S&P 500: 5 Biggest Earnings Season Winners of Q2 2023

2023.08.11 04:36

- Wall Street’s second-quarter earnings season draws to a close, and results have been better than feared for the most part.

- As such, I used the InvestingPro stock screener to identify some of the big earnings winners as the Q2 reporting season wraps up.

- Below is a list of five notable winners from the second quarter earnings season.

Despite concerns over elevated , high , and a possible economic slowdown, Wall Street’s second-quarter earnings season has offered a glimmer of relief as the expected slowdown in profits proves less than feared.

Of the 443 companies in the that have reported quarterly earnings as of Friday, 78.6% have beaten consensus Q2 EPS estimates, according to Refinitiv data.

This strong performance has narrowed the year-over-year decline in Q2 earnings to -3.8%, a significantly smaller drop compared to the gloomy -6.8% drop projected at the start of the reporting season.

As the dust settles, it’s time to look back and identify which companies have managed to weather the storm amid the challenging environment.

In this article, I will delve into the five notable winners of Wall Street’s Q2 earnings season. Using the InvestingPro stock screener, I also examined the potential upside and downside for each name based on their Investing Pro ‘Fair Value’ models.

1. Meta Platforms

- -Year-To-Date Performance: +154%

- -Market Cap: $786.7 Billion

