Sherwin-Williams Stock Might Have Just Bottomed

2022.10.14 08:24

[ad_1]

With five times as many stores as its nearest competitor, Sherwin-Williams (NYSE:) is the leading paint and coatings manufacturer in the world. The company has almost literally put a store on every painter’s way to work. And since 80% of a painter’s expenses are labor and only 20% the paint itself, SHW is practically saving its clients money by saving them time. Accessibility and convenience give the company a strong competitive advantage. No wonder the stock had been on an upward trajectory for decades until it reached an all-time high of $354 late last year.

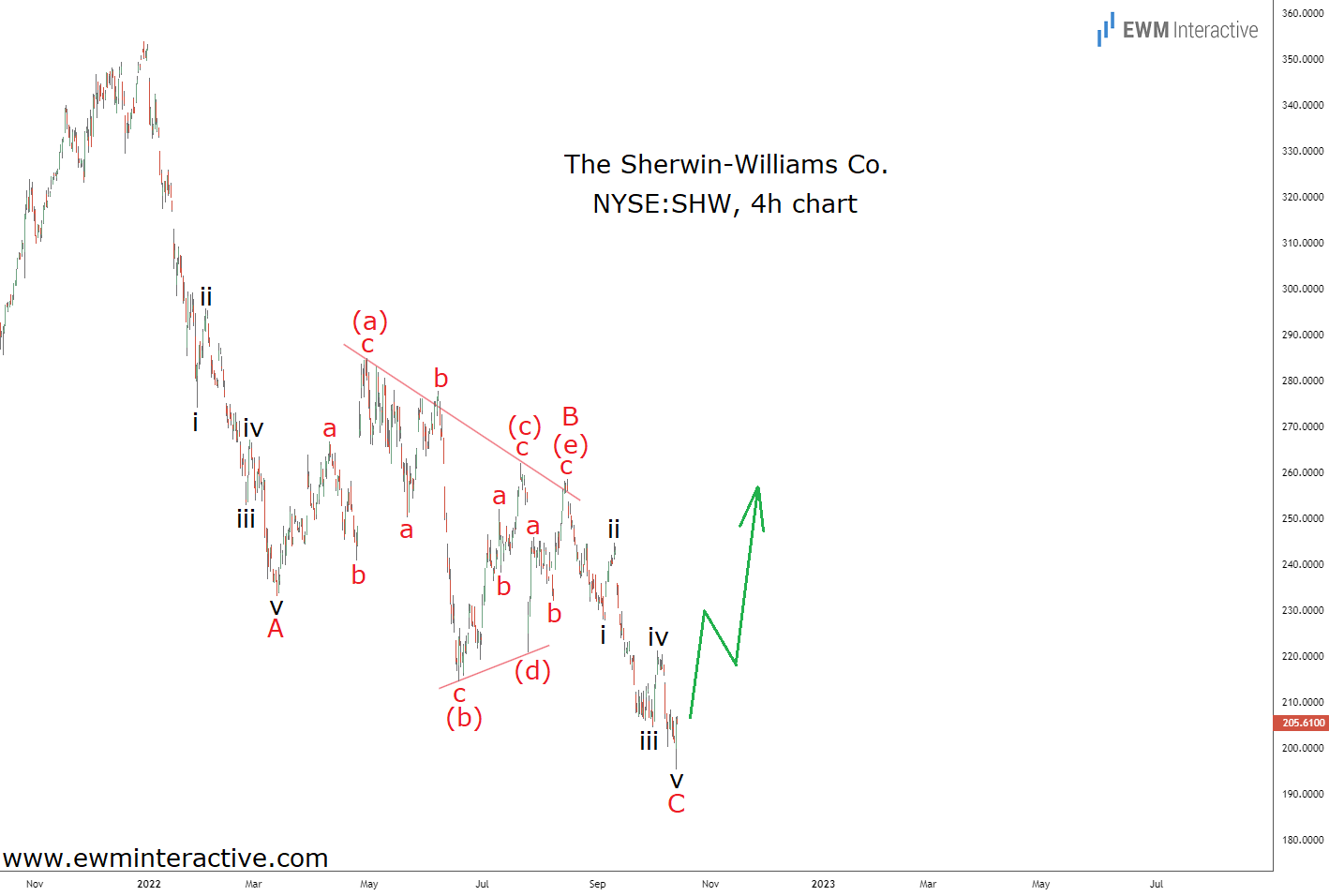

On the other hand, Sherwin-Williams’ market cap is down by as much as 45% in 2022. Yesterday, the stock barely held above $195 before bouncing up to close $10 higher above $205. Given the company’s strong financials, market position and large Total Addressable Market (TAM), many investors are wondering whether it is time to buy the dip. The Elliott Wave chart below suggests they may be onto something. Sherwin-Williams Stock Chart

Sherwin-Williams Stock Chart

The 4h chart of SHW reveals that the decline from $354 to $195 is a clear A-B-C zigzag correction. Waves A and C are both impulse patterns, labeled i-ii-iii-iv-v, while wave B is a triangle. According to the theory, once a correction is over the preceding trend resumes. Since Sherwin-Williams was clearly in an uptrend prior to this drop, it makes sense to expect more strength once the bears are done.

Besides, triangles are known to precede the final wave of the sequence. In this case, the final wave is C, which looks like a complete impulse already. If this count is correct, SHW’s uptrend is ready to continue. In the long term, the bulls should be able to lift the stock to a new record. This translates into eventual targets above $360 a share.

Original Post

[ad_2]

Source link