S&P 500 Bulls Trapped Below 4,200: Significant Reversal on the Horizon?

2023.05.22 03:56

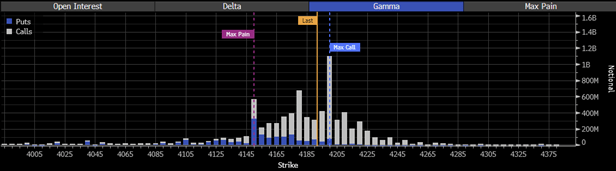

Stocks managed to conclude the week on a positive note, primarily driven by flows related to options attributed to Friday’s OPEX. The primary concern in the future is the location of the call wall and its potential impact on pushing the market higher. The call wall represents the level with the highest call gamma, acting as a resistance level. Similarly, the put wall signifies the level with the highest put gamma, serving as a support level.

The call wall has remained consistently at 4,200 in the for a considerable period. Preliminary data suggests that the call wall will likely persist at 4,200 for Monday. It’s important to note that this can change on a daily basis. Understanding the position of the call wall holds significant importance, particularly if one anticipates a market upturn from the current state.

This implies that market makers will likely sell S&P 500 futures above 4,200, thereby restricting the index’s upward movement. Furthermore, the 4,150 level is likely to be the zero gamma level. This signifies that market makers will also act as sellers of the S&P 500 below 4,150. As the index experiences a decline, the selling pressure intensifies due to entering a negative gamma regime.

Puts Vs. Calls

Consequently, the current situation leaves bullish investors in a predicament unless there is a significant shift in the sentiment of the options market. Presently, the options market does not seem to provide the equity market with the necessary impetus to move higher. As long as this situation persists, both the index and the bulls remain trapped. While it is possible for the index to reach 4,225, I have reservations about its ability to surpass that level, given the prevailing dynamics.

Although the index broke above the diamond pattern this week, it is crucial to acknowledge that as long as the call wall remains at 4,200, there is a substantial risk that this entire rally could be a deceptive trap for the bulls and might even trigger a significant reversal in the index. Especially now that a significant portion of gamma has been removed after OPEX, the supportive cushion that aided the market this week is no longer in place.

Moreover, the decrease in gamma levels is likely to result in an increase in the . Currently, the spreads in the VIX futures contract compared to the spot price remain considerably wide. This condition is typically associated with market tops, further indicating a potential negative outlook for the market.

VIX Futures Vs. Spot

Lastly, let’s analyze the McClellan US Summation Index, which has been exhibiting a notable divergence from the . This divergence is historically concerning, as it has often resulted in unfavorable outcomes over the past few years.

The summation index serves as a gauge of changes in advances and declines, providing insights into the overall breadth of the market. The current pattern resembles similar actions observed in late 2018, the spring of 2019, February 2020, September 2020, and throughout the second half of 2021.

This type of divergence has typically been associated with unfavorable outcomes.

McClellan US Summation Index Vs. NASDAQ Composite

This week’s FREE YouTube Video:

Original Post