Stock Markets Analysis and Opinion

S&P 500 E-Mini Indicates Start of a Pullback

2024.07.22 12:29

Market Overview: S&P 500 E-Mini Futures

The weekly candlestick was a big outside bear bar possibly indicating an E-Mini start of a pullback. The bears want a TBTL (Ten Bars, Two Legs) pullback trading far below the 20-week EMA. The bulls want the pullback to form a higher low followed by a resumption of the broad bull channel.

S&P 500 E-Mini Futures

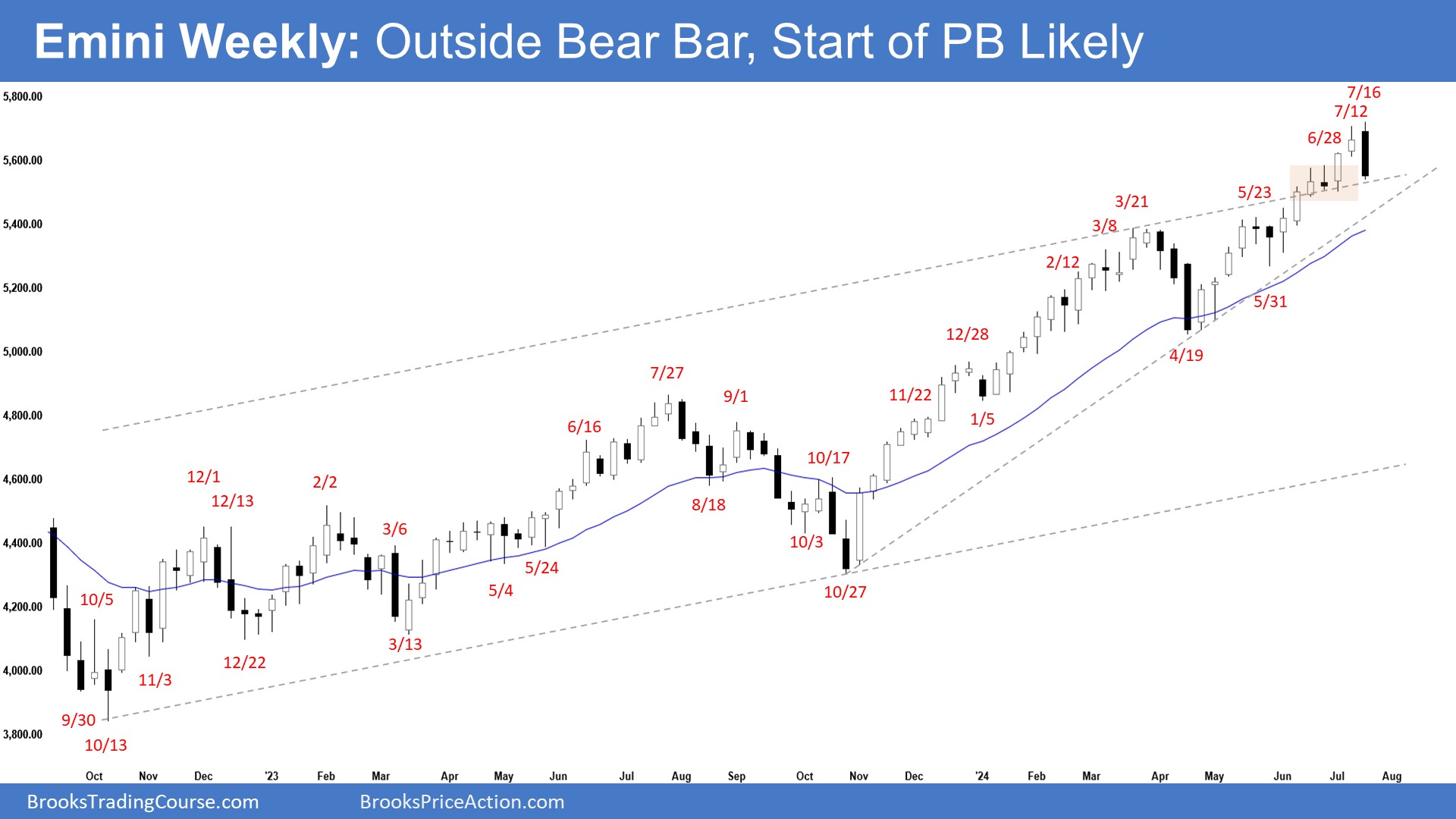

The Weekly S&P 500 E-Mini Chart

- This week’s E-Mini candlestick was a big outside bear bar closing near its low.

