South Africa raises rates more than forecast; decision split

2022.07.21 17:58

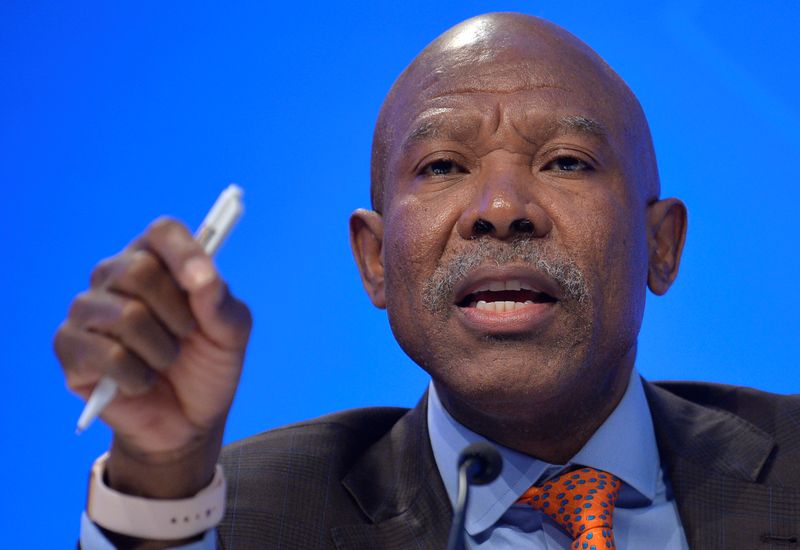

FILE PHOTO: South Africa’s Reserve Bank Governor Lesetja Kganyago, who is also International Monetary Finance Committee (IMFC) chairman, makes remarks at a closing news conference for the IMFC, during the IMF and World Bank’s 2019 Annual Meetings of finan

JOHANNESBURG (Reuters) – South Africa’s central bank raised its main lending rate more than expected on Thursday, by 75 basis points to 5.50% to try to keep a lid on inflation.

This was the fifth meeting in a row that the South African Reserve Bank’s monetary policy committee (MPC) has raised its repurchase rate. The decision was split, with three MPC members preferring a 75 basis points (bps) rise, one a 100 bps hike and one a 50 bps increase.

Governor Lesetja Kganyago told a news conference that the risks to the inflation outlook were “assessed to the upside.”

“The revised repurchase rate path remains supportive of credit demand in the near term, while raising rates to levels consistent with the current view of inflation risks,” Kganyago said.

“The aim of policy is to stabilise inflation expectations more firmly around the mid-point of the target band and to increase confidence of hitting the inflation target in 2024.”

Analysts polled by Reuters had predicted a 50 bps increase.

The rand gained on the interest rate announcement.

The SARB has now hiked rates by a cumulative 200 bps since November last year in a bid to tame price pressures. It initially hiked in 25 bps increments before a 50 bps move at the previous meeting in May.

But June inflation quickened to a 13-year high of 7.4% year on year from 6.5% in May, moving further from the bank’s 3%-6% target range.