S&P 500: 2024 Marks Best Election Year Since 1936 – Stage Set for Year-End Surge?

2024.10.08 03:31

As we approach the final stretch of 2024, much of the nation’s focus is on the upcoming U.S. presidential election. But while the political landscape remains uncertain, the markets are painting a different picture. September, traditionally a sluggish month for global equities, delivered an unexpected surge.

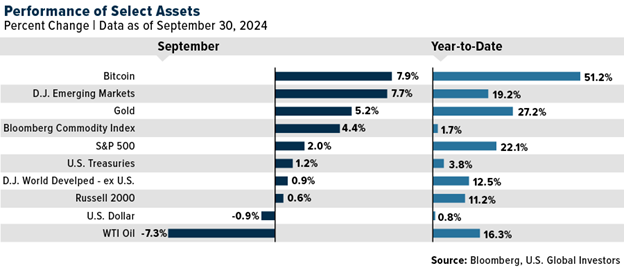

The gained 2.02%, marking its strongest September since 2013. This brought its year-to-date return to 22.08%, making 2024 the best presidential election year for stocks in almost 90 years (more on that later).

has been another standout performer. Once viewed with skepticism by traditional investors, the digital currency posted a nearly 8% gain last month, bringing its year-to-date growth to an astonishing 51%. With the Federal Reserve adopting a dovish stance, the has weakened, prompting investors to seek alternative assets like Bitcoin and as hedges against inflation and uncertainty.

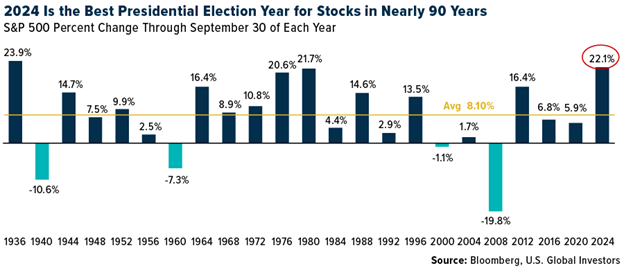

Best Election Year for Stocks Since 1936

Election years often bring volatility as markets grapple with the uncertainty surrounding potential changes in leadership, but 2024 has proven to be an outlier. Central bank easing has provided a powerful tailwind, helping to stabilize markets and lift stocks higher, despite lingering concerns over who will occupy the White House next year.

In fact, 2024 is shaping up to be the best presidential election year for stocks in nearly 90 years. By the end of September, the S&P 500 had risen more than 22%, the highest return during an election year since 1936. Investors have embraced the Fed’s commitment to looser monetary policy, which has kept market sentiment buoyant despite the political backdrop.

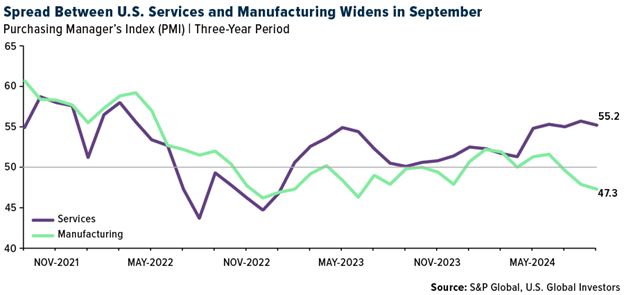

Services Drive Economic Growth as Manufacturing Contracts

Beneath the surface of these impressive market gains, however, lies a more complex picture of the U.S. economy. It’s a tale of two sectors: while services continue to thrive, manufacturing is struggling.

The U.S. services sector—which accounts for nearly 80% of the country’s GDP—has now expanded for 20 consecutive months. New orders continue to grow, driven by steady consumer demand and a reduction in interest rates, which has made borrowing more affordable for businesses and households alike, according to S&P Global. Despite some moderation from the 14-month high we saw in August, the sector looks strong, providing a foundation for economic stability.

