S&P 500 Earnings in Good Shape as Yield Jumps to 5.80%

2023.10.30 04:00

S&P 500 Q3-23 EPS Growth as of 102723

S&P 500 Q3-23 EPS Growth as of 102723

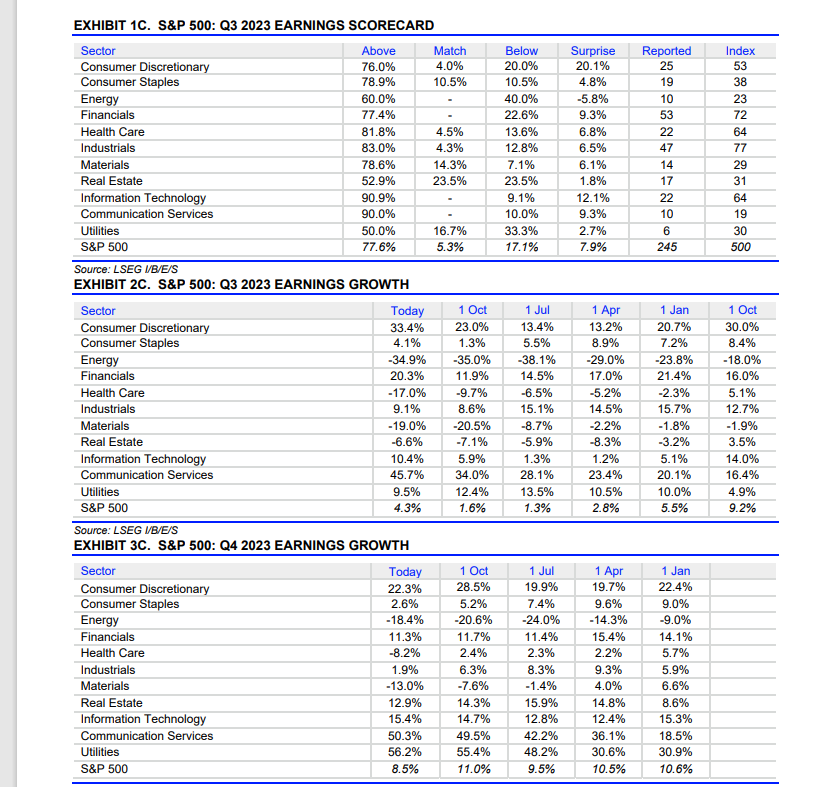

Changing up the presentation a little, here is a page from this week’s (10/27/23) Refinitiv “This Week in Earnings” report which details exactly what is going on with earnings at present:

1.) The first table at the top shows that with half the having reported, the current “upside surprise” rate for the S&P 500 is 7.9% – very healthy;

2.) The middle table shows the progression in expected Q3 ’23 S&P 500 EPS: the expected S&P 500 EPS growth rate has jumped from +1.6% expected on October 1 to +4.3% now expected as of 10/27/23. This upward revision to 3rd quarter growth is well within the normal 2% – 5% improvement typically seen every quarter, but it’s important given how stocks are trading.

3.) The changes to Q4 ’23 (third table) show a 2.5% decline in the expected Q4 ’23 growth rate for S&P 500 EPS (+11% to +8.5% as of 10/27), yet not out of the ordinary given historical patterns.

Here’s what jumps out in the data that readers might find interesting:

- Financial sector expected EPS growth has now doubled for Q3 ’23, from 11.9% on October 1 to 20.3% (middle table) as of 10/27/23, and yet the stocks are getting hammered despite the EPS growth. What are the financial sector stocks “predicting”? Is there pain coming in credit, or has the market mispriced the sector?

- Health Care is having a tough Q3 ’23 reporting season: expected EPS growth of -9.7% on 10/1/23, is now -17% as of 10/27/23. Health Care has not been a traditional safe haven for a tough market in 2023;

- There are 4 sectors where “expected” EPS growth has improved for Q4 ’24 in the last 4 weeks (bottom table):

- Energy: just barely from -20.6% as of 10/1 to -18.4% as of 10/27/23;

- Technology: from 14.7% on 10/1, to 15.4% as of 10/27/23;

- Comm Services: from 49.5% on 10/1. to 50.3% as of 10/27/23;

- Ute’s: from 55.4% on 10/1 to 56.2% on 10/27/23;

Readers may think these are minor upward revisions, but you have to remember, the normal revision pattern is lower for the coming quarter, thus the fact there is upward or positive revisions to expected Q4 ’23 growth rates is actually pretty telling.

S&P 500 Data:

- The S&P 500 forward 4-quarter estimate slipped to $238.46 from last week’s $238.95, despite a good week of tech sector earnings;

- The PE ratio fell to 17.3x this week from last week’s 17.7x and 9/30/23’s 18.4x;

- The S&P 500 earnings yield jumped this week to 5.79%, versus last week’s 5.66%. 5.79% is the highest EY since 1/20/23’s 5.80%;

- The Q3 ’23 bottom-up S&P 500 EPS estimate rose to $56.75 from 9/30/23’s $55.92;

- The S&P 500 EPS beat rate is 7.9% in Q3 ’23 (mentioned above) but the revenue beat rate is 1% too, it’s been trending down now for 9 quarters.

Conclusion:

The earnings data remains in good shape, or at the very least, there is still not the red flags that you would see if there were trouble ahead, like the forward four-quarter estimate starting to decelerate sharply. Looking at Alphabet’s (NASDAQ:) EPS and revenue revisions, forward EPS estimates were raised slightly while forward revenue estimates were revised slightly lower, and more importantly, forward growth rates for 2023 – 2025 EPS and revenue didn’t change much at all. The stock price reaction was sure remarkable for the search giant, well in excess of the estimated changes.

Frankly, Q3 ’23 earnings look fine so far. The only metric that gave me pause reading it was the Q3 ’23 revenue “beat rate” of 1%, which is the lowest of the last 9 quarters. Part of this is post-Covid though. However, it could speak to an economy on the cusp of slower growth.

More to come on this.

***

Take all of this as one one opinion, and past performance is no guarantee of future results. All S&P 500 EPS and revenue data is sourced from IBES data by Refinitiv, or Factset if specifically noted. None of this is advice or a recommendation. Capital markets can change quickly for both the good and the bad.