Solid U.S. Job Growth But Slower Earnings

2022.10.10 07:53

[ad_1]

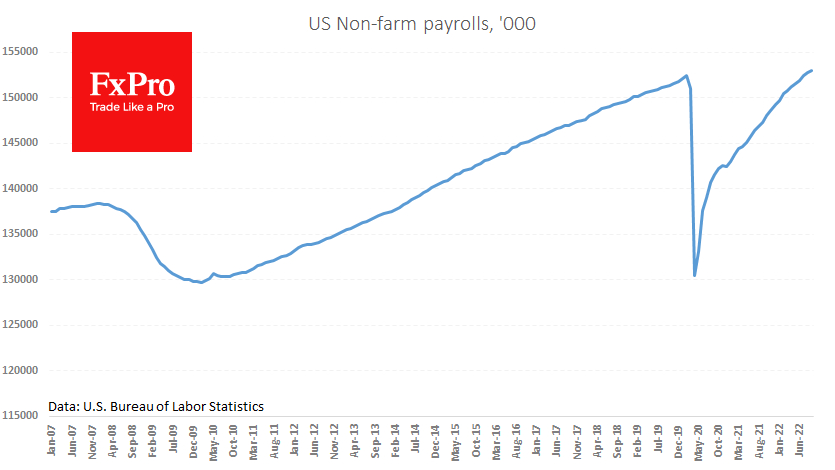

The US economy added in September – slightly above forecasts for growth of 250K-255K. The has returned to 3.5% after 3.7%, reversing concerns that there was already a sustained upward trend in the rate. We recall that the Fed expects unemployment to rise to 4% by the end of the year, calling for economic pain to be accepted to suppress inflation.

The US economy added 263K jobs in September

The US economy added 263K jobs in September

Impressive job growth and falling unemployment rates are fuelling speculation that the Fed will once again raise the rate by 75 points in early November. CME’s FedWatch tool indicates that markets have an 82% chance of such an outcome. A week ago, the odds of such an outcome were below 57%, and this shift is lying behind the latest boost to the dollar and the decline in equities.

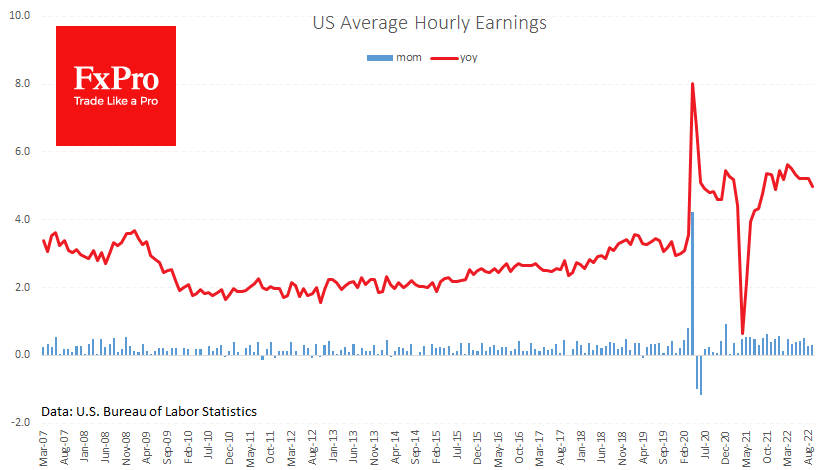

However, the situation is not clear-cut, as rising employment almost paradoxically leads to slower wage growth. After adding 0.3% for the month, hourly earnings added 5.0% y/y against 5.2% a month earlier and a peak of 5.6% in March. Rising employment paradoxically leads to slower wage growth

Rising employment paradoxically leads to slower wage growth

Job growth would allow the Fed to take another big step towards a rate hike without fear of bringing down the economy. But already in November, we should expect signals of a further reduction in the pace of rate hikes, which limits the medium-term potential for a stronger and weaker stock markets.

The FxPro Analyst Team

[ad_2]

Source link