Selling Pressure Hits Nasdaq and S&P 500 but Semiconductors Could Shine

2023.03.23 03:38

Monday’s action had looked to provide some security for bulls, but then bears came in with gusto and closed the day with bearish engulfing patterns for the and and a big red candlestick for the .

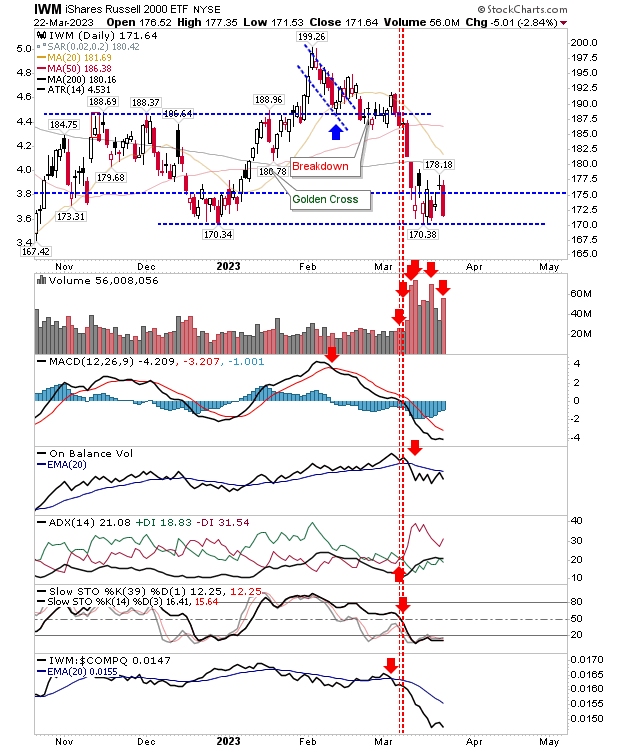

The Russell 2000 experienced the biggest sell-off of lead indices. The substantial red candlestick came with higher volume distribution at a time when it looked like the selling was done. The index continued with its underperformance to the Nasdaq and S&P 500, so it looks like the crash watch is back on.

Russell 2000 (IWM) Daily Chart

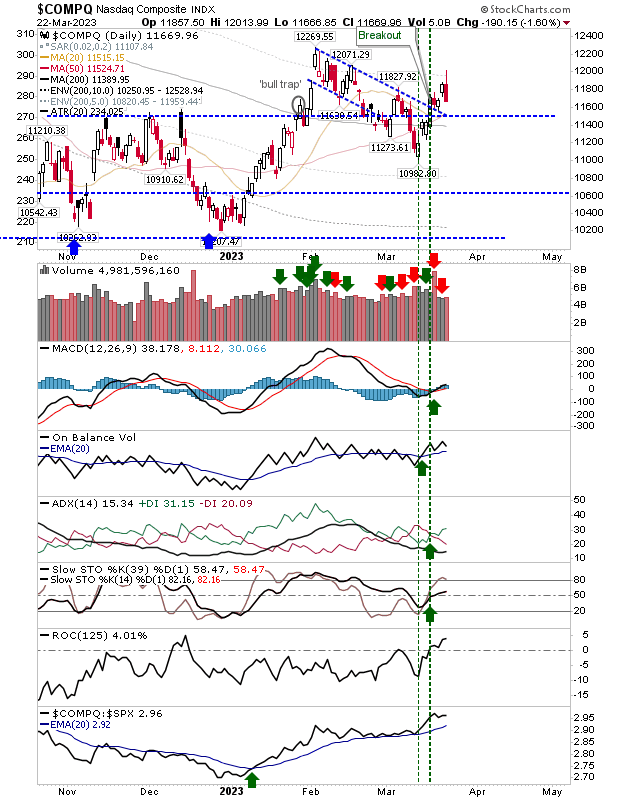

The Nasdaq experienced a classic bearish engulfing pattern but managed enough to keep technicals net bullish while volume rose to register as distribution (just…). The prior breakout is still valid and will likely remain so for a few days longer, even if the selling was to continue, but today’s selling is not one to inspire confidence.