- Last week, we said that the odds continue to slightly favor sideways to up. Traders will see if the market can continue the sideways to up buy climax for another 1-3 weeks or will the bears be able to create a strong entry bar with follow-through selling instead?

- The market made new highs early in the week but reversed sharply lower from midweek onward, creating a strong bear entry bar.

- The bears got a reversal from a higher high major trend reversal, a wedge pattern (Jul 27, Mar 21, and Jul 16) and a trend channel line overshoot.

- They also see an embedded wedge in the current leg up (May 23, Jun 28, and Jul 21) and a possible final flag pattern (sideways consolidation from the mid to the end of Jun).

- They want a TBTL (Ten Bars, Two Legs) pullback trading far below the 20-week EMA.

- At the very least, they want a retest of the April 19 low, even if it forms a higher low.

- The bears need to create follow-through selling next week to convince traders that they are back in control.

- The bulls hope that the rally will lead to months of sideways to up trading (broad bull channel).

- They want the pullback to form a higher low followed by a resumption of the broad bull channel.

- If the market trades lower, they want the 20-week EMA or the bull trend line to act as support.

- They hope to get at least a small second leg sideways to up to retest the all-time high.

- Since this week’s candlestick is an outside bear bar closing near its low, it is a sell signal bar for next week.

- The move up was becoming climactic and overbought. Traders are looking for reasons to take profits off the table.

- The risk of a minor pullback and profit-taking event is elevated.

- Traders will see if the bears can create a follow-through bear bar, even if it is just a bear doji.

- For now, the odds slightly favor the profit-taking phase has begun.

- Traders will see if there is an attempt to form a small retest of the prior high.

- Or will the market continue to sell off with bigger and stronger bear bars?

- Sometimes, the candlestick after an outside bear bar can be an inside bar or has a lot of overlapping price action.

