Stock Markets Analysis and Opinion

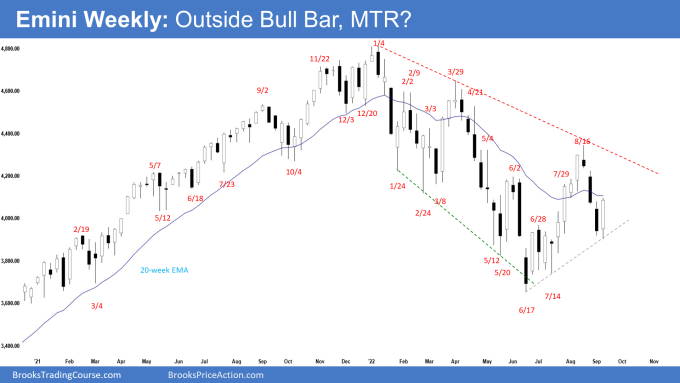

S&P 500 E-Mini Futures: Start Of Second Leg Up?

2022.09.12 21:34

[ad_1]

The futures traded below last week’s low but reversed into an E-mini outside bull bar closing near the high. Bulls want a reversal higher from a higher low major trend reversal. The bears want at least a small second leg sideways to down following the recent strong sell-off.

S&P500 E-mini futures

- This week’s E-mini candlestick was an E-mini outside bull bar closing near the high.

- Last week, we said that odds are the E-mini is still in the sideways to down pullback phase. The bulls still hope for at least a small second leg sideways to up after the pullback. Because of the strong move down, they will need a strong reversal bar, or at least a micro double bottom before traders are willing to buy aggressively.

- This week traded below last week but reversed to close above last week’s high.

- The bears got a reversal lower from around the May 4 high, or the major bear trend line. They want a retest of the June low.

- They want a strong leg down like the one in April. The bears will need to create consecutive bear bars closing near their lows, to increase the odds of a retest of the June low.

- The selloff was strong with consecutive bear bars closing near their lows with an open gap and a micro gap. That means strong bears.

- The bears want at least a small second leg sideways to down to retest Sept 6 low.

- The move up from June 17 low was in a tight channel. The bulls want a second leg sideways to up after a pullback. At the very least, they want a retest of Aug 16 high.

- They want a reversal higher from a higher low major trend reversal.

- The problem with the bull’s case was that the recent selloff was very strong. The second leg sideways to up may only lead to a lower high.

- Since this week was a bull bar closing near the high, it is a good buy signal bar for next week. Next week may gap down at the open, however, small gaps usually close early.

- The next targets for the bulls are the 4100 big round number, the major bear trendline and the Aug 16 high. The 20-week exponential moving average and major bear trendline are resistances above.

- Bulls will need to create a follow-through bull bar closing far above the 20-week exponential moving average to increase the odds of a retest of the Aug 16 high.

- Bears hope next week closes with a bear body even though it may trade higher first.

- The candlestick after an outside bar sometimes is an inside bar, or has a lot of overlapping price action.

- For now, odds slightly favor sideways to up for next week. Traders will be monitoring whether the bulls get a consecutive bull bar or fail to do so.

- If the bulls get a consecutive bull bar, the odds of a test of the bear trend line and Aug 16 high increases. However, if next week closes as a bear bar, we may start to see sellers return for the second leg sideways to down.

- The E-mini traded below last week’s low on Tuesday but reversed higher for the rest of the week with a gap up and closing near the high on Friday.

- Previously, we have said that traders expect at least a small sideways to up retest of the August high after this pullback is over.

- It seems that the second leg sideways to up is currently underway.

- The move up from June 17 low was in a tight channel. That increases the odds that the bulls will get at least a small second leg sideways to up to retest August 16 high.

- The bulls want a continuation higher from a higher low major trend reversal after the current pullback.

- The targets for the bulls are the 4100 big round number, followed by the August 26 high.

- Bears got a strong reversal lower from around the May 4 high, or around the bear trend line. They want a retest of the June low, followed by a breakout, and a measured move down.

- The selloff from Aug 16 was strong enough for traders to expect at least a small second leg sideways to down.

- If the E-mini continues higher, the bears want a reversal lower from a double top bear flag with the August 26 high, or a double top major trend reversal with the August 16 high.

- Since Friday was a bull bar closing near the high, Monday may gap up at the open. Small gaps usually close early.

- The bulls will need to create consecutive closes far above the 20-day exponential moving average first to increase the odds of the E-mini trading higher.

- For now, odds slightly favor sideways to up for next week.

- However, if the bulls fail to create consecutive bull bars above the 20-day exponential moving average early next week, we may see sellers return for the second leg sideways to down to retest the Sept 6 low.

[ad_2]

Source link