Solar Stocks in the Dark as High Interest Rates Cast a Shadow on the Industry

2024.05.01 10:41

First-quarter earnings have verified well thus far, but rate-sensitive industries continue to face headwinds

Berkshire Hathaway’s Q1 results will be released at its annual shareholder meeting this Saturday

Costco’s same-store sales figures come out the following Wednesday, and the retailer has received a lot of press for its presence in the gold market

After a cool spell late last week, springtime is in full bloom around our parts in the Northeast. As the calendar flips to May, Q2 hasn’t come without its bouts of uncomfortable market conditions either. The pared its 2024 gains in April, but earnings growth appears on track, according to the latest collective numbers by the world’s biggest companies. Along with a Fed meeting this week, key macro data will shower investors on Friday and thereafter via employment and inflation updates.

Solar Stocks Still Sour

This week, let’s shine a light on one stock-market niche that has been flat-out burned ever since interest rates began to lift off in late 2021. The solar industry, once tied to happenings in the Energy sector, is now among the most susceptible areas to higher borrowing costs.

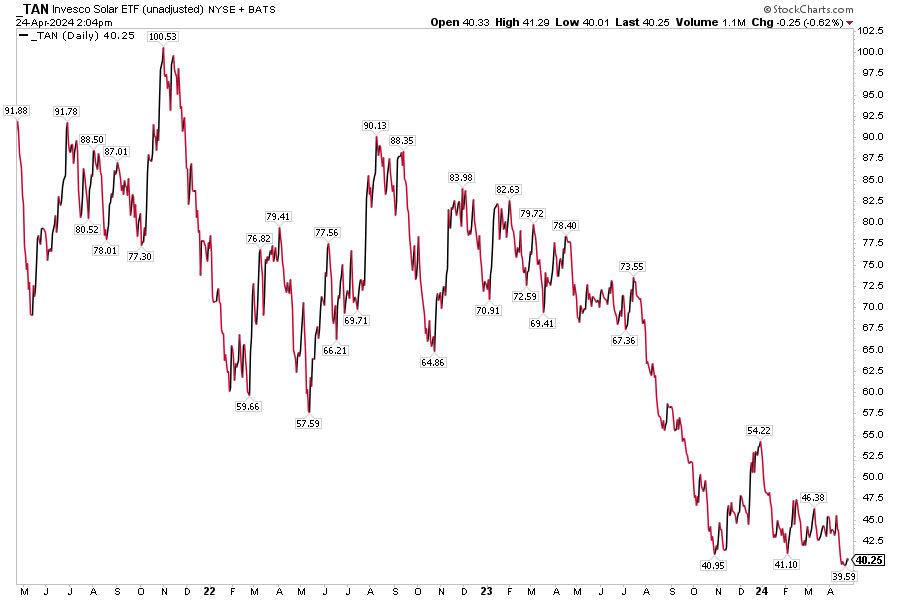

The debt-dependent group seems to just live and die by the latest moves in the US Treasury bond market. When yields spike, you tend to see an impact to names like Invesco Solar ETF (NYSE:), charted below. The market has shown that when rates retreat, relief rallies often ensue.

When will that intermarket relationship break? It’s hard to pinpoint, but we will hear from a few of the solar industry’s big players in May through quarterly reports, shareholder meetings, and corporate conferences.

TAN Solar ETF Down 45% from Q3 2023

Source: Stockcharts.com

A Dim Outlook

Last week, Enphase Energy (NASDAQ:) (ENPH) was among the biggest earnings movers after it posted a double miss on the evening of April 23. The $15 billion market cap Semiconductor Materials & Equipment industry company within the Information Technology sector recorded Q1 non-GAAP EPS of $0.35 while revenue of $263 million also came up shy of the Wall Street consensus.

Shares plunged immediately after the numbers hit the tape, but then found some footing by Wednesday morning. It was really a triple-play miss considering Enphase’s management team lowered top-line guidance amid softening domestic demand, though sales growth in Europe jumped 70% from Q4.

First Solar Earnings and Shareholder Meeting on Tap

It seems to be the same old story for solar stocks. The TAN ETF notched multi-year lows in April and traded lower after the ENPH report. There is potential for more volatility. According to Wall Street Horizon’s data, TAN’s biggest weight, First Solar (NASDAQ:), is confirmed to report Q1 2024 earnings on Wednesday, May 1 AMC with a conference call immediately after the numbers cross the wires. China’s GCL Technology Holdings (GCPEF) also issues quarterly numbers then.