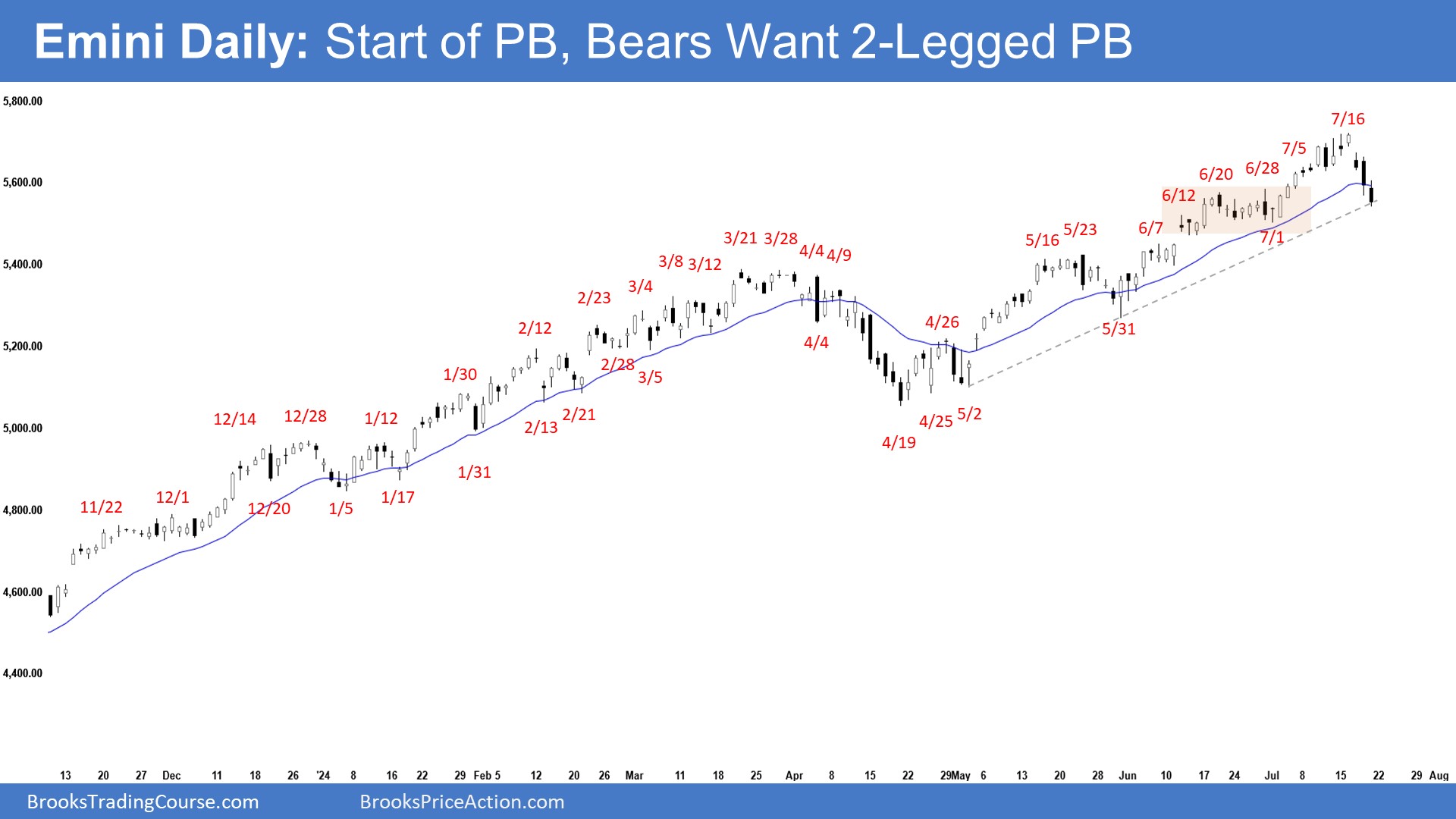

The Daily S&P 500 E-Mini Chart

- The market made new all-time highs (Mon & Tues) early in the week. It then gapped lower on Wednesday with follow-through selling on Thursday and Friday.

- Last week, we said that the market remains Always In Long but the odds of at least a small pullback are increasing. If the bears start getting big consecutive bear bars closing near their lows, it will likely signal the start of a two-legged sideways-to-down pullback phase.

- The bears got a reversal from a higher high major trend reversal and a large wedge pattern (Jul 27, Mar 21 and Jul 16).

- They want a reversal from a wedge in the current leg up (May 23, Jun 28, and Jul 16) and from a final flag pattern (starting from the second half of Jun).

- They want at least a two-legged pullback lasting at least a few weeks.

- At the very least, they want a retest of the April 19 low, even if it only forms a higher low.

- If the market trades higher, they want a reversal from a small double top or a lower high major trend reversal.

- The bears need to continue creating strong bear bars trading far below the 20-day EMA to increase the odds of a deeper pullback.

- The bulls hope that the rally is in a (broad) channel phase.

- They want the pullback to form a higher low followed by a resumption of the broad bull channel.

- They want the 20-day EMA or the bull trend line to act as support.

- So far, the bears managed to create strong consecutive bear bars, something they have not been able to do since April.

- The odds slightly favor the pullback phase has begun.

- If there is a pullback to retest the all-time high (Jul 16), traders will see the strength of the pullback. If it is weak and sideways, the odds of another strong leg down will increase.

- Traders expect at least a two-legged sideways to down pullback.

- For now, traders will see if the bears can continue to create strong bear bars in the weeks ahead.

- Or will the pullback end up as a sideways trading range (with weak bear bars, doji(s) and bull bars) instead?