Sentiment Speaks: Coming Week Will Tell Us How We Get to 4300 on the S&P 500

2022.12.06 23:30

[ad_1]

Early on in the week, the US markets declined and the supposed reason for such decline was due to the COVID lockdowns and mass protests of such in China. Yet, the Chinese markets surged strongly at the same time. And, this had many people scratching their heads.

Furthermore, right before we began the mid-week surge towards our next higher target/resistance, Powell gave a wonderful speech during which is he basically did not say anything different than what the market already knew. Yet, of course, pundits were quick to point to the speech as the reason we rallied to the next resistance/target.

Then, on Friday, the market tanked in the premarket hours. And, of course, everyone was quite certain that the “reason” was because of the jobs number. I guess that meant to them that the Fed was going to tighten more so than expected. Yet, the market rallied all the way back to even by the end of the day, with some indices actually closing in the green. So, does that mean that the market changed its mind?

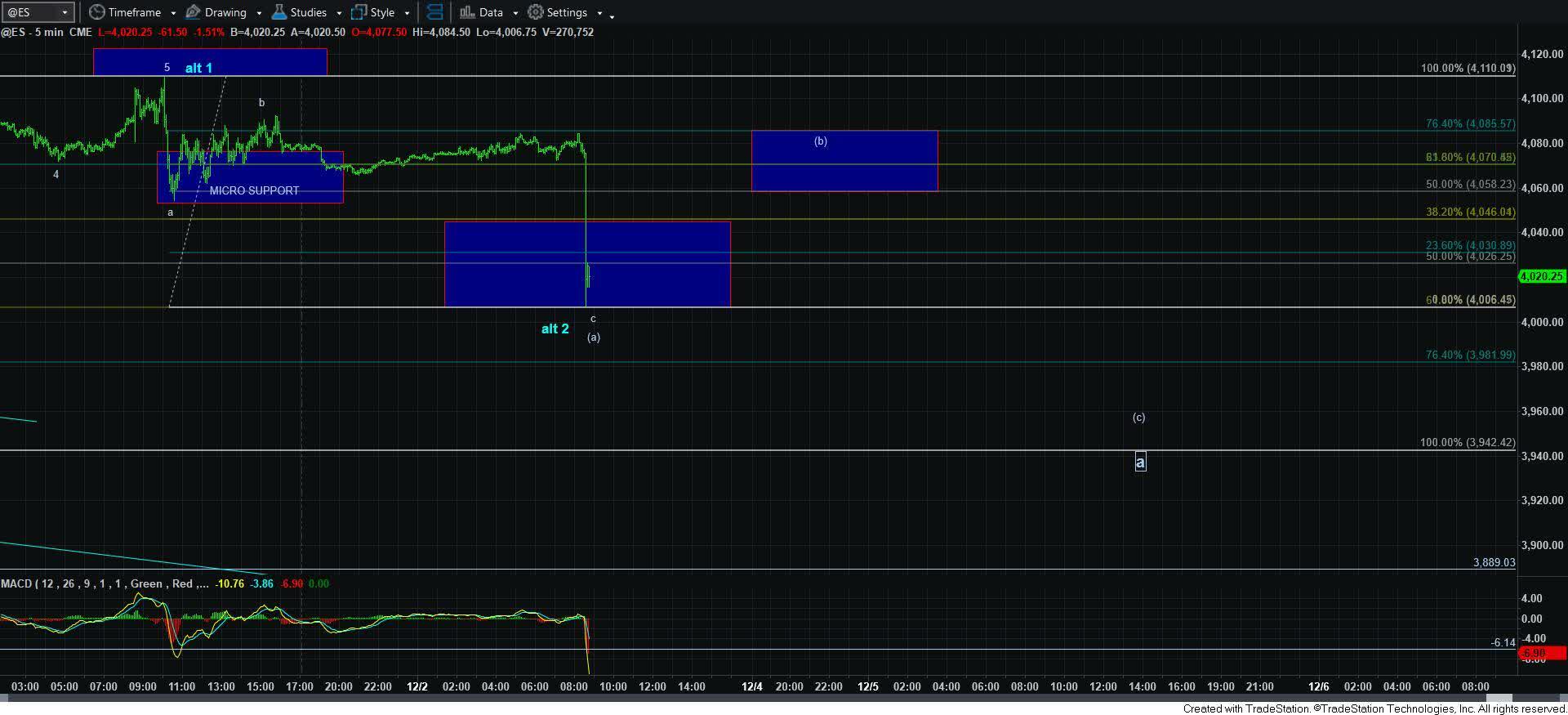

What is really interesting is that we called for those moves without really caring about the news. In fact, this past week, I outlined my expectations for a pullback once we topped on Wednesday, and Friday morning the market dropped to the lower end of my pullback target. As we were hitting that bottom target to the penny on Friday morning, I outlined my expectation for a rally to take hold off that low, as you can see here:

As we know, the market rallied right to the top of the blue box target I provided that morning. So, as you can see, I usually ignore the substance of news events and follow the price patterns the market provides to us.

Along those lines, if you have been reading my updates over the last several months, then you would have been preparing for what I termed a potentially major bottom as we moved into October. And, as I am sure many of you have already forgotten, the market bottomed where I expected and began this rally despite a majorly negative CPI report on October 13. If you are being honest with yourself, then you probably remember how most in the market were expecting the market to tank another 5% after that report was published. Yet, the exact opposite happened. But, I prepared our members for this potential when I posted the following analysis on ElliottWaveTrader.net the night before that CPI report was published:

“Thus far, the market has made several attempts at hitting the blue box support region on the 60-minute SPX chart. And, each time, divergences continue to grow. And, if you look at the 5-minute SPX chart, there is still opportunity to actually strike that support below as long as we remain below the smaller degree resistance noted. . . But, I think we will likely be much higher than where we stand today as we look out towards the end of October, or even into early November, depending on how long it takes the market to bottom out, and how fast the rally I expect takes hold.”