In contrast, the manufacturing sector is showing signs of strain. The end of the third quarter saw manufacturing dip deeper into contraction territory. Slowing demand, both domestically and internationally, has weighed heavily on the sector, and many analysts are pointing to broader economic challenges as the cause. The uncertain outcome of the upcoming election has only added to the unease, as companies hold off on major investments until they have a clearer sense of the country’s political direction.

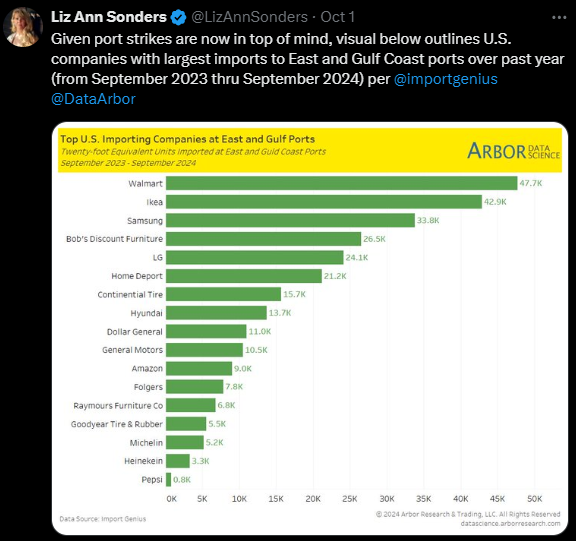

Lingering Effects of Port Strike Could Impact Holiday Supply Chains

In addition to domestic economic concerns, several external factors threaten to disrupt the positive momentum we’ve seen in the markets.

Hurricane Helene, for instance, serves as a reminder of the unpredictable risks posed by Mother Nature. The storm caused what could amount to $34 billion in total economic losses, with insured damages expected to exceed $6 billion.

The recent resolution of the dockworker strike at East Coast and Gulf ports—a potential “man-made disaster,” according to President Joe Biden—is a welcome development, but its impact will likely linger. The strike, which disrupted one of the busiest shipping periods of the year, created a huge backlog of goods waiting to be processed. Major retailers like Walmart (NYSE:), Ikea and Home Depot (NYSE:), which rely heavily on these ports for imported goods, were among the hardest hit.

As operations resume, shipping giants such as Maersk and Hapag-Lloyd have warned that freight costs are likely to rise as a result of the delays. While the strike itself has ended (for now), the fallout could affect supply chains well into the fourth quarter, particularly as retailers ramp up for the holiday season.

Record Holiday Sales Expected as Retailers Offer Deep Discounts

Despite these challenges, there’s still reason for optimism as we head into the holiday season. Adobe (NASDAQ:) is forecasting a record $240.8 billion in online holiday sales, an 8.4% increase over 2023. Electronics and apparel are expected to be the standout categories, driven by deep discounts as retailers aim to move inventory.

As we move into the final quarter of 2024, there’s much to be hopeful about. Central bank easing has provided a strong foundation for market growth, and the holiday season promises to deliver robust consumer spending.

At U.S. Global Investors, we believe in taking a long-term view. While the short-term outlook remains favorable, it’s essential to stay diversified and prepared for whatever the future may hold. As always, our focus is on helping investors navigate both the opportunities and challenges ahead.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The aims to provide 95% market capitalization coverage of stocks traded in emerging markets. The Bloomberg Commodity Index (BCOM) is a financial benchmark that provides exposure to physical commodities through futures contracts. It’s designed to be a diversified index that doesn’t have any one commodity or sector dominate it. The Bloomberg US Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded by the maturity constraint but are part of a separate Short Treasury Index. The Index is designed to measure 95% of the market capitalization of stocks traded in developed markets, excluding the U.S. The is a small-cap U.S. stock market index that makes up the smallest 2,000 stocks in the Russell Index. The is an index of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners’ currencies.

Disclaimer: None of U.S. Global Investors Funds held any of the securities mentioned in this article as of 9/30/2024.

Past performance does not guarantee future results. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.