Sell in July and Go Away?

2023.07.06 03:02

One of the most interesting things about July in the market is the biannual reset of the 6-month calendar range.

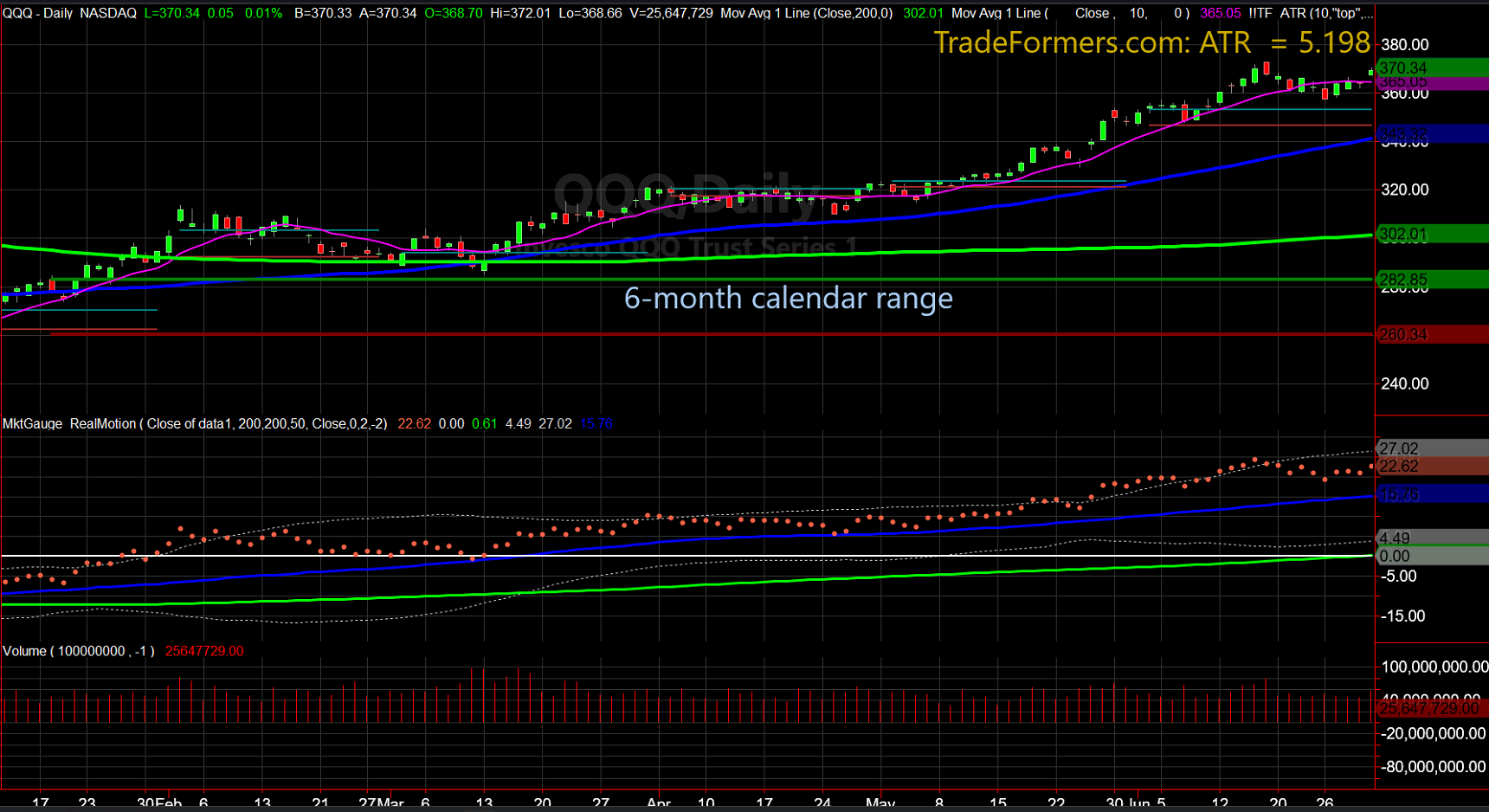

Here is a chart of the with the January 6-month calendar range drawn in.

QQQ 6-Month Calendar Range Chart

QQQ 6-Month Calendar Range Chart

To clarify, it is the solid green line that goes perfectly horizontal across the screen.

The lower chart is the Real Motion momentum indicator.

The bottom is the daily volume.

Since the beginning of 2023, Invesco QQQ Trust (NASDAQ:) cleared the 6-month calendar range high and never looked back. We had a brief test in March, but no violation.

As we are about to reset that range, note the momentum.

QQQs are working off a mean reversion from early June.

The current momentum, considering how close QQQs are to the recent highs made on June 16, is not bad, but meh.

The volume pattern in July thus far is also meh.

So, we do not know yet how much more upside versus downside the large-cap growth stocks have yet.

What we do know, though, is that the NASDAQ looks one way, while the small caps look completely different.

In January, iShares Russell 2000 ETF (NYSE:) cleared its 6-month calendar range high. Then, in March, IWM failed those highs.

Since then, IWM has not been able to get back above the calendar range high on a closing basis.

The Real Motion momentum indicator is also mainly meh but holding.

And looking at volume, IWM has had only 1 accumulation (June 29), on an up day since June 26.

While NASDAQ did not look back once that calendar range high cleared, small caps to date refuse to clear.

Nonetheless, with the rest, we are open to anything.

Our guess is that if IWM can clear the calendar range, we will get ourselves at least a leg higher and perhaps more.

We imagine this would give value stocks a boost.

However, should IWM fail to clear the calendar range high and, worse, break down under a new 6-month calendar range low (the thick red horizontal line), then it would be hard to think NASDAQ sustains current levels.

Either way, the range will reset in less than 2 weeks.

ETF Summary

- (SPY) Needs one more push or begins to look a bit toppy based on lethargic momentum

- Russell 2000 (IWM) 190-193 still the overhead resistance to clear

- Dow (DIA) 34,000 support to hold

- Nasdaq (QQQ) Still working off a reversal top until it takes out 372.85

- Regional banks (KRE) Need a new move over 42

- Semiconductors (SMH) 150 support

- Transportation (IYT) 250 pivotal and a potential correction /mean reversion in store

- Biotechnology (IBB) 121-135 range

- Retail (XRT) 63 support