Small Cap, Retail, Transportation Stocks’ Impressive Rally Faces Key Test Ahead

2023.11.15 02:28

The Economic Modern Family has opened its loving arms to the bulls and to us after our 2 weeks away.

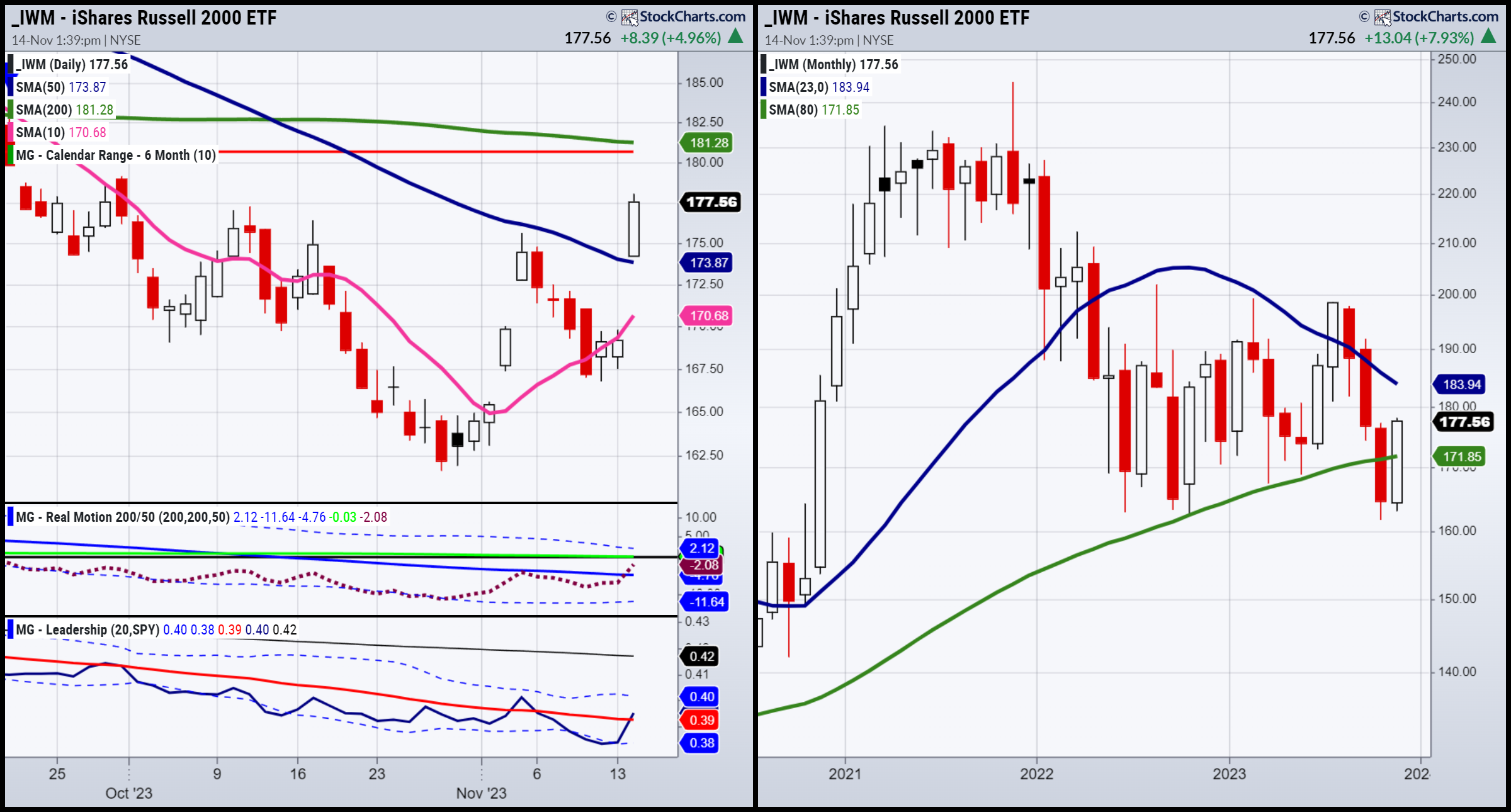

Beginning with or Granddad , Monday began with a gap up over the 50-DMA (blue).

We will watch for a phase change confirmation. Furthermore, the monthly chart shows IWM back above the 80-month MA (green). Resistance at 191 area is on tap if IWM holds above 174.

Granny Retail gave us the clutch hold before we left by never breaking down under the 80-month moving average (green).

Now, XRT has more to prove and needs to be watched carefully. You can see the resistance at the 200-DMA (green), but more importantly, keep watching the monthly chart.

XRT has not cleared the 23-month MA (blue) yet in 2023.

Both IWM and XRT are right into resistance on the momentum or Real Motion charts.

Another bright spot potential is in the Leadership chart with IWM now outperforming the -this could be a game changer if continues.

