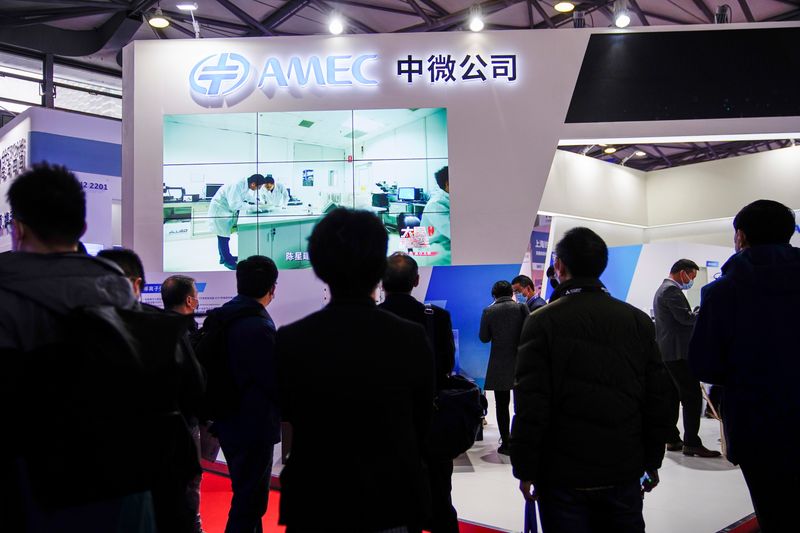

Shares of AMEC jump after removal from US’s ‘China military company’ list

2024.12.18 02:31

BEIJING (Reuters) – Shares in Advanced Micro-Fabrication Equipment (AMEC), one of China’s leading chip equipment makers, jumped 4.35% on Wednesday after it was removed from a list of Chinese companies the Pentagon said were allegedly working with Beijing’s military.

AMEC was added in February to Washington’s “Entities Identified as Chinese Military Companies Operating in the United States” list, prompting it to file a federal lawsuit in August against the U.S. Defense Department.

The company, which sought a court order to remove the designation, said it has never been involved in military activities and strictly complies with all laws and regulations.

The U.S. Defense Department updated the list to remove AMEC, as well as IDG Capital, one of China’s largest venture capital and private equity firms. The list of dozens of companies was updated on Tuesday and scheduled for publication on Wednesday.

The list includes entities that have been targeted by U.S. trade sanctions in recent years, including Huawei Technologies and state-owned aerospace and defence manufacturing conglomerate Aviation Industry Corporation of China (AVIC).

IDG Capital, which was also added to the list in February, did not sue but has previously said it has no association with the Chinese military and does not belong on that list.

While being placed on the list doesn’t involve immediate bans, it can be a blow to designated companies’ reputations and represents a warning to U.S. entities and companies about the risks of conducting business with them.