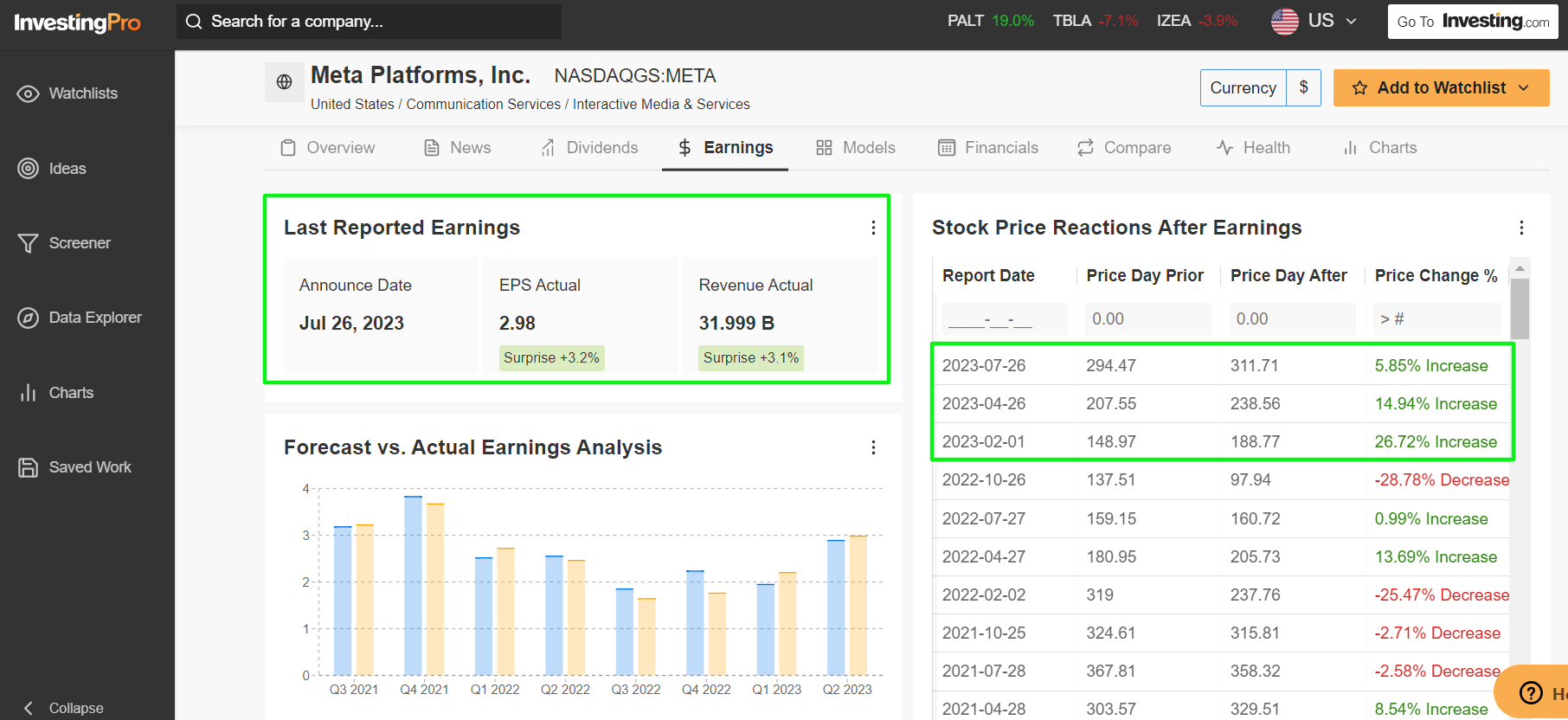

Meta Platforms (NASDAQ:) reported its second straight ‘earnings triple play’ last month, delivering profit, sales growth, and guidance which all exceeded consensus expectations. META stock rose 5.5% in response to the upbeat results and solid outlook, its third big earnings-reaction-day rally in a row.

Source: InvestingPro

The parent of Facebook, Instagram, WhatsApp, and (now) Threads posted for the second quarter on July 26, along with third-quarter guidance that was well ahead of Wall Street estimates, reflecting a rebound in the digital advertising market.

Meta’s ongoing attempts to improve its ad system following Apple’s iOS privacy change finally appear to be showing signs of success, with sales growth expected to pop up into the double digits in the second half of the year, as the Mark Zuckerberg-led company continues to focus on improving operating efficiency.

Shares have staged an astonishing rally in 2023 and are up a whopping 154%, making META one of the best-performing S&P 500 stocks of the year. Investors have been encouraged by aggressive cost-cutting measures implemented by CEO Mark Zuckerberg in recent months.

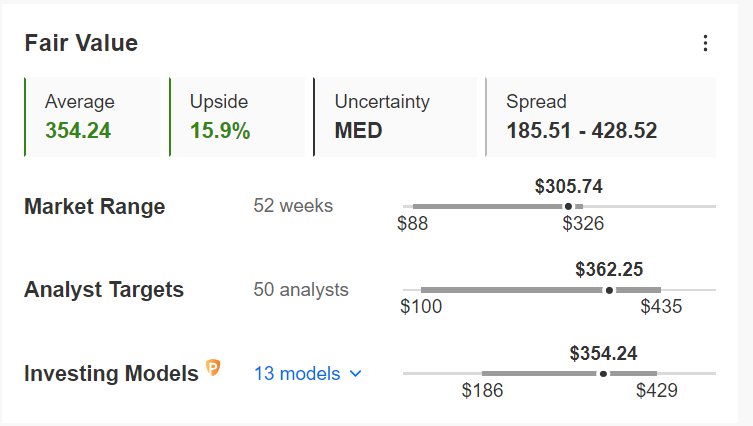

It should be noted that even after the stock more than doubled since the start of the year, META shares remain undervalued at the moment according to InvestingPro models and could see an increase of 15.9% from Thursday’s closing price of $305.74.