Then, on the afternoon of May 8, First Solar holds its annual shareholder meeting right before a pair of industry companies post their quarterly results; the embattled SolarEdge Technologies (NASDAQ:), down more than 80% over the past 12 months, and Sunrun (NASDAQ:), off by more than half since this time in 2023, both post Q1 numbers and host earnings calls. Array Technologies (NASDAQ:) reports the following afternoon.

Conference Color

On the conference front, updates from many major solar industry players will be heard at Citi`s 2024 Energy and Climate Technology Conference from May 14 to 15 and the Deutsche Bank Global Solar & Clean Tech Conference 2024 (virtual) on May 16. So, as executives shed light on existing issues and emerging trends, keep this slice of the market on your radar.

Value Investors Gather

What else is happening as the new month gets going? The first Saturday in May doesn’t only mark the big race at Churchill Downs (NASDAQ:). It’s also when Berkshire Hathaway’s (NYSE:) annual shareholder meeting takes place. The first year without the esteemed presence of the late Charlie Munger will be tough, but investors may take solace in seeing Warren Buffett on stage along with other Berkshire execs.

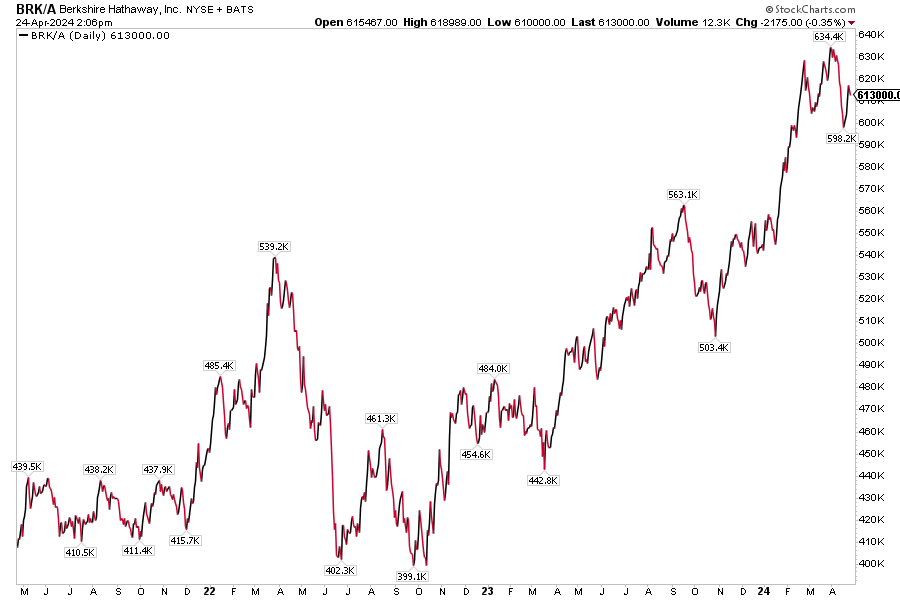

It comes at a time when the insurance industry faces increasing scrutiny considering steep rate increases in the homeowner and auto categories. Berkshire stock has come off its highs after rallying sharply in the previous 18 months. In general, rising interest rates are a net positive for insurers. Following somewhat sanguine comments from JPMorgan Chase (NYSE:) CEO Jamie Dimon last week, describing the US economy as “booming,” we’ll hear how Buffett views the state of the macro.

Berkshire Shares Take a Breather After a Big Run-Up

Source: Stockcharts.com

Will Costco’s April Sales and Q1 Earnings Glitter?

After Cinco de Mayo, Costco (NASDAQ:) offers among the first April reads on consumer spending via its monthly same-store sales report. With full quarterly earnings not due until May 30, investors will find out if the $317 billion market cap retailer built on its March 9.4% year-over-year net sales jump. You might have heard that Costco is now in the gold market. Last summer, it began offering gold at relatively cheap prices compared to other physical gold sellers.

The strategy was apparently a hit as the company then started offering low-markup to its members. It’s estimated that the precious metals business could be adding 1% to comparable-store revenue and 3% to its General Merchandise sales tally. At the very least, media attention has been high as prices have increased toward $2400 per ounce.

The Bottom Line

First-quarter results are tracking pretty well for companies through week three of the reporting season. Not all areas enjoyed profitability gains, however. The troubled solar industry continues to grapple with higher interest rates and ongoing tariff chatter. Elsewhere, Berkshire Hathaway issues its Q1 results this Saturday in Omaha at “Woodstock for Capitalists.” Finally, will Costco’s move into the metals dealing business be a hit? We might get details on that later in May when the company issues its results.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Source link