S&P 500 E-Mini in a 6-Day Tight Trading Range

2024.08.28 12:27

S&P E-Mini Market Analysis

- The yesterday formed, a bull reversal bar closing near its high on the daily chart. While the signal bar is good for the bulls, the context is bad. The daily chart is in a 6-day tight trading, which increases the odds of failed breakouts and sideways trading.

- The 6-day tight trading range is in breakout mode, and the market is deciding on whether the breakout of the 6-day range will be up or down.

- Because of the strong reversal up from the August 5th low, the odds favor the bulls getting trend resumption.

- The problem for the bulls is that the market is high in the overall trading range on the daily chart.

- This means that the theoretical risk for the bulls is at the August low, which means that the risk/reward is bad for the bulls. If the daily chart continues to go sideways, the probability would be closer to 50% for both the bulls and the bears. This means that bulls would have to reduce their risk in order to improve their risk/reward, increasing the odds of a pullback.

What to Expect Today

- The U.S. Session opened with a small gap that closes during bar 1.

- The Globex market rallied in a tight bull channel on the 15-minute chart for most of the overnight session.

- The Bulls broke above yesterday’s high around 5:00 AM EST and found sellers. This is because the market has been in an overall trading range over the past four trading days.

- As of 9:20 AM EST, the market is near the middle of the four-day trading range. This increases the odds that the market will be neutral going into the open of the U.S. Market.

- The bears formed a strong selloff down to 8:15 AM EST, and the odds favor a second leg down. However, the second leg down may form a trading range near the 8:15 low.

- Traders should expect today to have a lot of trading range price action on the open.

- There is an 80% chance of a trading range open and only a 20% chance of a trend from the open up or down.

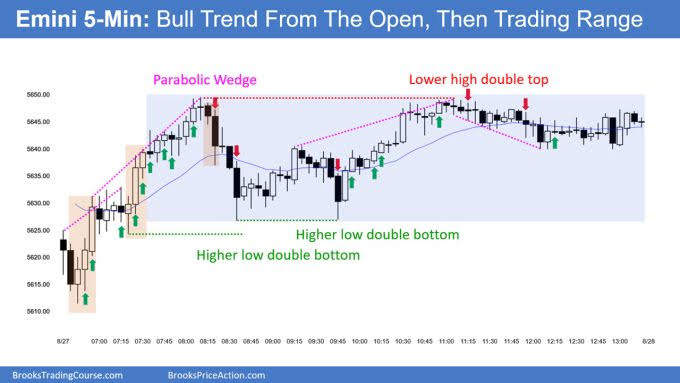

Yesterday’s E-Mini Setups

Here are reasonable stop-entry setups from yesterday. I show each buy entry bar with a green arrow and each sell entry bar with a red arrow.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These, therefore, are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp) but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.