Source: InvestingPro

2. Eli Lilly

- -Year-To-Date Performance: +42.5%

- -Market Cap: $469 Billion

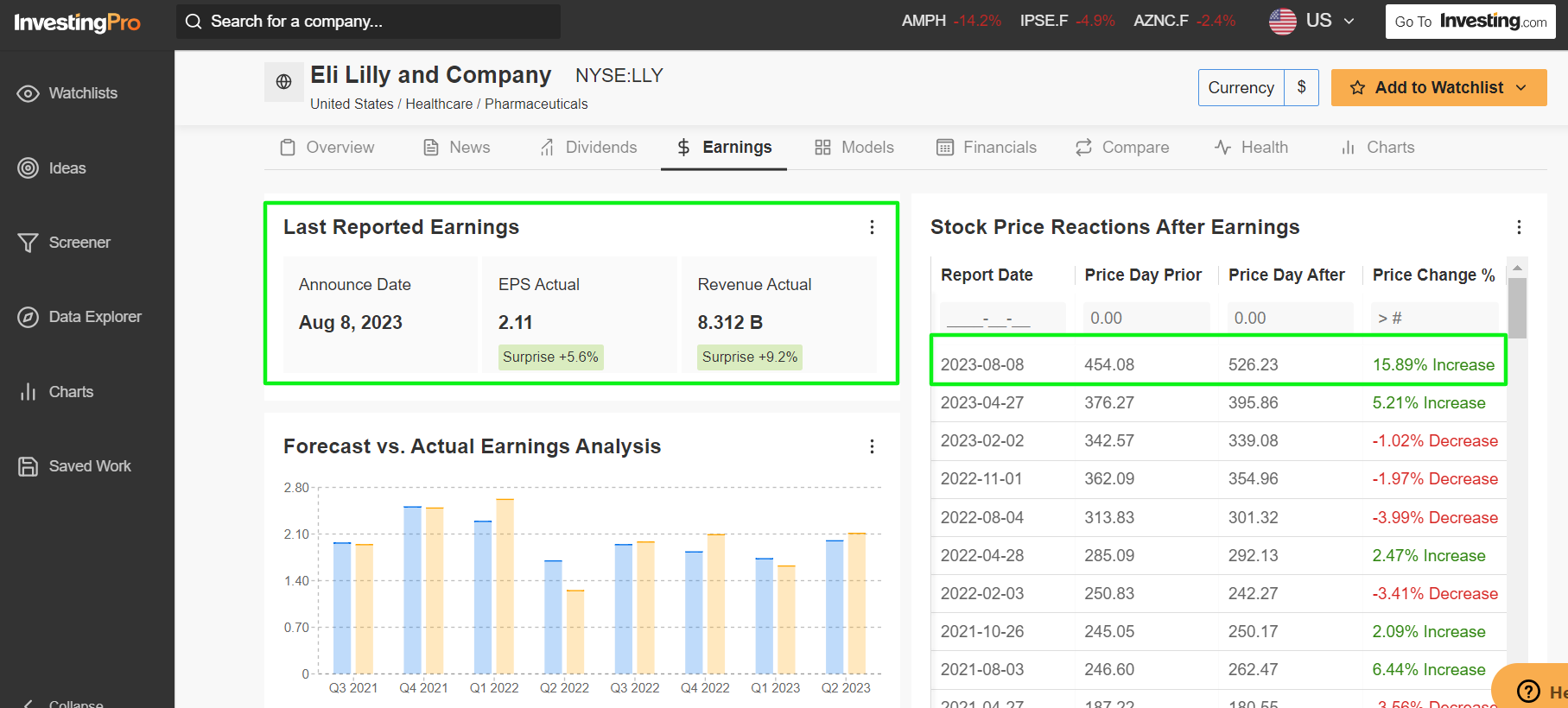

Eli Lilly and Company (NYSE:) reported earlier this week, as white-hot demand for its new diabetes drug Mounjaro lifted the pharmaceutical giant to one of its most profitable quarters on record. The upbeat results prompted Eli Lilly to boost its full-year profit and sales guidance.

Source: InvestingPro

Second-quarter earnings per share jumped 85% from the same period a year earlier, while sales increased 28% annually amid booming demand for its various blockbuster drugs.

Investors have placed high hopes on Mounjaro’s potential mega-blockbuster trajectory beyond diabetes. Last month, Eli Lilly filed for Food and Drug Administration approval of the injection for chronic weight management.

Eli Lilly’s stock soared 15.9% and added $64 billion to its market cap following the Q2 earnings release to become the world’s most valuable healthcare firm, overtaking health insurer UnitedHealth (NYSE:).

With a market value of $469 billion, Eli Lilly is now the world’s ninth-biggest company on the U.S. stock exchange.

