S&P 500 Earnings: Nvidia and Walmart This Week – Both Matter

2024.11.18 03:52

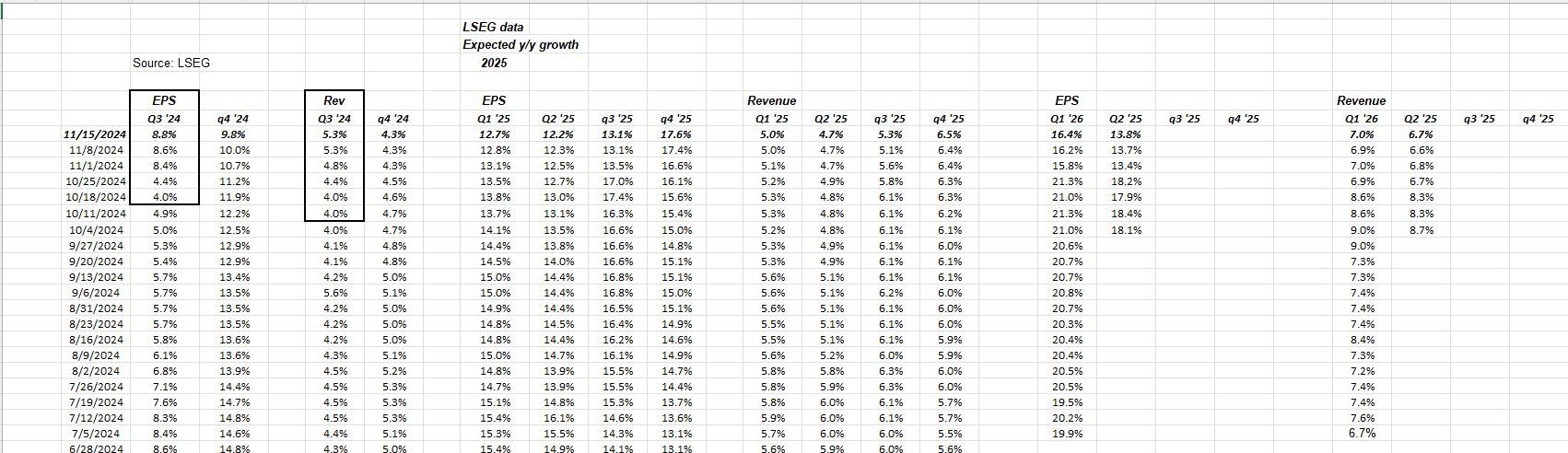

earnings continue to be healthy, as evidenced by the weekly trend in the quarterly EPS and revenue growth rates for the S&P 500 that are detailed below in the Excel spreadsheet.

In the bordered boxes, note the jump in Q3 ’24 S&P 500 EPS growth, since expected EPS growth for Q3 ’24 bottomed during the week of October 18th.

The revenue improvement isn’t too shabby either. It doesn’t look like much, but a 1.3% increase over the 4% revenue growth estimate is healthy.

S&P 500 Data:

- The S&P 500 forward 4-quarter estimate fell to $263.01 last week, from the prior week’s $263.39, and the October quarter’s start of $266.66;

- The PE ratio ended this week 22.3x vs last week’s 22.7x after this week’s 2% drop in the S&P 500;

- The has now risen 8 straight weeks, to close this week at 4.43%;

- The S&P 500 “earnings yield” ended the week at 4.48%, which is about where the earnings started the quarter;

- The “average” credit spread for the high-yield credit market ended the week at +264 (the equivalent Treasury), and has now tightened for 10 straight weeks;

- The S&P 500’s EPS “upside surprise” improved again to 7.7% this week;

Nvidia:

Nvidia (NASDAQ:) reports after Wednesday night’s, November 20th’s close, and the hype machine will be in full effect.

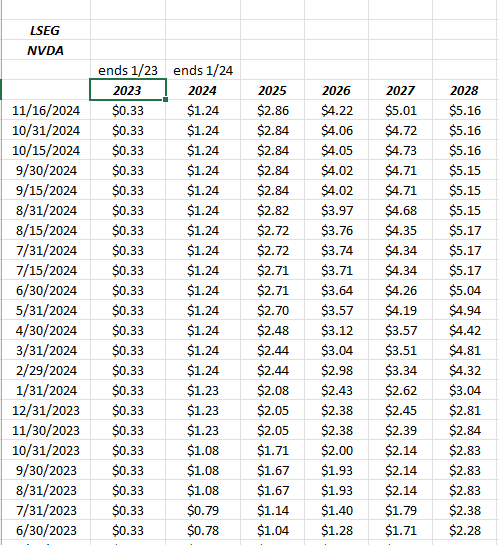

EPS Estimate Revisions:

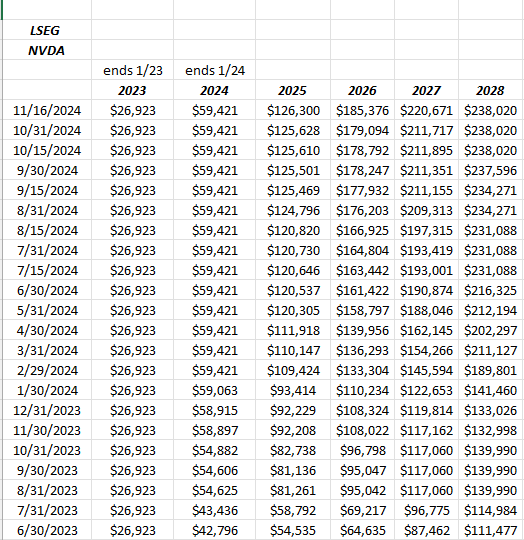

Revenue Estimate Revisions:

NVDA looks like it’s scheduled to report their fiscal Q3 ’25 financial results after the bell on Wednesday, November 20 ’24.

Excuse the wayward cursor in the EPS estimate trend spreadsheet.

Readers are seeing 18 months of both EPS and revenue estimate revisions for Nvidia.

The revisions remain powerful in percentage terms. What caught my eye is expected 2028 revenue estimates. As of 11/16/24, those revisions are still doubling – really more than doubling – from the June ’23 revenue estimates. Usually, analysts tend to pull in their expectations for “further-out years” which in this case is more than 3 years from now.

Walmart (NYSE:) is going to report its financial results on Tuesday morning, November 19th, 2024, and like Nvidia Walmart is on a January fiscal year end so Walmart too is reporting their fiscal Q3 ’25 financial results Tuesday morning, November 19th ’24.

A separate Walmart earnings preview will be posted this weekend for readers. Walmart is +61.5% YTD as of the market’s close on 11/15/24.

Conclusion:

Because “send” was accidentally hit before this blog post was finished, this weekend’s S&P 500 earnings update is being concluded quickly to get the full blog post in readers hands.

No question that the EPS and revenue estimate trends for NVDA remain positive. This blog has sold all of their (semiconductor ETF) and all of the NVDA position, (of which the SMH position was much larger) and have no direct or indirect exposure to NVDA today outside of some style ETF’s or direct index exposure. That may change before Wednesday night, as some short-term trading positions may be taken in NVDA stock prior to earnings, given the trend in estimate revisions.

The SMH was sold about a 6 – 8 weeks ago in client accounts, and after Applied Materials (NASDAQ:) stock drop after their Thursday night, November 14th earnings results, that may have been the right move. AMAT was down 12% last week, while the SMH fell 7.50% last week.

The semiconductor stocks are tough to trade, either on an individual stock basis, or the SMH ETF. Just be careful with the sector, as someone who has been in and out of the group over 30 years.

NVDA’s estimate revisions are – again – a positive, but that can change quickly. The level of persistent and vocal bullishness around the stock is another red flag for NVDA. I get the fundamental story, and NVDA is a fabless semi, so the return-on-invested-capital is formidable over years, but I do fret over the sudden acquisition of the nuclear power facilities by Amazon (NASDAQ:), Microsoft (NASDAQ:) and Alphabet (NASDAQ:) all of a sudden, wondering if that disrupts NVDA fundamental story.

With October retail sales reported Friday, 11/15/24, Walmart’s fiscal Q3 ’25 should be fine. The overall consumer remains healthy, but what is driving or rather helping Walmart’s margins and revenue growth in fiscal ’25 is the “flywheel” effect of a growing advertising and data business.

Walmart’s an AI beneficiary rather than an AI disrupter, which is already being seen in the numbers.

As of 11/15/2024, Walmart was +61% in terms of YTD return while NVDA was +187% (non-annualized returns).

Disclaimer: None of this is advice or a recommendation but only an opinion. Past performance is no guarantee or even suggestion of future results. Investing can and does involve the loss of principal even for short periods of time. Any content posted to this blog, may or may not be updated, and if updated, may not be done in a timely fashion. Readers should gauge their own comfort with portfolio volatility, and adjust accordingly.

Thanks for reading.