S&P 500 Bears Wrong Again? Earnings Estimates Move Up to All-Time Highs

2023.09.15 10:19

You really have to give the Bear Camp credit these days. Despite being just plain wrong about the economy, earnings, and the state of the stock market, our furry friends are sticking to their guns.

Yes, uber-bear Mike Wilson kind of did a mea culpa a couple of months back. But like the rest of our furry friends, Morgan Stanley’s chief equity strategist is still issuing warnings about the future of the stock market almost weekly. But as far as the rest of the bears go, they continue to opine that the market and the economy can only head one direction from here. Down. Hard. Just you wait!

The last part is really the rub. You see, those who insist on making predictions and big market calls believe that being early is okay. We’re not wrong, the prediction just hasn’t happened yet. They cry as in, sitting in cash while the market rallies 30+% isn’t a problem because those gains – as well as the massive gains in AI tech – are merely temporary.

But for the rest of us in the investing game, being early is not okay. If there are gains to be had, you need to capture them. In fact, from my perch, being “early” (as in a couple of years early) is the EXACT same thing as being wrong. As Ned Davis so eloquently wrote, in the stock market game, it isn’t about being right, it’s about making money. Or, as I like to say, the key to this job is “getting it right,” not about being right. Put yet another way, investors need to make hay while the sun shines, not preparing for the next storm (which may or may not occur).

The Next Big Worry

Currently, the bears are shouting to anyone who will listen about their outlook for the consumer. We are told that John Q Public and his family are sure to fall on hard times – and soon. Inflation is going to kill them.

The bears point to Bloomberg’s latest Markets Live Pulse survey, which suggests the US consumer is about to crack. According to Bloomberg, more than half of 526 respondents said that personal consumption, which is, of course, the most important driver of US economic growth, will decline in early 2024. And another 21% said the dive will happen even sooner because, yep, you guessed it; inflation and its related high borrowing costs are sure to eat into household spending.

Maybe it’s just me, but this sounds an awful lot like the dire predictions about the economy that started back in the spring of 2022. You remember, right? As the Fed embarked on what turned out to be the most aggressive rate hiking campaign in history, the analysts told us the economy was about to crumble. However, a year and a half later, the team’s soft landing seems to be in control.

So, here we go again. Never mind the fact that Mr. and Mrs. Public both have good jobs and are making more money than they ever have. Forget that the value of their home has increased rather impressively over the last few years. And that the 401K account they glance at quarterly is looking pretty darn healthy. Oh, and I guess we should ignore the cash in the bank they squirreled away during COVID.

Yet, our furry friends in the bear camp continue to tell us – and rather emphatically so – that the end is nigh. Again, just wait!

The Fly in the Ointment

While I don’t pretend to have the predictive power that Mr. Wilson and the rest of the uber-bears seem to have, I do pay attention to an awful lot of actual economic data. You know, numbers on stuff that is happening now. Things that have tended to matter to the stock market historically. Things like, oh, I don’t know, earnings.

It is said that earnings are the mother’s milk of stock prices. And in my experience, while the concept can certainly be argued academically, when earnings are going up, stock prices tend to follow.

And while I may take some heat for being overly simplistic here, my thinking is if the earnings of the are movin’ on up to all-time highs, then maybe, just maybe, stock prices will follow suit.

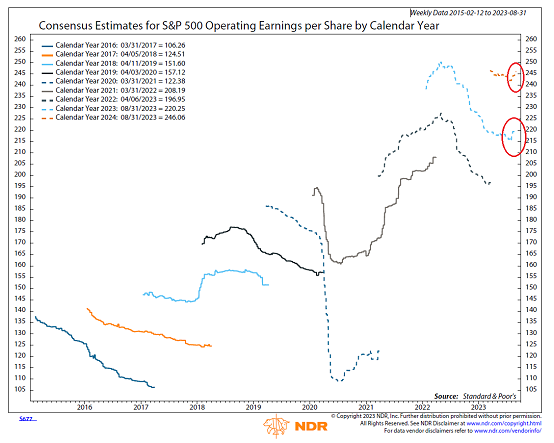

Don’t look now, fans, but the consensus earnings estimates for the S&P 500 are indeed moving on up – and yes, to all-time highs. Below is a chart from by the fine folks at Ned Davis Research showing the consensus earnings estimates for the S&P for each calendar year over time.

Note the two areas circled in red for Calendar Years 2023 (the light blue dashed line) and 2024 (the orange dashed line).

S&P 500 EPS by Calendar Year

See what I mean? Earnings estimates are now moving up, not down. Hmmm.

Also, note the EPS totals for each calendar year in the upper left. S&P earnings were at $197 at the end of 2022. They are projected to come in at $220 for 2023 and $246 for 2024. And yes, both are all-time highs.

Granted, the estimates can and do change – all the time. But for me, the key to the macro outlook here is the S&P 500 currently sits Below where it was at the end of 2021. Yet earnings are higher than they were then and look to be heading even higher going forward.

No, we can not count on $246 for 2024. Again, these are the consensus estimates, which as the chart details, move around a fair amount. The estimates will ebb and flow with the economy. However, my point is that $246 is a lot higher than $208. And if (note the use of all caps) those estimates hold up, then stock prices ought to be higher as well. Perhaps a lot higher.

But then again, the bears could certainly be right. After nearly two years of warning, the economy could crack. Which, of course, would indeed impact earnings. We shall see.

But for now, I’m looking at the earnings glass as at least half full.