Shares have been on a tear since the start of 2023 and are up 42.5% for the year, driven in part by the company’s progress with its promising obesity drug pipeline, as well as positive trial results for its experimental Alzheimer’s drug.

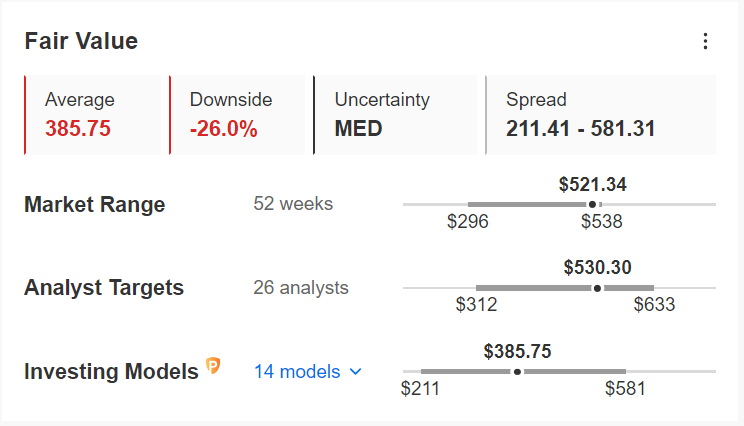

Despite soaring enthusiasm over its future prospects, Eli Lilly’s stock is extremely overvalued compared to the InvestingPro Fair Value price estimate, which implies a potential downside of 26% from current levels.

Source: InvestingPro

3. Caterpillar

- -Year-To-Date Performance: +18.5%

- -Market Cap: $144.8 Billion

Caterpillar (NYSE:) reported on August 1 that crushed analysts’ expectations for earnings and revenue, with sales rising 22% year-over-year amid robust demand for its wide array of construction, mining, and energy equipment.

