S&P 500 Earnings: Forward EPS Estimates Have Firmed

2023.07.31 03:08

Roughly half of the companies have reported Q2 ’23 financial results, and the forward estimate has firmed up a little bit. The 2023 and 2024 calendar year EPS estimates for the S&P 500 were also revised higher this week.

- The forward 4-quarter estimate finished this week at $230.44, revised up from last week’s $229.94 and June 30th’s $224.01;

- The PE on the forward estimate is 19.9x versus 19.7x last week and 19.9x as of June 30th;

- The S&P 500 earnings yield continues to skirt the 5.00% level, ending the week at 5.03%. Since mid-June ’23, the S&P 500 earnings yield has gravitated between 5.03% and 5.23%. I’d like to see that EY back in the mid-5.5 % range.

- The bottom-up quarterly estimate for Q2 ’23 as of June 30, ’23, was $52.91, and today it’s $52.37. The upside surprise for S&P 500 earnings is 6.6%, still very healthy, thus expect the $52.37 to be revised upward in the next few weeks;

S&P 500 Earnings Rate-of-change Has Firmed

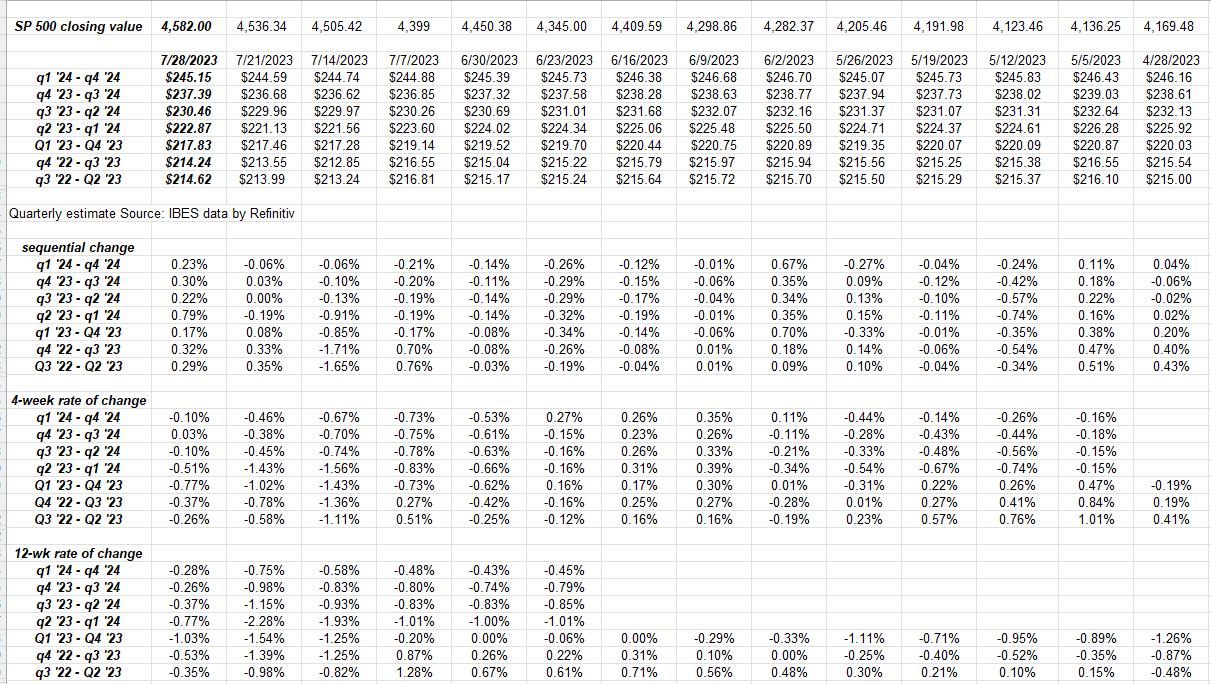

S&P 500 EPS Rate Of Change

S&P 500 EPS Rate Of Change

Click on the above spreadsheet and note how the “forward estimate” curve for the S&P 500 is evolving.

Note how the sequential or week-to-week rates of changes have firmed, followed by the 4-week rates of change.

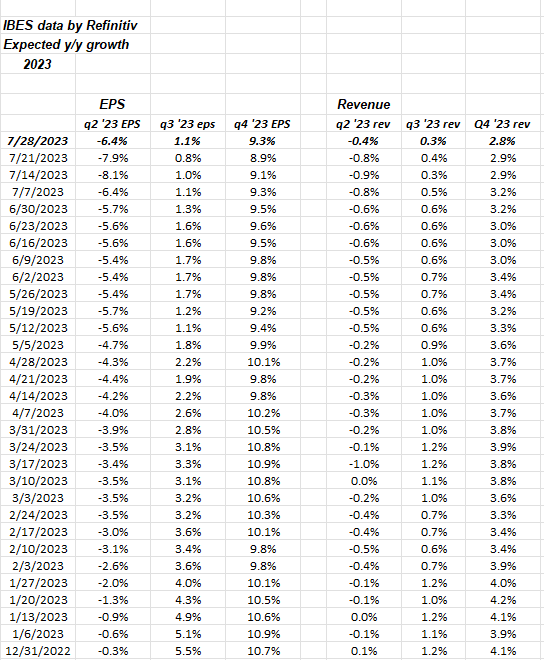

The 4th quarter of 2023 has shown no degradation in S&P 500 EPS growth, as the table below indicates:

SP500 EPS Q4 23 EPS-Growth

Note the trend in the 3rd column, i.e. Q4 ’23 EPS, start at the bottom and work higher.

Conclusion

The sharpest upward revisions to full-year 2023 expected S&P 500 EPS growth rates since July 1, ’23, have come from consumer discretionary and the communication services sectors. This week, we get both Amazon (NASDAQ:) and Apple (NASDAQ:) reporting on Thursday, August 3rd, after the closing bell. Two names also of interest are Merck and Pfizer (NYSE:), which report this week.

S&P 500 earnings look fine for Q2 ’23. With half the index reported, it’s unlikely the trends will change from here.

It’s interesting that China is beginning to perk up. After the Jack Ma affair and watching what the Chinese party leadership did to him, I will never be a direct investor in China ever again, but companies like Nike (NYSE:), which is down from it’s high of $175 in late ’21 to $109 today, have a significant China business line, and owning Nike could be one way to play a China recovery. Clients also own the EMXC or the Emerging Markets Ex-China ETF since China is such a big part of that asset class. (Long Nike and continue to add more slowly.)

Take all this with considerable skepticism. Past performance is no guarantee of future results, none of this is advice, and all opinions are my own. The information may or may not be updated, and if updated, may not be done on a timely basis. Readers should gauge their own appetite for market volatility and adjust their portfolio’s accordingly.