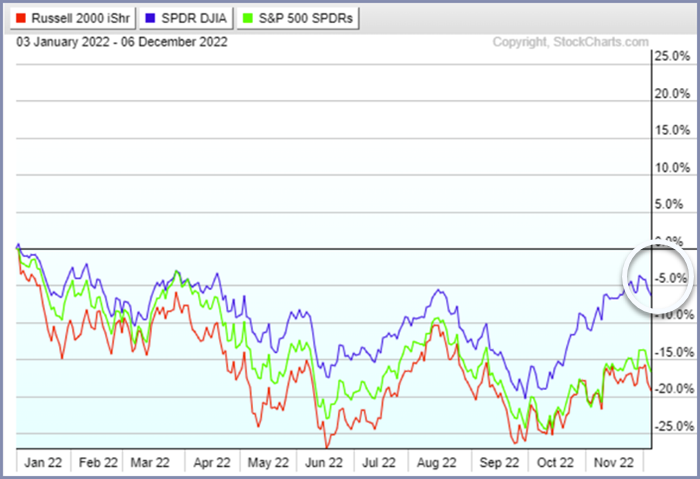

Small Caps Vs. Large Caps: Who is Leading?

2022.12.09 01:30

[ad_1]

Large-cap stocks have been leading with the down the last year to date, but even though the selling pressure has been constant, trading volume has been anemic.

iShares Russell 2000 ETF (NYSE:) normally trades approximately 27 million shares on average daily and traded approximately 17 million shares today. IWM also held the lows from this morning to this afternoon, and all the indices faced similar tests today.

Our proprietary Real Motion Indicator is showing downward momentum, but it almost looks like our RM Indicator ran into an imaginary force, and momentum was stopped in its tracks.

The is creeping up, so tomorrow is a make-or-break day for the bulls since the has seen five straight days of declines.

This is a tradable market, and weekly closures are probably more important than intra-week volatility, so let’s follow the trend.

Grandpa (small-cap stocks) is the worst performer compared to large-cap stocks, but that does not mean this trend will continue.

The major indices have all experienced back-to-back days of significant declines, wiping out gains from when Powell spoke.

The SPY extended losses Tuesday to drop below the 200-day moving average and needs to hold support around 390 to begin scaling back up to 400.

This stock market rally has had several significant one-day gains followed by pullbacks. That’s made it difficult for stocks flashing buy signals to make much headway.

Investors should be wary of adding too much exposure until the SPY ETF moves decisively above the 200-day moving average.

The and Grandpa (IWM) falling below their 50-day moving average and the falling further would be a sign to reduce exposure, but let’s see.

Also note that the November inflation report comes out on Dec. 13, with the year-end Fed rate hike and Powell news conference the following day.

Those significant events could catalyze a market rally or reasons for the market to go South. So, investors should be ready to act.

That means having watchlists ready, but it also means staying engaged and having a flexible mindset.

ETF Summary

S&P 500 (SPY) The 50-week MA looms above as resistance 410 – until that clears, this could return to support at the 50-DMA or 380.

Russell 2000 (IWM) Similarly, 190 is resistance, now looking at 177 as support and must hold.

Dow (Dow Jones Industrial Average ETF Trust (NYSE:) As the only index above the 50-WMA, support at 329 is key.

Nasdaq (Invesco QQQ Trust (NASDAQ:) Still the weakest index. Hovering on major support at 278 or trouble ahead.

S&P Regional Banking ETF (NYSE:): After weeks of sideways action, this failed with the last major support at 57.00.

VanEck Semiconductor ETF (NASDAQ:): 212 support to hold, and if this can lead, then 230 is the place to clear and take notice.

iShares Transportation Average ETF (NYSE:): Another one to fail at the 50-WMA. Now, 213 to 214 is key support.

iShares Biotechnology ETF (NASDAQ:): This has been the year of do not chase the breakouts. Like DIA above the 50-WMA and will see if it can hold 127.

S&P Retail ETF (NYSE:): Never got the clearance over 67.00, so now we watch 63 as a major support.

[ad_2]