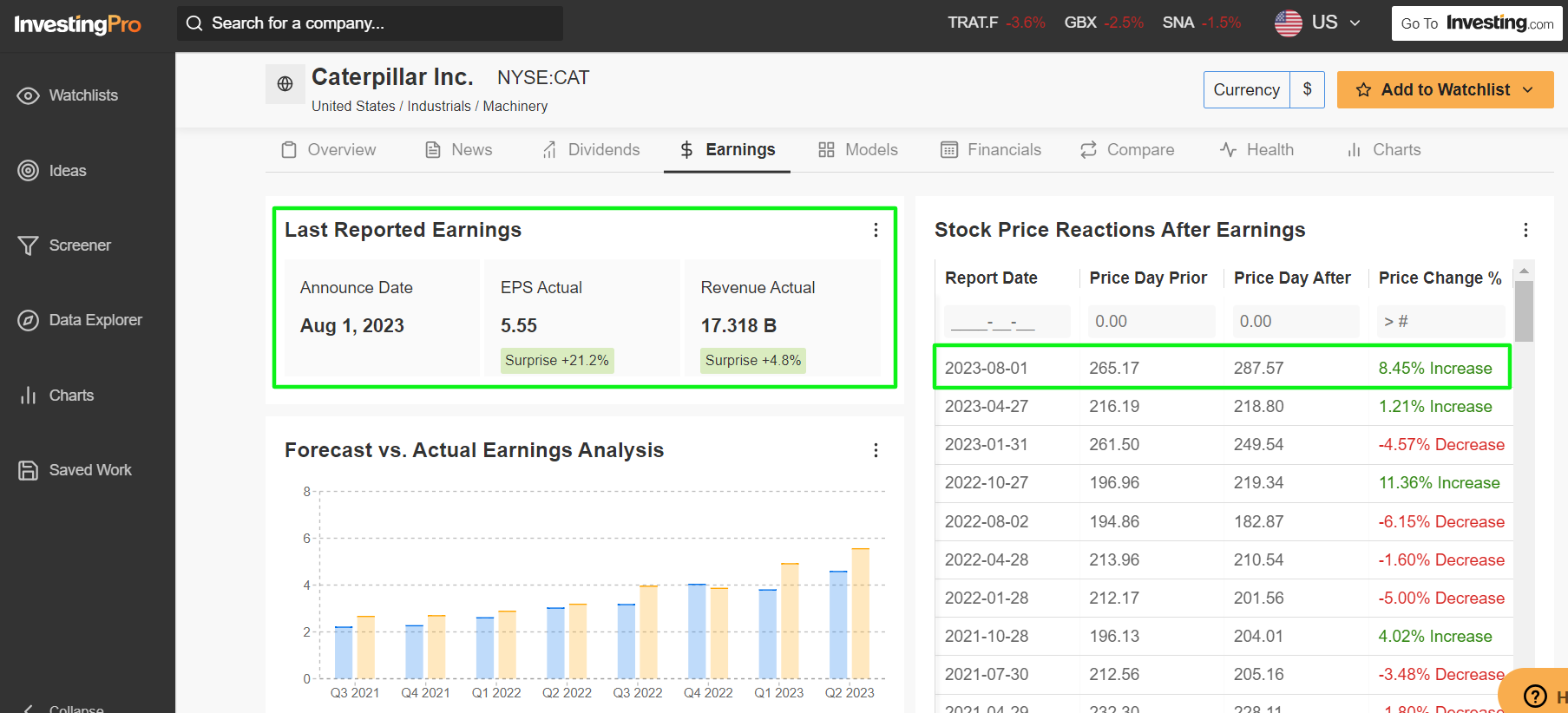

Caterpillar Earnings Data

Caterpillar Earnings Data

Source: InvestingPro

The industrial giant, seen as a proxy for global economic activity, said it expected higher sales and operating profit margin in the second half of the year, compared with a year earlier, as it benefits from favorable industry demand trends given the promising outlook for construction and mining machinery sales.

CAT stock jumped 8.5% to a new all-time high as investors cheered the big beat and solid outlook.

Caterpillar’s shares – which are one of the 30 components of the – are up 18.5% in 2023 amid optimism over the resilience of the global economy.

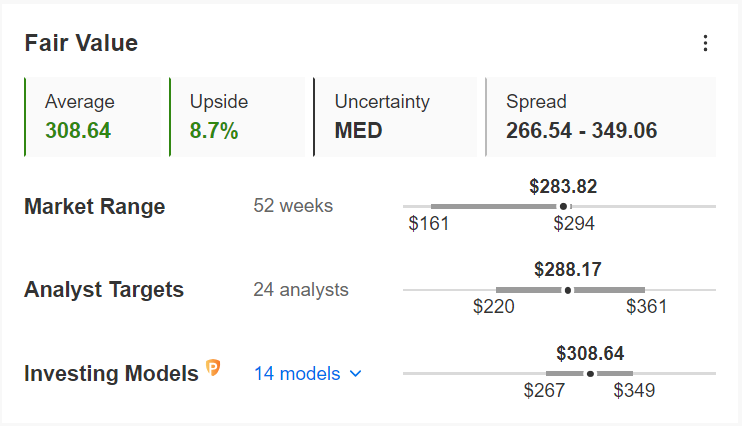

Despite strong year-to-date gains, it should be noted that Caterpillar’s stock is still undervalued according to InvestingPro: the average ‘Fair Value’ price target for CAT stands at $308.64, a potential upside of 8.7%.

