S&P 500 Correction: Will Jerome Powell Come to the Rescue This Time?

2023.08.21 06:12

- The US stock market is correcting and may continue to do so for a while

- Rising treasury yields and China’s real estate issues are strong headwinds

- With this backdrop, markets are eyeing Jerome Powell’s speech at Jackson Hole this week

The combination of headwinds preying on the US stock market is screaming ‘correction’ so loudly that, interestingly, the only factor weighing against such a move from occurring might be the very fact that markets frequently defy expectations when a situation seems overly apparent.

With the never-ending property crisis in China reaching new worrisome developments, the highest in 16 years, a still hawkish Fed going into the , August seasonality, and a possible double-top formation on the technical chart, risks are at one of the highest levels since the beginning of 2023.

As pointed out by Tavi Costa, the double-top pattern is more apparent when adding FANG stocks to the .

FANG + Total Market Monthly Chart

FANG + Total Market Monthly Chart

Source: Tavi Costa

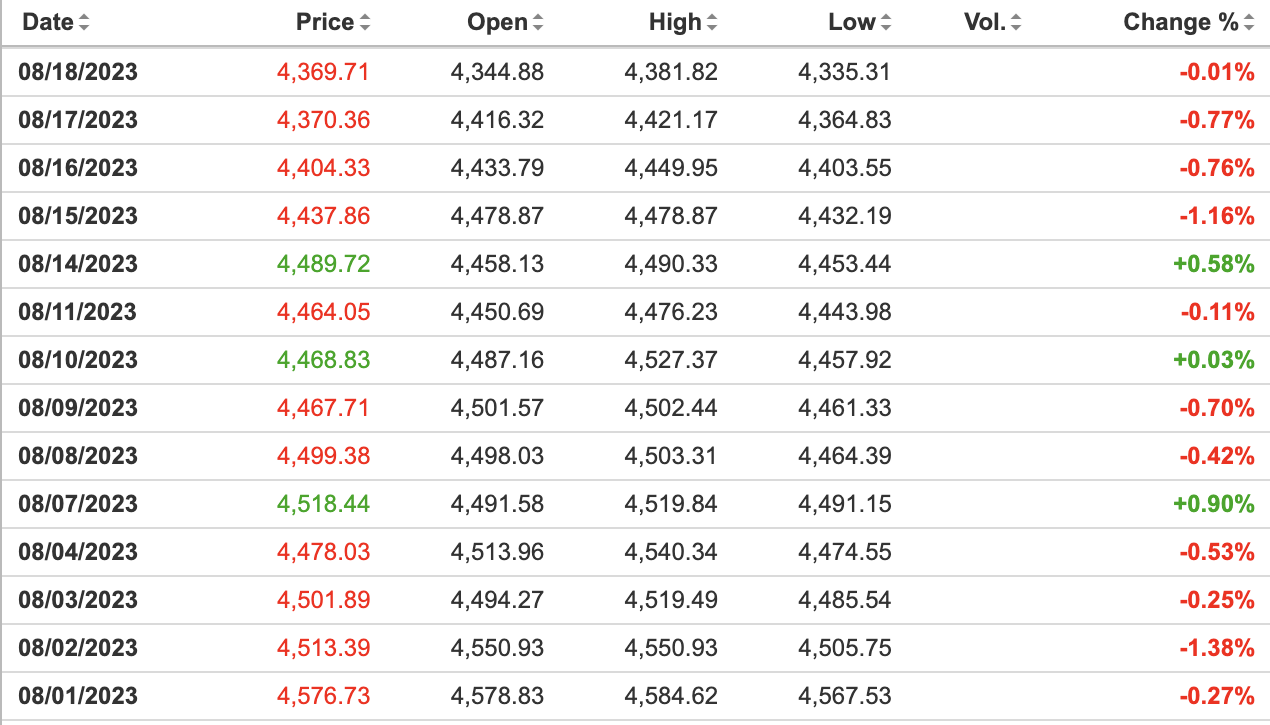

In fact, the S&P 500 has lost ground in 11 out of the 14 market days of August, down roughly 4.8% for the month, indicating that the highly-expected correction might be already underway.