Nasdaq Daily Chart

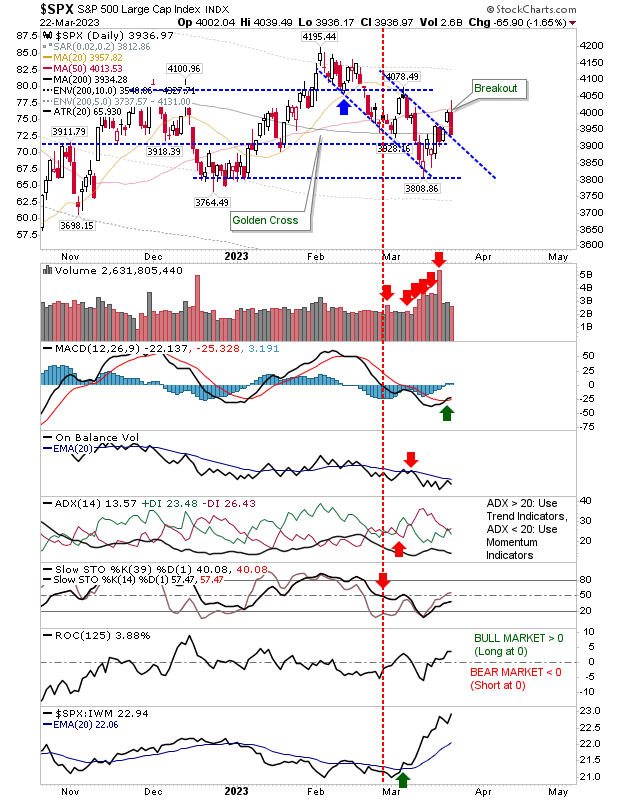

The S&P 500 experienced a sell-off similar to the Nasdaq, closing at breakout support (which is also its 200-day MA). The type of candlestick posted today is not typical of an immediate bullish reversal. We may see a small bullish candlestick, but I would be looking for some spike low or a move sub 3,900. The only good news was that volume didn’t rank as distribution.

S&P 500 Daily Chart

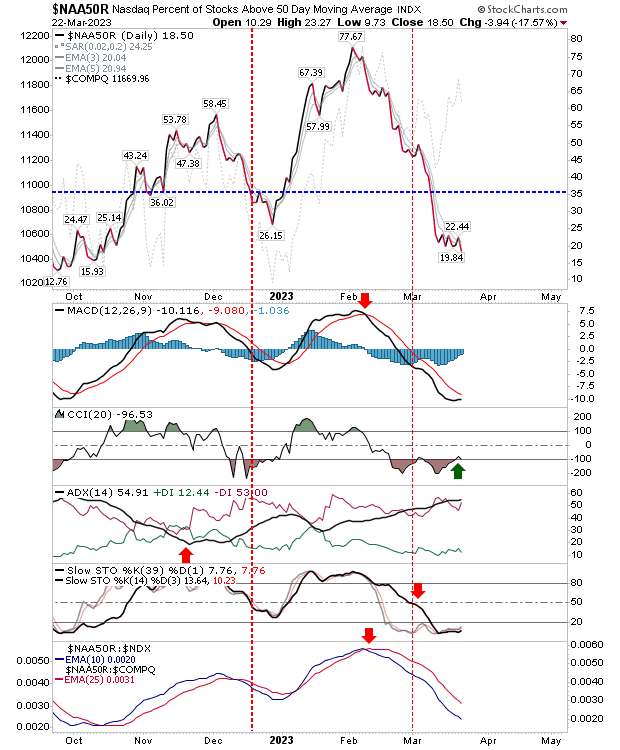

One thing I haven’t mentioned in a long time is breadth metrics. The Percentage of Nasdaq Stocks trading above their 50-day MA is below 20%, a typical zone where bottoms appear. Technicals are oversold, although the CCI has crept above the 20 line. We should be seeing a bottom soon.

Nasdaq Daily Chart: Percentage of Stocks Trading Above 50-Day MA

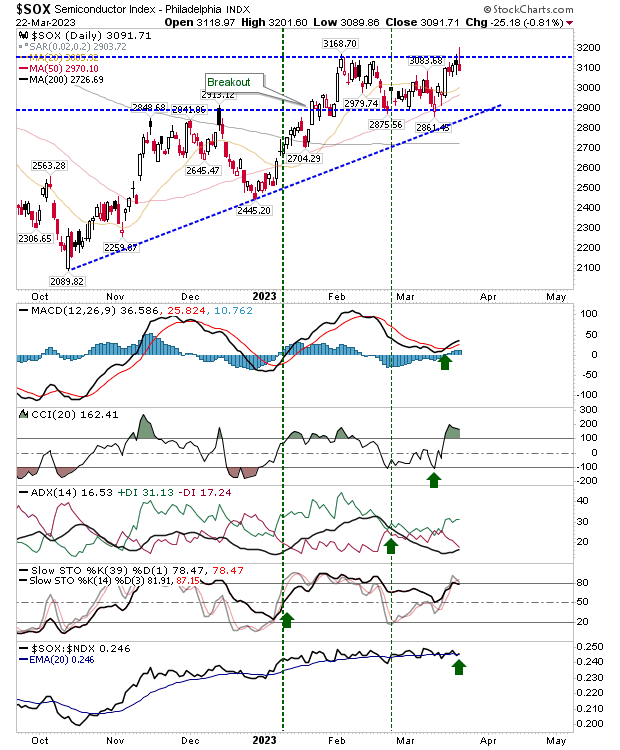

I’m watching the . It’s most likely to clear resistance and deliver some optimism for markets.

Philadelphia Semiconductor Index Daily Chart

Tomorrow, the two indices to watch are the Russell 2000 for a breakdown and the Semiconductor Index for a breakout.