Shipping firms impose surcharges as Red Sea attacks hit global trade

2023.12.22 09:37

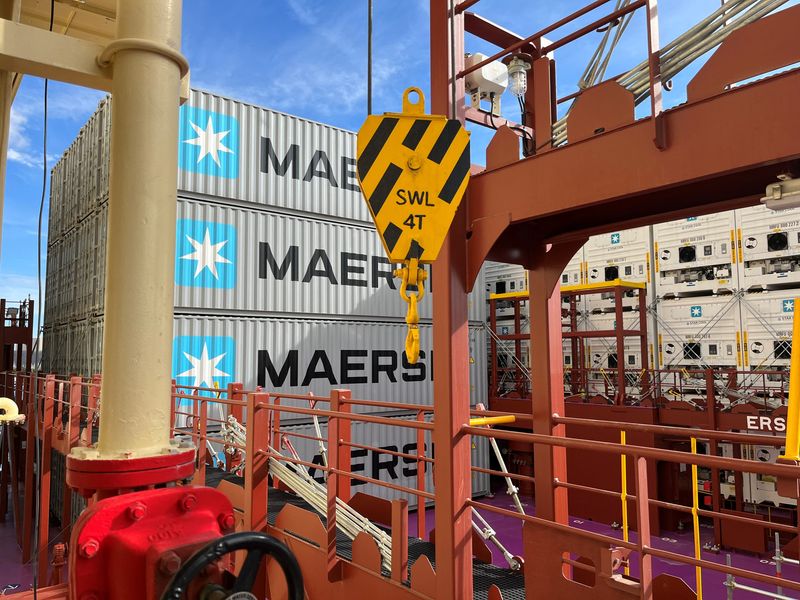

© Reuters. FILE PHOTO: The world’s first methanol-fueled container vessel Laura Maersk, owned by shipping company Maersk, is seen in Copenhagen, Denmark September 14, 2023. REUTERS/Jacob Gronholt-Pedersen/File Photo

OSLO/PARIS (Reuters) -Maersk and CMA CGM, two of the world’s largest shipping firms, will impose extra charges after deciding to re-route ships following attacks on vessels in the Red Sea, as worries about the disruption to global trade grow.

The surcharges, designed to cover longer voyages around Africa compared with routes via the Suez Canal, will add to rising costs for sea transport since Yemen’s Houthi militant group started targeting vessels.

Maersk and CMA CGM are among leading shipping lines to have suspended the passage of vessels through the Red Sea that connects with the key Suez Canal, the quickest sea route between Asia and Europe.

Instead, they are directing ships around the Cape of Good Hope at the southern tip of Africa, adding about ten days to a journey that would normally take about 27 days from China to northern Europe.

Citing “severe operational disruption”, Maersk said late on Thursday that additional payments include an immediate transit disruption surcharge (TDS) to cover extra costs associated with the longer journey as well as a peak season surcharge (PSS) from Jan. 1.

Earlier on Friday, Chinese automaker Geely told Reuters its electric vehicle sales were likely to be hurt by a delay in deliveries to Europe, the latest company to warn of disruption

China’s second largest automaker by sales said most of the shipping firms it uses for European exports have plans to go around southern Africa.

The alert bodes ill for other automakers in China as they seek to increase exports to Europe due to overcapacity and weak demand at home.

The United States has announced a multinational force to patrol the Red Sea, but shipping sources say details have yet to emerge and companies continue to avoid the zone.

In a message to customers, logistics firm CH Robinson Worldwide (NASDAQ:) said it had rerouted more than 25 vessels to southern Africa over the past week.

“That number will likely continue to grow due to ongoing war risks in the Red Sea and the drought in the Panama Canal,” it said.

SURCHARGES

It said cancellations and rate increases were expected to continue into the first quarter and recommended customers book 4-6 weeks in advance to ensure space on vessels.

In total, Maersk said a standard 20-foot container travelling from China to Northern Europe now faced an extra charge of $700, consisting of a $200 TDS and $500 PSS.

Containers bound for the east coast of North America will be charged $500 each, consisting of the $200 TDS payment and a $300 PSS, the company added.

Maersk also said routes in other parts of its network would be affected by the Suez disruption, triggering emergency contingency surcharges on a wide range of journeys.

CMA CGM also announced surcharges late on Thursday, including an extra $325 per 20-foot container on the North Europe to Asia route and $500 per 20-foot container for Asia to the Mediterranean.

The charges were part of its contingency plan to reroute vessels around the Cape of Good Hope, it said.

France-based CMA CGM listed 22 of its vessels as having been re-routed.