Small Caps’ Fate to Determine Large Caps’ Future

2023.07.17 04:29

In the Bible story, David and Goliath represent resilience and overcoming the odds.

David, a small sheepherder, places a stone in a sling to hurl at Goliath’s head. David gets a clean hit, and Goliath falls. David then uses Goliath’s sword to kill and decapitate the giant.

If we look at the small caps and the large caps as seen through the lens of iShares Russell 2000 ETF (NYSE:) and Invesco QQQ Trust (NASDAQ:), it certainly has similarities to the parable.

Small caps, like David, have had to overcome odds to show resilience. In October 2022, both IWM and QQQs bottomed out.

Then, in February 2023, it almost looked like the small caps were ripe to take out the 23-month moving average in blue (or about a 2-year business cycle)…until…the commercial bank crisis.

If you are new to the pieces, I have written extensively on the 2-year cycle as key this year, given the bull run of 2021 and the bear run of 2022.

This year, we knew could be pivotal.

But is it really?

Once the small caps fell from the key resistance, Goliath woke up. Large caps began to rally, departing from the weakness of the small caps.

QQQs kept going and, by May, cleared the 23-month, and off it went.

Meanwhile, IWM struggled to hang on to the 80-month or about the 6–8-year business cycle low.

Except for the covid crash, IWM has been above the 6-8 year business cycle low for over a decade.

In fact, we avoided the recession from a technical perspective as not only did that business cycle low hold, but in June, the IWM began to run up as well.

Anyway, back to our story.

It seemed that this past week, small caps were once again ripe to run.

Of course, has not stopped. After all, technology, according to market sentiment, is the savior of everything…but is it really?

Here is where David v. Goliath comes in.

Small caps once again ran right to the 23-month moving average and closed the week below it.

Now, it may clear it later this month.

If IWM does clear, we think that will take some thunder from the large caps with another rotation to value, but not necessarily the final blow for QQQs.

However, if IWM cannot clear, then we can begin to speculate that David has slung the rock at NASDAQ’s giant head. Only this time, they both may fall.

Why might IWM not clear the 23-month MA?

Inflation, Fed hikes, bonds back in vogue, poor earnings, consumers cutting back???

Take your pick.

It is, though, too soon to tell.

But let’s end with a potential stone.

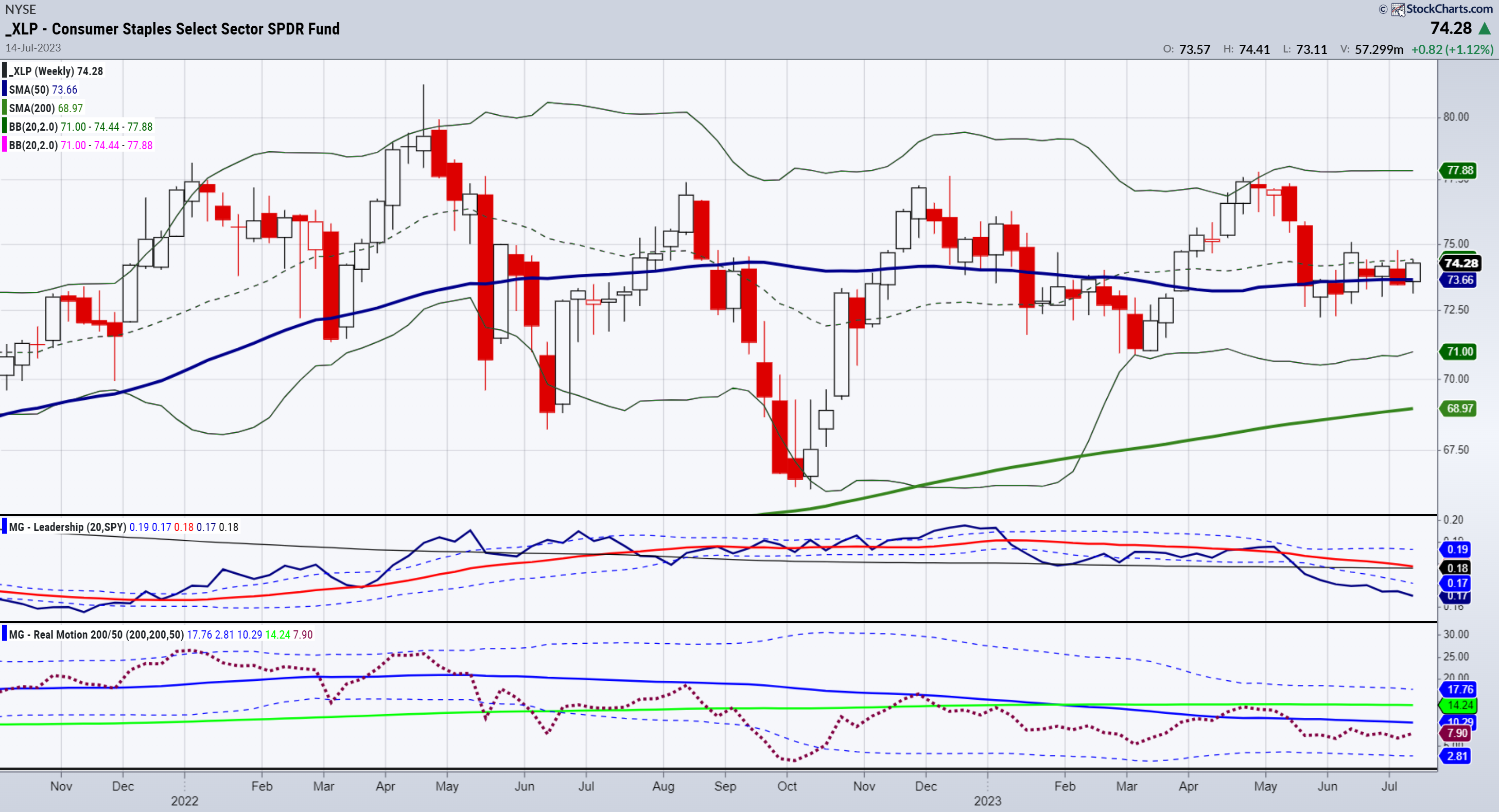

Consumer Staples Select Sector SPDR® Fund (NYSE:).

As this just cleared the 50-daily moving average, a move over 75.00 could indeed signal that the consumer is shifting away from toys and more towards things they really need.

ETF Summary

- S&P 500 (SPY) 450 pivotal area failed 440 support

- Russell 2000 (IWM) 193 is the 23-month holy grail

- Dow (DIA) 34,000 pivotal

- Nasdaq (QQQ) had a Great weekly close, so IWM will definitely be key

- Regional banks (KRE) 42.00-44.00 range

- Semiconductors (SMH) Where Goliath goes, so do semi’s-another potential reversal top

- Transportation (IYT) Under 250 some trouble

- Biotechnology (IBB) 121-130 range

- Retail (XRT) 65.00 key support for this coming week