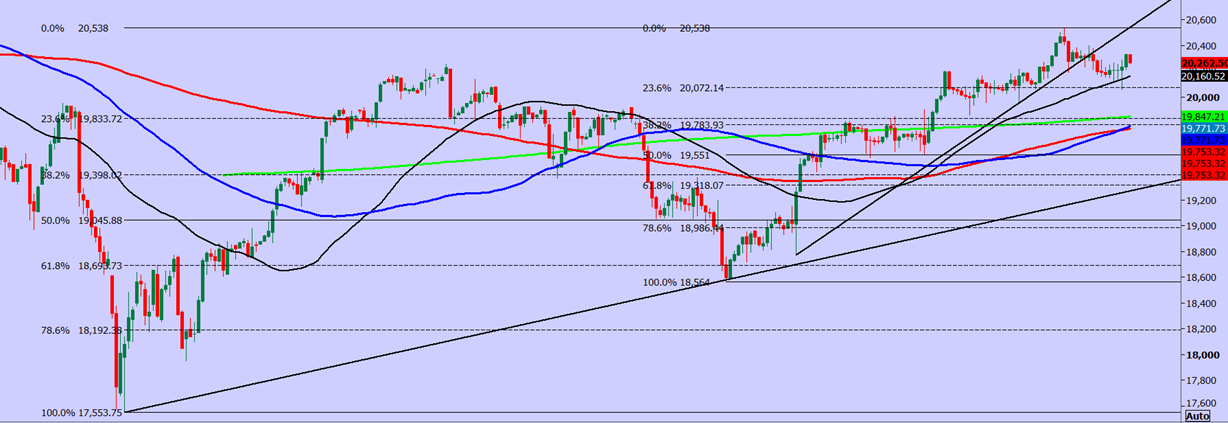

Nasdaq September Futures

-

‘s break above the August high of 20217/251 hit my targets of 20330/340 & 20400/430, but not quite as far as 20600 just yet, with a high for the week at 20538.

-

We just held at support at 20250/150 yesterday but longs need stops below 20050.

-

If we continue lower this week we meet very strong support at 19900/800 and longs need stops below 19700.

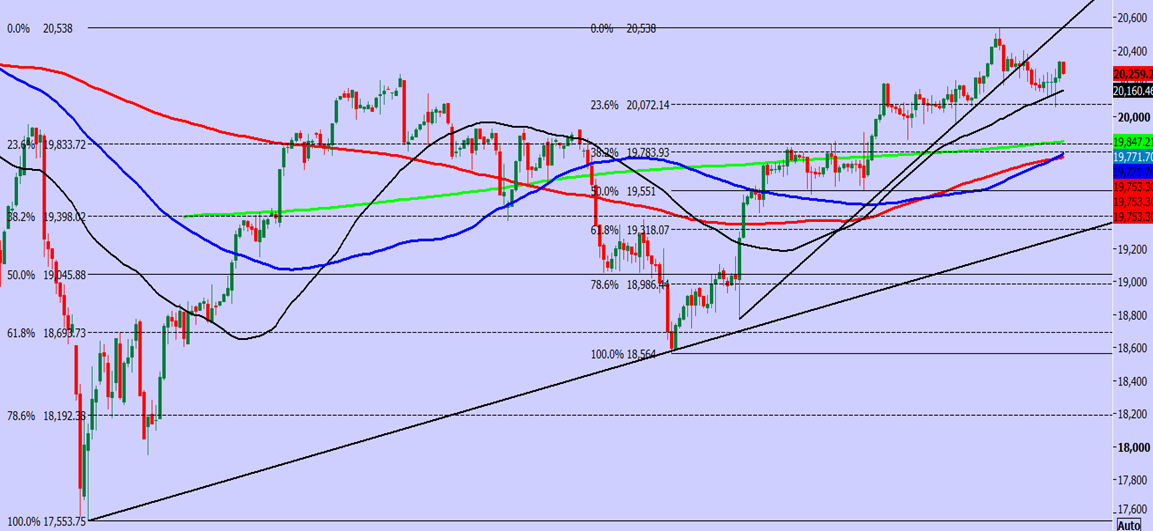

Emini Dow Jones September Futures

-

We wrote: I think gains are likely to be limited in severely overbought conditions but there is definitely no sell signal and I will remain a buyer on any profit taking.

-

We did dip as far as support at 42350/250 as predicted and this did prove to be an excellent buying opportunity but longs need stops below 42150 on a retest today.

-

Targets of 42500 and 42650 were hit immediately, meaning we caught the low and high for the day.

-

A break lower this week however risks a slide to 42000/41900 and longs need stops below 41800.