S&P 500 Daily Performance in August 2023

S&P 500 Daily Performance in August 2023

Source: Investing.com

As a result, a mounting number of analysts are growing worried about the health of this year’s stock market rally:

“Markets are being hit by the perfect storm,” Barclays Head of European Equity Strategy Emmanuel Cau said last week.

Likewise, David Roche, president of Independent Strategy, told NBC last week:

“I think the downside in markets is very big, still, at these levels, and they’re not priced for it,”

But despite the short-term headwinds, big picture-wise, the economy shows impressive resilience. Morgan Stanley economist Ellen Zentner wrote in a note to investors last week:

“We have maintained our out-of-consensus call for a soft landing since early last year. The data have continued to move in our direction, our view has only strengthened, and a soft landing has become consensus.”

Let’s have a look at the factors currently in play for the market to evaluate the probable depth of the impending correction and whether this could present a buying opportunity.

China Problem

Evergrande’s downfall began in 2021 when China’s government introduced strict measures to control excessive borrowing and cool the property market, depriving developers of a key funding source. With $300 billion in debts, Evergrande couldn’t generate enough cash to meet its obligations, resulting in a default in December 2021 that sparked market panic. This set off a chain reaction of defaults, keeping China’s real estate market unstable, halting construction on numerous projects, and leaving pre-sale buyers in financial distress.

Now, Evergrande, once a real estate giant, has sought US bankruptcy protection, causing concern in Asian markets and sending shockwaves through the global financial system. This crisis has widespread implications, creating turmoil in China’s real estate industry and raising uncertainties in the world’s second-largest economy.

Investors are watching closely as Country Garden, a company employing around 300,000 people, has missed two debt payments and is exploring debt management strategies.

China’s economy heavily relies on real estate, contributing up to 30% of its economic activity, and more than two-thirds of household wealth is tied to this sector. However, China’s persistent ‘zero COVID’ restrictions over the past three years have hindered economic growth, leading to hesitancy among consumers to buy new homes due to high unemployment and falling property values.

To counter that trend, the reduced its short- and medium-term lending rates, surprising markets last week. However, investors are urging the implementation of more precisely focused fiscal actions, indicating that risks remain high in the world’s second-largest economy.

Things to Keep an Eye on:

- A deeper recession in China would likely impact global markets, slowing long-term economic activity across various sectors worldwide.

- The main thing investors should keep their eyes on at this point is the fallout risks forthcoming from this crisis. A second shoe to drop would send shockwaves across the market, leading to further correction in the global market.

- China’s rates could have a big impact on the , leading to significant changes in the country’s economic matrix.

- This is an event that has long-term consequences, significantly affecting S&P 500 companies’ earnings.

10-Year Treasury Rate Hits 16-Year High

On Thursday, the 10-year Treasury yield reached its highest level since 2007. This marked a significant jump from the year’s lowest point in April, which was at 3.68%.

The rise in yields has cast a cloud over the stock market’s strong performance in 2023 for several reasons.

First of all, higher rates imply that the market is pricing in a higher-for-longer picture. Until a few weeks ago, Wall Street appeared highly confident that the Federal Reserve was nearing the end of its rate-hiking strategy, a move that many economists believed might push the United States into a recession. However, a series of robust economic indicators have since called these assumptions into question.

However, the US economy has proven remarkably robust, with the Atlanta Fed projecting a substantial 5.8% annualized growth rate for the third quarter. Unemployment remains at low levels, and consumer spending continues to display strength.

“The reason behind the rise is the strong data on US domestic demand. The minutes (from the Fed’s July meeting, released Wednesday) feel really dated, they are talking about a gradual slowdown in the US economy, but when you look at the data, we are not even in a slowdown,” said Samy Chaar, chief economist at Lombard Odier.