Source: InvestingPro

4. Boeing

- -Year-To-Date Performance: +25.1%

- -Market Cap: $143.7 Billion

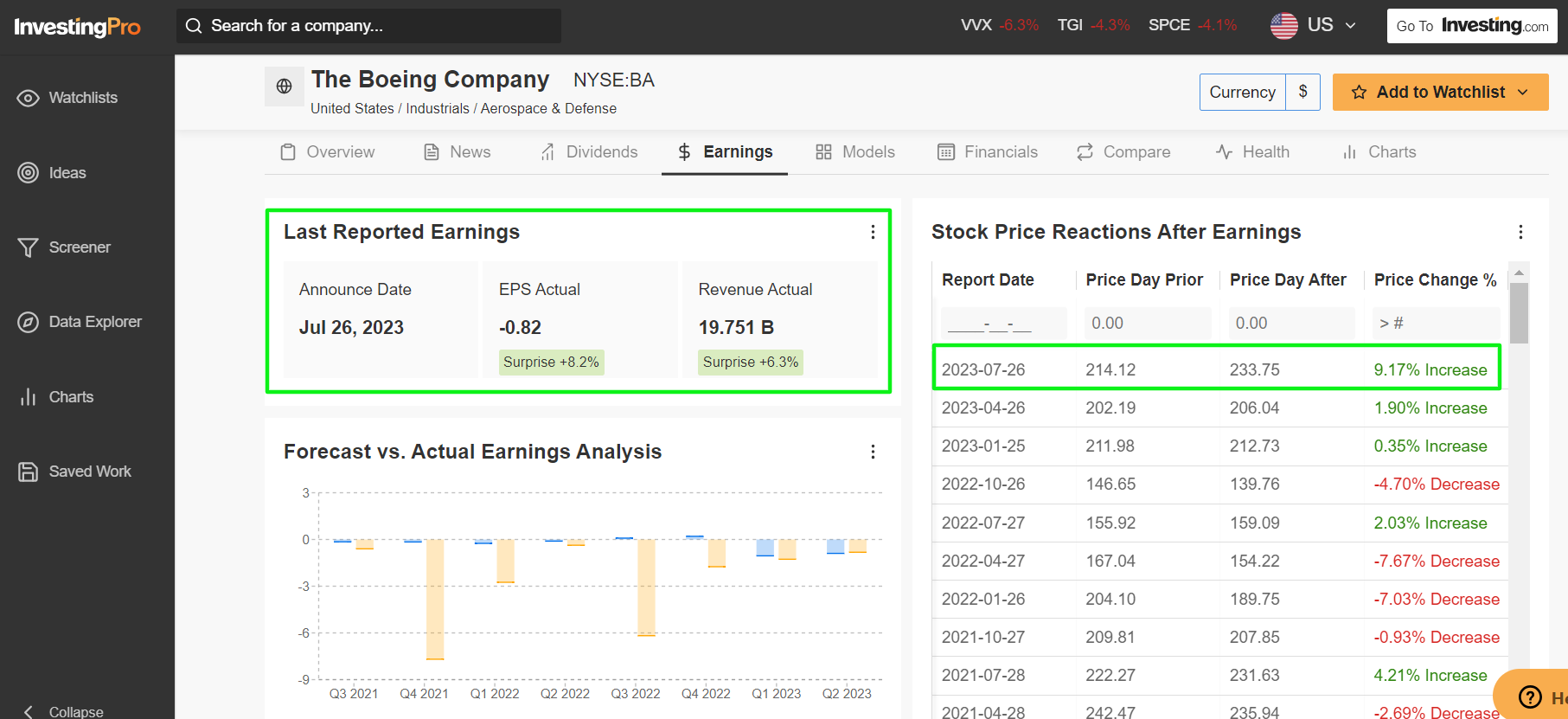

Boeing’s (NYSE:) and revenue soared past analyst forecasts when it reported results on July 26, thanks to a pickup in commercial aircraft deliveries.

Source: InvestingPro

What’s more, the U.S. aerospace giant generated $2.6 billion of free cash flow in the June quarter, well ahead of analyst forecasts, and reiterated its full-year guidance of between $3 billion and $5 billion of free cash flow.

Along with the better-than-expected earnings, Boeing said it plans to ramp up production of its best-selling 737 Max aircraft from 31 jets to 38 jets per month as supply-chain issues begin to ease.

Boeing shares surged 9.2% to their highest closing price since November 2021 following the update. It was the stock’s third-best earnings-day reaction in the last 20 years and its best earnings-day reaction since Q2 2017 when it rose 9.9%.

BA stock is up 25.1% year-to-date amid indications the airplane manufacturer may be starting to come out of the woods after being plagued by MAX- and COVID-related problems in recent years.