The next morning, when we saw the initial downside reaction after the CPI report was published, I posted this alert to our members:

“[t]his should now be the selling climax that completes the downside structure.”

And, minutes later, the market began the rally we have been seeing since we struck that low.

Then, in November, I outlined my expectations for the market to rally to at least the 4300SPX region. And, it seems many pundits have since jumped on that bandwagon. In fact, so many have jumped on that bandwagon that it now supports my expectation for a pullback before we head to that target. For now, I am still thinking we rally to at least the 4300SPX region. But, I am unsure about the path.

You see, the market is progressing in 3-wave structures. That often suggests corrective action. And, corrective structures are the most variable structure within the Elliott Wave 5-wave formation. So, it forces me to track two paths quite intently right now, and both point to at least the 4300SPX region.

The first one would suggest that we break down below the pre-market low struck on Friday in the coming week, which would provide an initial signal that a larger corrective pullback is under way. This pullback would target the 3700-3870SPX region before we begin a rally to 4300+.

The second path would hold over the low struck on Friday, and take us more directly through the 4118-4154SPX resistance, and point us to at least the 4300SPX region in a more direct fashion.

At this time, my preference is the larger pullback first, as there are more signs in the market pointing to that potential than the second path.

As I have said to you many times in the past, I will never be able to tell you how the market is going to move with certainty, especially when it is tracing out corrective structures. Rather, the best I can provide is parameters which will outline where the market has high probability turning points.

As one of my members posted this past week:

“Totally unbelievable how this community here led by you is helping us. You setting up the right parameters ignoring bearish/bullish sentiment and chaos in the mkt did help me recover all my losses and turn green for this year which is a big achievement as I blew up my account before joining this community. I learned how to manage risk strictly following the parameters. All we need is success rate above 50% to make money and this community will give a lot more than 50%.”

So, depending upon how the market reacts early in the coming week, it will likely clue us in to the path it takes to get us to the 4300SPX region next. But, I must warn you, risk has risen in the market once again for at least a larger degree pullback.

[ad_2]

Source link