S&P 500 Countertrend Rally Continues. But a Pullback First?

2022.11.15 15:08

[ad_1]

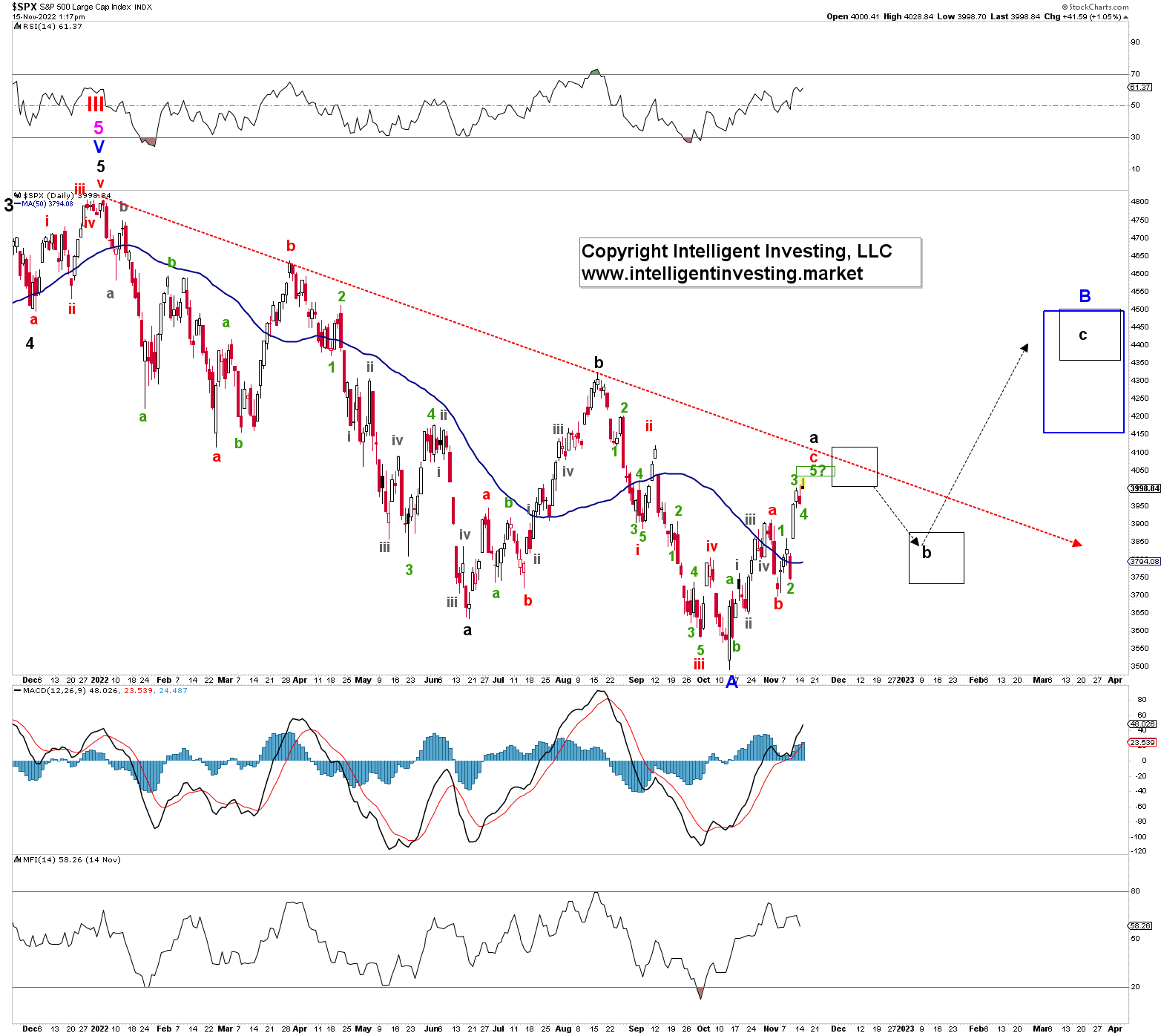

In my last update, see , I found by using the Elliott Wave Principle (EWP) for the (SPX):

“I am looking short-term higher (red W-b) [to $3850+/-25], then lower (red W-c) [to $3650+/-50] before looking for higher prices again (black W-c) [to $4000-4400]. But please remember, counter-trend rallies are tricky because they represent overlapping price action—especially W-b of -B. So be ready to change POV and positions quickly.”

Fast forward, and the index topped one day after my update was posted at $3859, dropped to $3744 the next day, and reached as high as $4028 today. Thus only my red W-c target was off by 1-2.5%. And all the price action happened in six sessions. Therefore I hope one took my “be ready to change POV and positions quickly” to heart and will continue to do so.

The next question now is: where does that leave us? Figure 1 below shows the updated chart.

The answer to that question is that last week’s pullback did not reach the ideal W-c target zone, so it was not a W-c but a minor degree (green) W-2 within a more significant impulse higher (see figure 1 above). This, in turn, means that the black W-b from last week has been postponed and should have commenced as soon as the rally reached the lower end of the ideal (green) W-5 target zone today.

Moreover, in last week’s update, I shared the average seasonality of a mid-term year with a new Democrat administration, which shows a top due around mid-November, followed by a decline into late-November and then a strong rally into year-end. Hence the updated EWP count in Figure 1 matches even better than last week.

If my assessment is correct, the index should now be in a multi-day corrective pattern into late November, ideally targeting the black W-b box at $3735-3875. Once more price data becomes available, I can narrow this target zone down. From there, I expect the more significant black W-c back up to ideally $4350-4500.

[ad_2]