Schlumberger Q3 Earnings To Add Even More Fuel To Stock’s 50% Rally

2022.10.19 15:52

[ad_1]

- Reports Q3 2022 results on Friday, Oct. 21, before the open

- Revenue Expectation: $7.1B; EPS Expectation: $0.55

- Schlumberger is on track to post its largest annual sales since pre-pandemic days

Oil and gas services companies are emerging as major long-term beneficiaries of the current energy-price bull run. That trend will likely be evident when the sector’s largest company, Schlumberger (NYSE:), reports its latest earnings on Friday.

The Houston and Paris-based company is expected to report a 21% surge in sales compared to the same period a year ago, according to analysts’ consensus estimates compiled by Investing.com. The per-share profit for the quarter that ended on Sept. 30 may jump 53% to $0.55 a share.

This strength appears in SLB shares, which have gained about 50% this year, massively outperforming the benchmark . It traded on Wednesday at $44.85 after gaining about 3.5% at the time of writing.

Schlumberger Earnings Provide Insights For The Industry

The oil and gas services sector, often referred to as the hired hands of the oil industry, is seeing a resurgence in business after years of stagnation.

The big three oil-service providers, including Halliburton (NYSE:), Baker Hughes (NASDAQ:), and, of course, Schlumberger, are on track to post their most significant annual sales since pre-pandemic days.

From here, however, the primary concern is whether this strong rally has more room to run, especially when macroeconomic headwinds pressuring oil prices and oil-exporting nations have trimmed their output.

So far, nonetheless, the sector has remained remarkably resilient. In the most recent forecast, Schlumberger said it expects strong drilling activity in North America and the international market to boost yearly sales to at least $27 billion, up from its previous estimate of $23 billion.

This trend also shows that Schlumberger and its peers are successfully navigating through inflationary pressures and their customers are willing to pay more for their services.

While adding Schlumberger to its signature picks list, Wells Fargo said there is more upside in the sector which typically thrives later in the energy cycle.

Long-Term Value

Schlumberger operates in more than 120 countries, supplying the energy industry’s most comprehensive range of products and services, from exploration through production. Its last served as a bellwether for the energy business, given the company’s regional reach and insight into drillers’ plans.

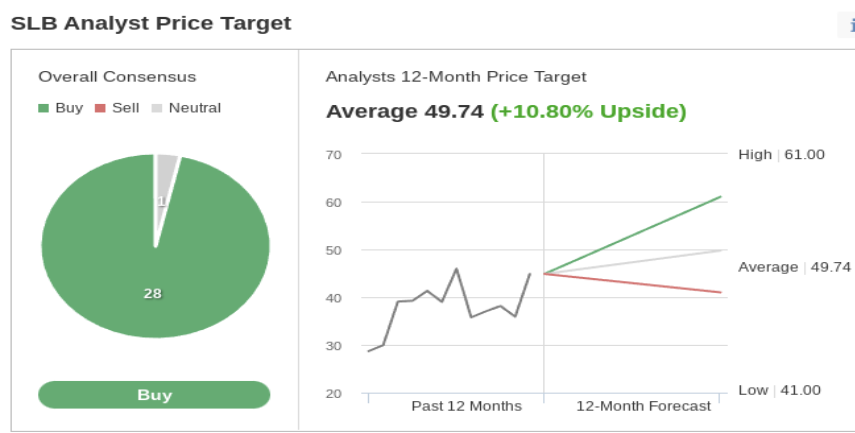

Wall Street analysts are also quite bullish on SLB stock. In an Investing.com poll of 29 analysts, 28 recommend buying the stock with their consensus 12-month price target showing a 10.8% upside.

Source: Investing.com

Piper Sandler, which assumed coverage of Schlumberger with an overweight rating and $50 price target, says in a note that there’s long-term value in the sector and that the crude’s recent pullback is short-lived.

This boom in energy prices will likely keep free cash flow strong next year, indicating that there is still value in stocks representing energy services companies.

Bottom Line

Despite some macro uncertainties, highly tight global energy supplies and massive investments in energy infrastructure will likely fuel further growth in Schlumberger earnings this year and the next. That means its stock has more upside potential even after this year’s powerful rally. The company’s incoming earnings report is likely to prove that point.

Disclosure: At the time of writing, the author did not own any shares mentioned in this report. The views expressed in this article are solely the author’s opinion and should not be taken as investment advice.

[ad_2]

Source link