Moreover, changes in the global bond market (as explained in my article from 2 weeks ago), such as the end of the Bank of Japan’s yield curve control program and the downgrade of the US long-term government foreign currency Issuer Default Rating have been exercising further selling pressure on US treasuries.

For the American consumers who drive the US economy, a higher 10-year Treasury yield translates to increased expenses for car loans, credit card interest rates, and even student loans. Furthermore, it results in more costly mortgage rates. This week, US mortgage rates reached their highest point in 21 years, leading to a decline in home affordability, which is now at its lowest level in several decades.

Analysts now think the 10-year could potentially hit as high as 5% in the upcoming months. Nicholas Colas, the co-founder of DataTrek Research, recently stated that the 10-year Treasury yield could “easily reach” 4.5%-5%. Likewise, Damped Springs CEO Andy Constan told NBC last week that he sees yields easily hitting 4.5%.

Things to Keep an Eye on:

- With yields as high as these, investors have the option of locking in substantial gains without risks on treasuries, which could lead to further pain in the stock market as investors flock to a lower-risk environment.

- The bond market has historically helped tell the direction of the stock market. If yields start moving lower again, it indicates that the market is shifting to a more risk-on environment.

- Conversely, if yields keep rising, current S&P 500 valuations will look very stretched.

- Several sectors will suffer if real rates remain as high, particularly the ones that depend on credit, i.e., real estate and retail.

Will J. Pow Come to the Rescue?

Two market events could potentially make or break it for the US market. The first one is Jerome Powell’s at the Jackson Hole symposium on Friday this week.

The US macroeconomic backdrop has significantly changed since when JPow vowed to keep, the Fed laser-focused on during his last year speech.

Since then, inflation has significantly dropped by two-thirds, all while the economy continues to expand, and the remains at a near-record low. The Federal Reserve appears to be successfully steering price growth back toward its targeted 2% annual rate.

This achievement comes through a combination of higher interest rates and the reduction of its balance sheet, all while sidestepping the “unfortunate costs” that Powell had cautioned about in his speech last year.

However, with inflation still substantially above the Fed’s target, the road ahead remains uncertain and loaded with considerable risks.

Mounting economic challenges are on the horizon as the impact of elevated interest rates begins to take effect. Moreover, inflation appears to be stabilizing at a level considerably above the Fed’s desired target.

The Federal Reserve has abandoned clear forward guidance and emphasized its reliance on data, all while economic data themselves are becoming increasingly intricate and challenging to interpret.

Things to Keep an Eye on:

- With treasury market pricing a higher-for-longer scenario, it is up to Powell to validate or shun that notion.

- An optimistic choice of words for the Fed’s chair could easily be interpreted as a risk-on signal, leading to changes in both the bond and the stock market.

- However, a hawkish tone could give stocks the final push they need for a deeper correction, sending markets tumbling.

Bottom Line

Although the market looks poised for a more than healthy short-term correction, my view is that big picture-wise, none of these factors indicate a retest of last year’s lows.

Unless a larger event occurs—such as the deepening of the Chinese property crisis or a very hawkish turn from the Fed—the highest probability remains that the S&P 500 will stay within the 4000s, with significant sideways action for quite some time.

Against this backdrop, investors are advised to consider hedging risks and align trading strategies accordingly.

There have been many times when being fully bullish on the market paid off this year. While this could prove another one of those, risks indicate otherwise.

***

Find All the Info you Need on InvestingPro!

Disclaimer: This article has been written solely for informational purposes; it does not constitute a solicitation, offer, advice, consultation, or recommendation for investment, nor does it intend to encourage the purchase of assets in any way. Please note that any type of asset is evaluated from multiple perspectives and carries high risk. Therefore, every investment decision and its associated risks are the responsibility of the investor.