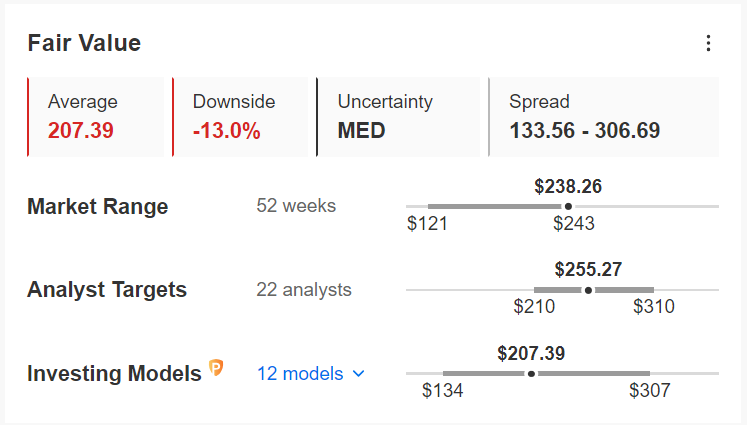

While Boeing remains a favorite amongst Wall Street analysts, shares appear to be slightly overvalued, as per the quantitative models in InvestingPro, which point to a potential downside of 13% from current levels.

Source: InvestingPro

5. Royal Caribbean Cruises

- -Year-To-Date Performance: +109.5%

- -Market Cap: $26.5 Billion

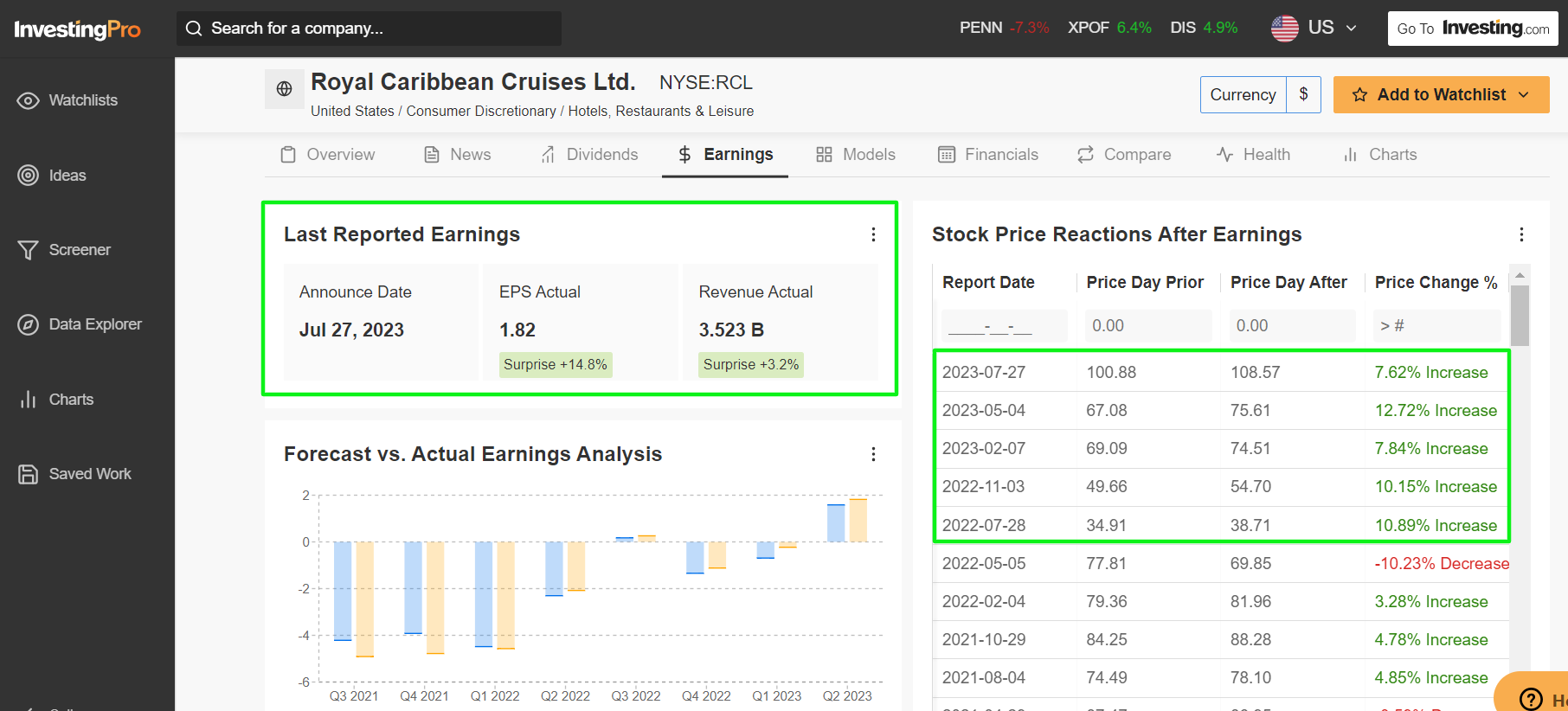

Royal Caribbean (NYSE:) reported its second consecutive ‘’ late last month, trouncing expectations for EPS and sales growth while also lifting its full-year guidance amid a robust demand outlook. The beat-and-raise quarter sparked a 7.6% rally in RCL shares, which marked their fifth straight earnings-reaction-day gain of more than 7%.

Royal Caribbean Earnings Data

Royal Caribbean Earnings Data

Source: InvestingPro

The cruise giant released second-quarter earnings that blew past analysts’ estimates on July 27 as profitability trends continue to recover from the COVID-19 pandemic amid the ongoing improvement in travel demand. It also posted a record quarterly revenue of $3.52 billion as travelers flock to its cruises amid the current macro environment.

