S&P 500 Eyeing 4300+?

2023.05.18 15:51

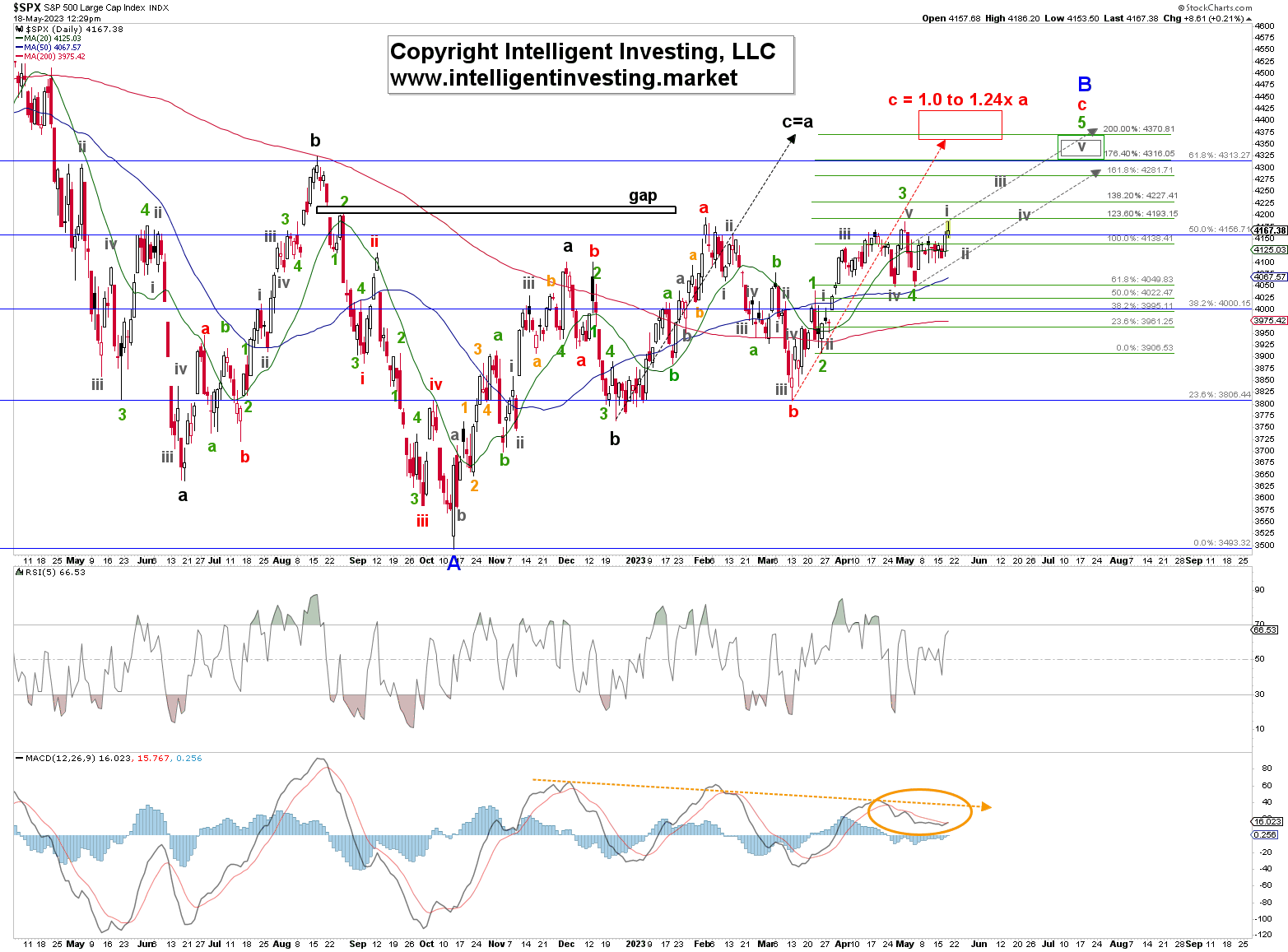

Ten days ago, using the Elliott Wave Principle (EWP) for the (SPX):

“The preferred path is looking for possibly a bit higher early in the week, ideally around SPX4155+/-5 for green W-b, before green W-c takes hold, bringing the index down to ideally $3925-4000. This downside target zone will be updated as more price data becomes available. A break below SPX4049 will confirm this option with a severe warning for the Bulls below $4090. The Bulls will have to push the index over $4200 on a daily closing basis to tell us the rally to $4300+ is most likely happening more directly.”

Three days later, the index topped at $4154 but also stalled at $4098 and went in a week-long sideways pattern, only to start rallying yesterday, reaching as high as $4186 today. Thus, although $4200 has not been breached (yet), the green W-c to $3925-4000 we were looking for did not materialize as the bears failed even to push the index below $4090.

