Sherwin-Williams Stock Reaches New Record High: Now What?

2024.08.21 10:43

We about leading paint and coatings company Sherwin-Williams (NYSE:) in mid-October, 2022. The stock had just fallen 45% and hardly anyone saw a rebound on the horizon as recession talks were growing louder by the hour.

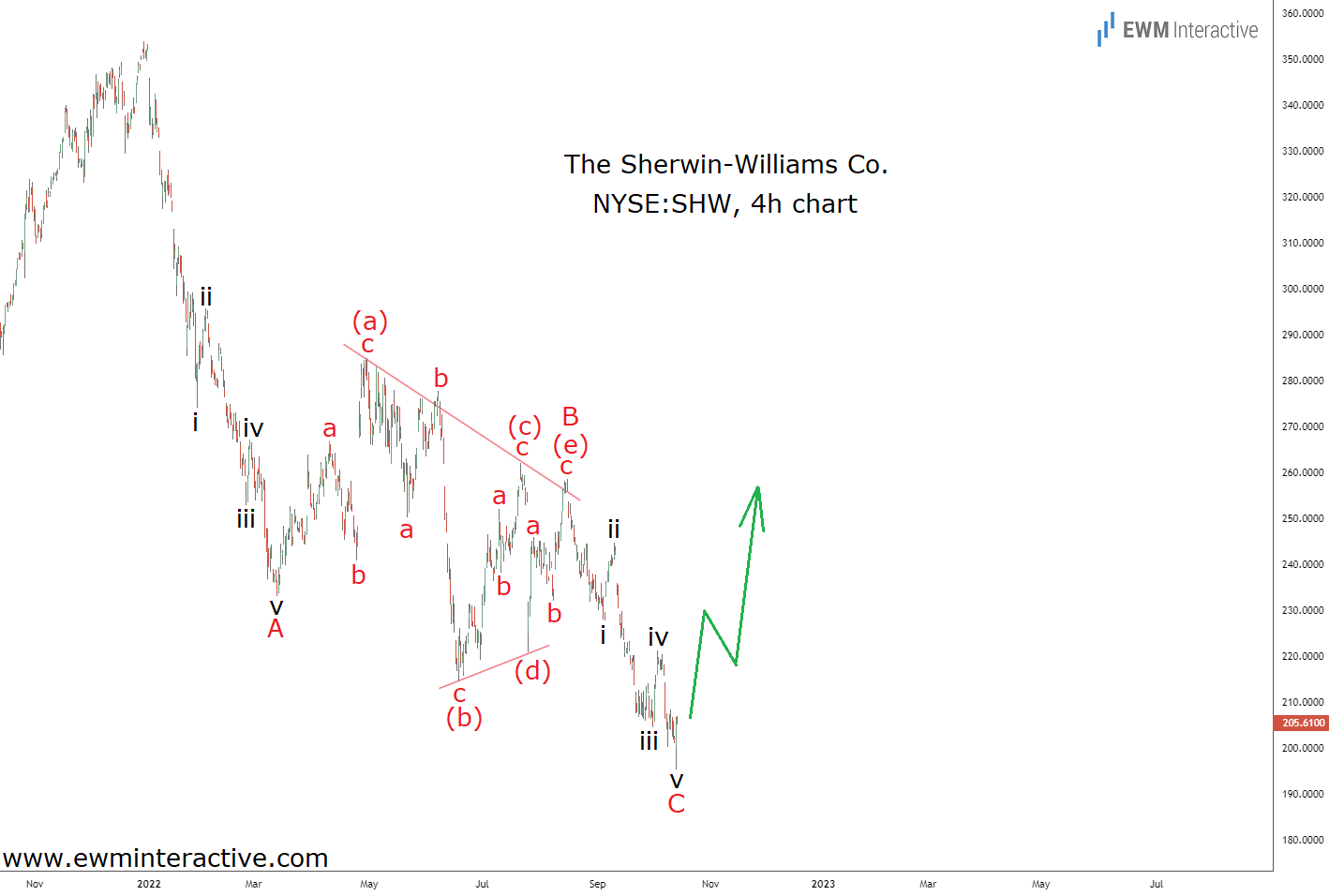

A quick look at the structure of that decline, however, made us think that Sherwin-Williams “might have just bottomed.” That conclusion was entirely based on the stock’s hourly chart below and the Elliott Wave sequence it revealed.

The 4-hour chart showed that the decline from $354 to $195 was a textbook A-B-C zigzag correction, where wave B was a triangle. The five waves of the impulse patterns in waves A and C were also visible.

According to the theory, once a correction is over the preceding trend resumes. Since Sherwin-Williams was clearly in an uptrend prior to this decline, it made sense to expect the bulls to return and “lift the stock to a new record.” The updated chart below show that this is exactly how the situation unfolded.

The bulls really did return and despite the three notable pullbacks along the way, made it to a new all-time high in the vicinity of $360 a share. Two problems now lie in their way higher.

The first is all too common, namely that Sherwin-Williams now trades at a forward P/E ratio of 31. Even after we consider the company’s undisputed industry leadership, this is still too expensive for a low-single-digit revenue grower.

And the second reason for caution is that the structure of the recovery from $195 looks corrective, as well. It can be seen as a W-X-Y double zigzag, whose waves W and Y are simple (a)-(b)-(c) zigzags.

This makes us think that a higher-degree (A)-(B)-(C) expanding flat correction could be in progress. If this assumption is correct, waves (A) and (B) are already in place and wave (C) down has yet to develop.

It is supposed to shape up as a five-wave impulse, marked I-II-III-IV-V, and breach the low of wave (A), putting downside targets below $195 within the bears’ reach. So instead of celebrating the new record, we think Sherwin-Williams investors would do well to take some chips off the table.

Original Post