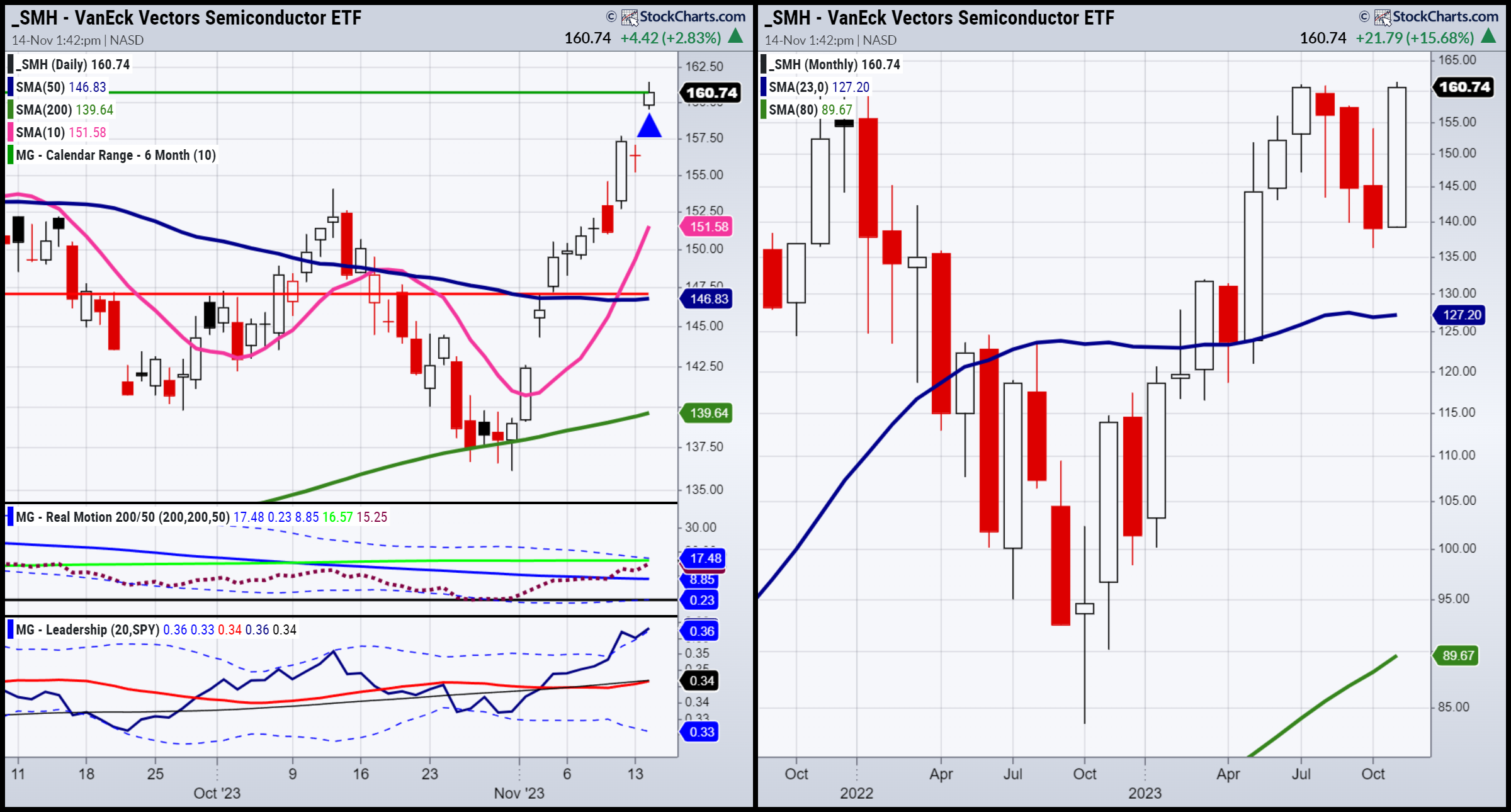

Semiconductors as do growth stocks, lead. Interesting that SMH touched the July 6-month calendar range high (green horizontal line) today.

The momentum indicator also hit resistance.

The monthly calendar never broke down. Now we watch for SMH to clear or not 160-161 level with volume.

Transportation is back to last month’s highs. IYT is actually underperforming in momentum while it cleared past the SPY in leadership.

Marginally clearing the 23-month right now, IYT must hold over 230 now to stay in the game.

The inside sectors of the economy as represented by IWM XRT and IYT, while impressive on this run, still have a lot to prove.

Semiconductors of course, are way stronger but also into some headwinds.

These monthly charts have been extremely reliable in helping us gauge the major support and resistance.

Seasonally, the market could remain strong.

ETF Summary

- S&P 500 (SPY) 450 clears see 465 Under 450 435 support

- Russell 2000 (IWM) 181 resistance 174 support

- Dow (DIA) 360 resistance 346 support

- Nasdaq (QQQ) 388 must clear and 370 must hold

- Regional banks (KRE) 45 big resistance

- Semiconductors (SMH) 160-161 now pivotal support

- Transportation (IYT) 230 key support

- Biotechnology (IBB) 120 pivotal

- Retail (XRT) 63 resistance and 60 pivotal support