Sliding airline profits and plane delays cast shadows at air show

2024.07.22 11:07

By Joanna Plucinska and Allison Lampert

FARNBOROUGH, England (Reuters) -A plunge in Ryanair’s quarterly profits cast a shadow over the opening of the Farnborough Airshow on Monday, where aviation leaders were already fretting about supply chain snags, aircraft delays and floundering plans to cut emissions.

Boeing (NYSE:) announced a bumper order from Korean Air for 20 777X jets and 20 787s, worth $7 billion according to estimated delivery prices from Cirium Ascend, in a boost for the U.S. planemaker’s long-delayed 777X programme.

But many delegates at the July 22-26 gathering of aviation leaders were not expecting the traditional deluge of deals as Airbus struggles to reach output goals and Boeing adopts a low-key posture amid its safety crisis, which was triggered by a panel flying off a 737 MAX jet in January.

Aviation was hit hard by the pandemic which saw air travel collapse only to bounce back sharply. That left many firms scrambling to resolve labour and parts shortages.

The situation has been exacerbated by a spiralling crisis at Boeing, which has had to slow production of its best-selling 737 MAX plane following the panel blowout.

Delays in delivering planes have hampered airlines’ efforts to capitalise on the post-pandemic surge in travel and inflated costs, and signs are growing they are struggling to pass those costs on to consumers as demand starts to normalise.

Ryanair, Europe’s biggest budget airline, reported on Monday an almost halving in quarterly profit, with fares plunging 15% and management warning of more pressure to come on prices.

CEO Michael O’Leary added there had been some improvement on deliveries from Boeing, but that there were still delays and he was getting a little concerned about deliveries due next year.

Separately, flydubai said its fleet expansion plans had been hit by delays in Boeing deliveries, while the boss of Air India said it was having to rob parts from some of its other aircraft to keep planes flying amid industry supply chain snags.

“The big question for the airlines here at Farnborough is what has happened to the halo effect of demand after the pandemic – has that recovery stalled?” said veteran aviation journalist Mark Pilling, who was due to host a panel of CEOs.

Pegasus Airlines CEO Guliz Ozturk told reporters customers were going “back to basics” seeking lower fares.

“We have started seeing the normalisation of demand. What does it mean? I mean, the demand is there, but now the travellers are looking for, as before the pandemic, for the most affordable, the lowest, the best price for their travel,” she said.

Ryanair’s warning on fares deepened worries about pressure on yields – a measure of average fare paid per mile by each passenger and a key barometer for airline profitability.

Airline shares were among the biggest fallers in Europe. Ryanair was down almost 17% at 1405 GMT, with rival easyJet (LON:) down 7%, TUI off 4.7% and BA-owner IAG 3.9% lower.

However, Boeing’s vice president of commercial marketing, Darren Hulst, said there was no sign of a weakening in demand for planes and suggested the warnings from airlines was just a sign of a “little bit more reality in the marketplace”.

FIXING SUPPLY CHAINS

With dealmaking expected to be limited, the focus at the air show is likely to fall on how manufacturers are tackling supply chain blockages.

Asked about flydubai’s complaints, Hulst conceded that Boeing had “disappointed our customers … over and over again, in many cases,” but that the work the company was doing this year was focused on ensuring that wouldn’t happen again.

Airbus CEO Guillaume Faury also said on Sunday that the European planemaker was making progress ramping up production of its top passenger jets.

Some deals will get over the line, delegates said.

Japan Airlines said it had ordered 10 Boeing 787-9s and agreed options for 10 more, while industry sources said Virgin Atlantic was close to placing a top-up order for Airbus A330neos and Saudi low-cost carrier Flynas was poised to order up to 30 of the same widebody aircraft.

The companies declined to comment.

Turkish Airlines, however, said engine talks were still holding up a potential big order with Boeing.

Pratt & Whitney, which is contending with problems with its GTF engine that have grounded aircraft, is also still winning orders. On Tuesday, Pratt is set to announce that lessor Avolon will select GTF engines to power 80 Airbus A320neo aircraft, an industry source familiar with the matter told Reuters. Pratt’s parent company RTX declined to comment.

This week’s air show will be peppered with sustainability panels and workshops as aerospace giants and airlines seek to emphasise their commitment to reducing carbon emissions, even as they plan to massively expand global air travel.

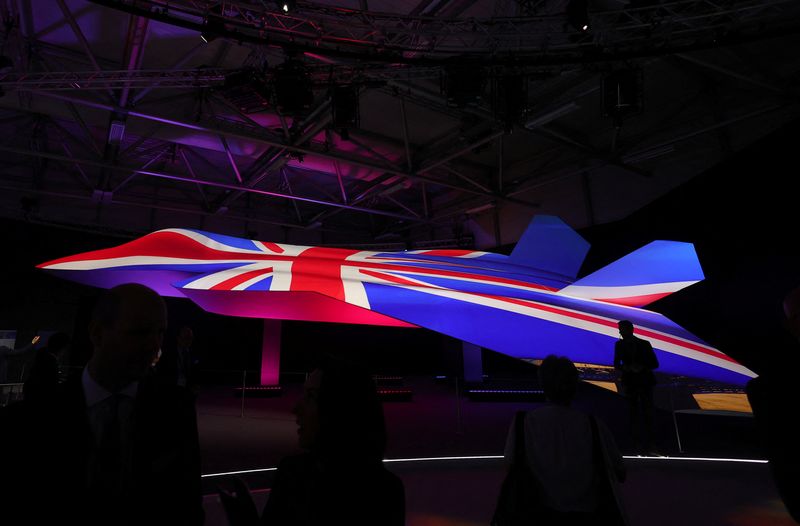

On the defence side, the focus will be on Ukraine, possible delays to America’s future F-22 fighter replacement, code-named NGAD, and a defence review by Britain’s new Labour government.

At the show, British Prime Minister Keir Starmer stressed the importance of the UK’s fighter jet capability, but stopped short of guaranteeing its next generation combat air programme with Japan and Italy would not be affected by the review.