Figure 1

As such, the seasonality pattern, which tracked perfectly from late January to mid-April (including the significant mid-March low), has since then diverged, skipping seasonal May weakness and opting to chop instead. The lack of sustained weakness during the bear phase in May is notable. Bullish seasonals return around May 22. This connect-disconnect shows that everything works, but not all the time. The key is to know when correlations stop working. However, we should still not forget the 10-year lag between and , which we have shared with you before. It has strength into the summer of this year, which should be a significant top. Namely, this brings us to the current EWP count as shown in Figure 1 above. It tells us that as long as last week’s low at $4098 holds, the index can allow for a more direct rally to ideally $4315-4370, reaching our long-standing target set forth mid-October :

“If the S&P 500 manages to rally above that level [SPX3886.75], without dropping below last week’s low first, then the index completed five waves lower from the mid-August high…We will then look for a multi-month rally to the SPX 4350-4650 target zone.”

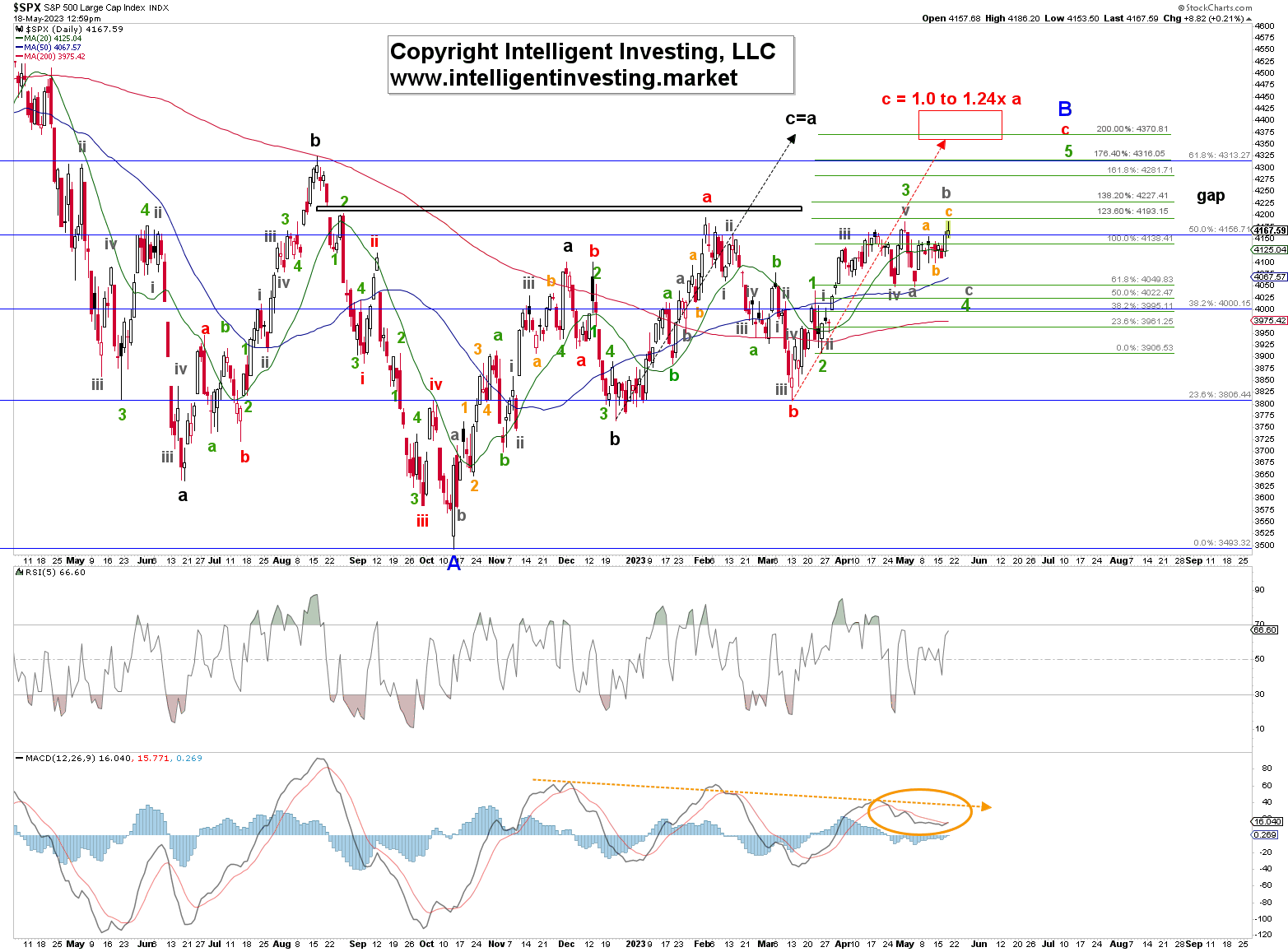

Below $4098 will trigger the EWP option shown in Figure 2 below. We should then expect a retest of $4050, possibly as low as $3960, before the index is ready to target $4300+.

Figure 2

Thus, our parameters are set, which helps us prevent havoc on our portfolio and allows us to trade the index objectively.