Royal Caribbean Daily Chart

Royal Caribbean Daily Chart

Cruise line stocks have surged this year as they benefit from pent-up demand for international travel delayed by pandemic lockdowns. Royal Caribbean’s shares have gained 109.5%, Carnival (NYSE:) has risen 115%, and Norwegian Cruise Line (NYSE:) Holdings is up around 50% so far in 2023.

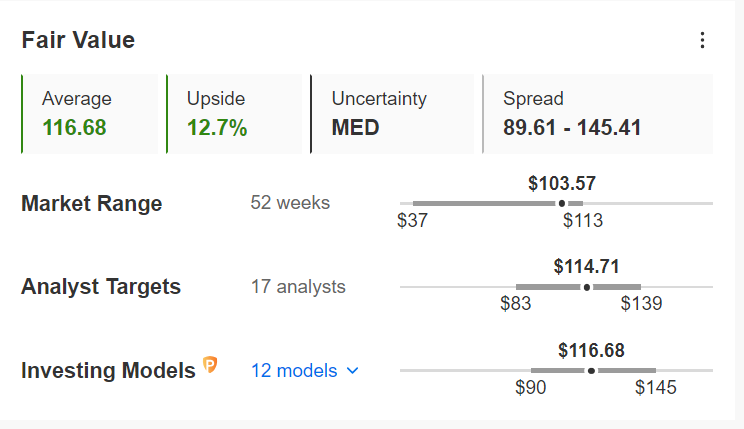

With that being noted, RCL stock is still cheap according to a number of valuation models on InvestingPro, with the average ‘Fair Value’ price target pointing to a potential upside of 12.7% from the current market value.

Royal Caribbean Fair Value

Royal Caribbean Fair Value

Source: InvestingPro

***

Sign Up for a Free Week Now!

Disclosure: At the time of writing, I am short on the S&P 500, Nasdaq 100, and Russell 2000 via the ProShares Short S&P 500 ETF (SH), ProShares Short QQQ ETF (PSQ), and ProShares Short Russell 2000 ETF (RWM). I am long on the Dow Jones Industrial Average via the SPDR Dow ETF (DIA). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.