Sequoia Capital Reduces Management Fees in Venture Funds

2023.01.13 05:16

Sequoia Capital Reduces Management Fees in Venture Funds

By Tiffany Smith

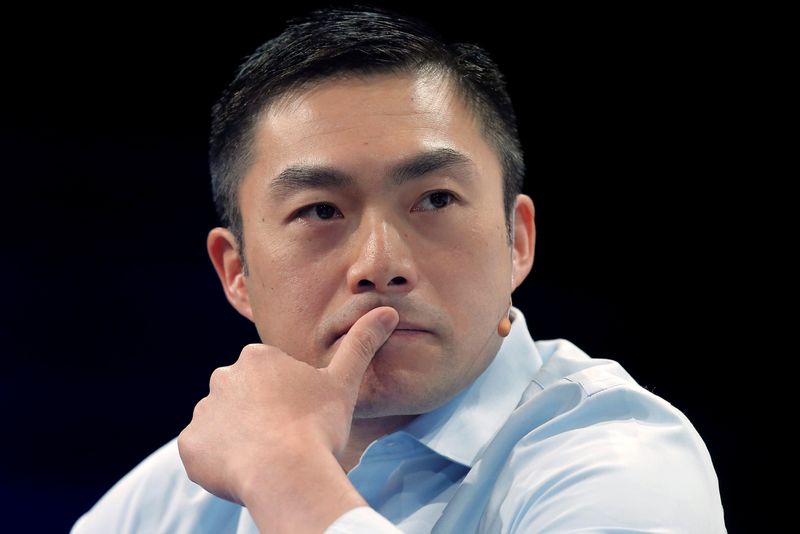

Budrigannews.com – As it prepares for a slower investment climate, partner Alfred Lin disclosed on Thursday that Sequoia Capital has lowered management fees for its two recently launched venture funds.

Limited partners (LPs) who committed capital to Sequoia’s crypto and ecosystem funds, which were launched early last year, can now pay management fees based on capital deployed rather than the standard model of capital under management that applies to other Sequoia funds. These changes to the fee structure were made available to investors in December.

A $950 million ecosystem fund and a $600 million crypto fund were launched by Sequoia to support Scouts and funds established by former Sequoia employees. Lin stated that 10% of the crypto fund has been utilized thus far.

After U.S. venture capital deals fell by 31% from their peak in 2021, the move is an unusual concession by the world’s leading venture investor. The long-standing relationships that Sequoia has had with LPs have been put to the test by the fallout from FTX, its portfolio company, and the sharp decline in tech company valuations.

Lin defended the company’s due diligence on Thursday at the StrictlyVC event, claiming that internal processes had resulted in extensive research and due diligence on FTX.

Lin stated, “We were misled for a variety of situations.”

According to Reuters, the Securities and Exchange Commission (SEC) of the United States has inquired into the due diligence procedures of some FTX investors.

Including $150 million from its third Global Growth Fund and $63.5 million from its crossover fund, Sequoia reduced its investment in FTX to zero. Lin stated that the company would continue to invest in cryptocurrencies.

“We will invest during a slower period, but we will also keep moving forward. Lin, who also led investment in Citadel Securities and Instacart, stated, “We are a long-term optimist in crypto and a variety of other sectors.”

More European stock market has been steadily growing for several days in a row