S&P 500 Faces Moment of Truth: Key Resistance Breach Could Set Stage for ATH Test

2024.08.23 06:19

After two weeks of gains, stocks ended slightly lower yesterday. However, things have started to pick up ahead of Powell’s highly anticipated speech at the conference.

At the time of publishing, are in the green alongside the which ended yesterday’s session lower by 1.68%.

Today, Powell is likely to set the stage for a 25bp cut in September. This comes after Fed on Wednesday suggested that a quarter-percentage-point cut is likely, followed by more cuts if the data is supportive.

As key indexes look forward to a positive open, let’s examine the technical setup for , , and the German ahead of a critical day for markets.

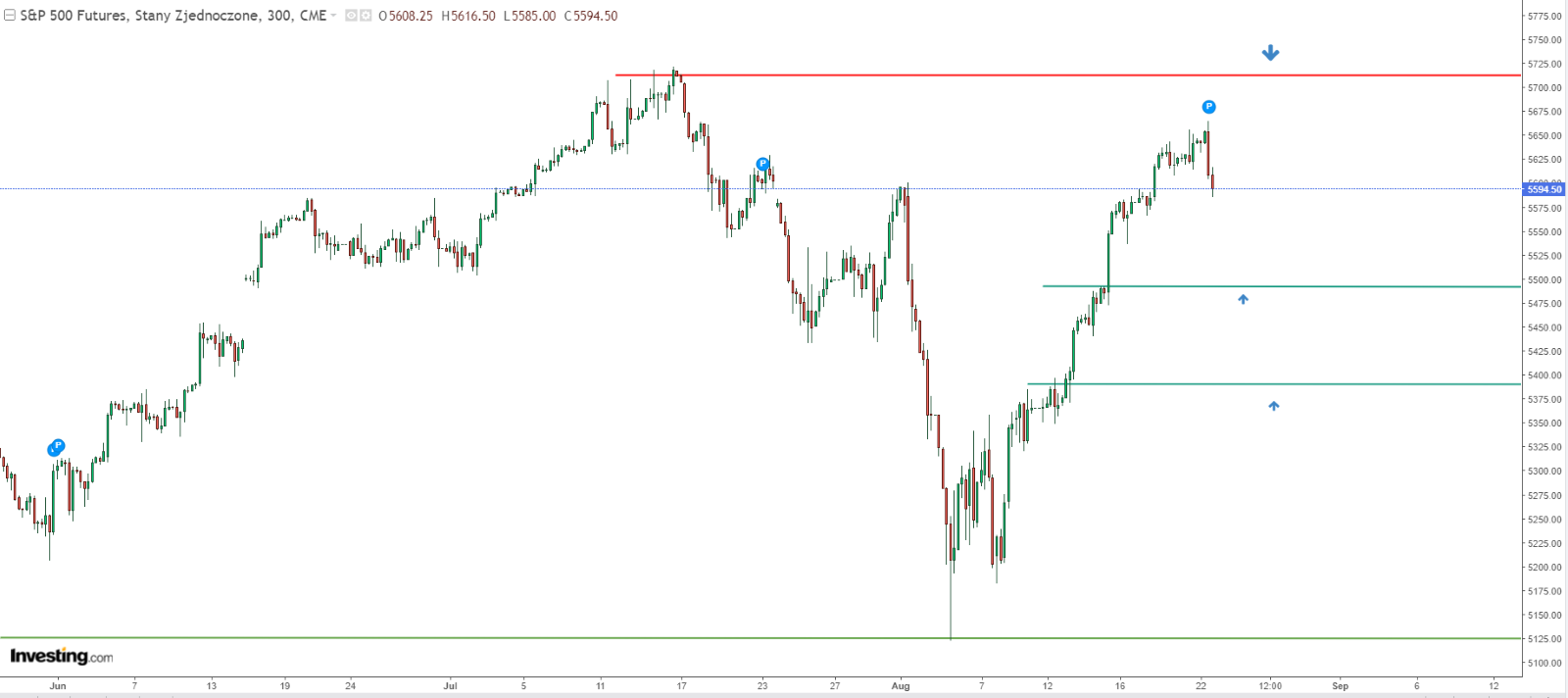

S&P 500 Eyes 5700

Given the strong bullish momentum, the market might not offer a chance for those looking to buy the dip. In the case of a positive open, look for a move to the all-time highs below 5,700 points.

In case of a correction, 5,500 points could be the next level bears can expect if the macroeconomic situation remains unchanged.

Looking for potential levels in case of a deeper decline, the local demand zone near 5,400 points could be the next stop after a decline below 5,500.

Nasdaq 100 Could Rebound Higher

The is steadily approaching its historical highs. Like the S&P 500, it’s currently experiencing a local rebound. This rebound could face its first challenges around the 19,200-19,000 point range, where it previously saw a surge in demand.

If the tech index falls below 19,000 points, it might experience a deeper pullback. For buyers aiming to reach new highs, the initial target is 20,400 points.

Meanwhile, in Europe, the German DAX May Keep Uptrend Intact

German DAX index continues to trend strongly upward with no signs of a correction. A potential unwind could occur if the accelerated uptrend line is broken, which remains a possibility.

If that happens, sellers will likely target the demand zone just below 18,000 points.

On the other hand, the demand side aims to push the index beyond the 19,000 points barrier, targeting new historical highs.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor’s own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.