Salesforce Q3 Earnings Preview: Report Represents Test of AI Demand

2024.12.03 11:57

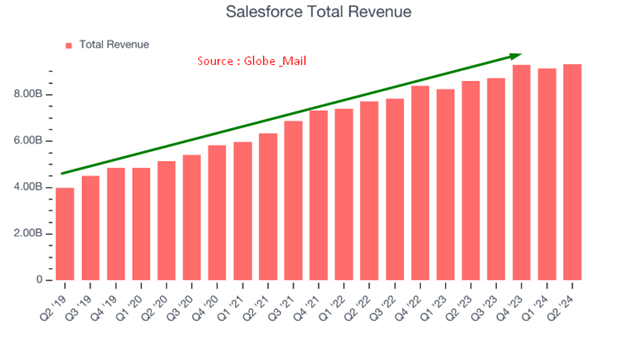

Salesforce.com (NYSE:) is the leading provider of on-demand Customer Relationship Management (CRM) software in critical operations i.e., sales force & marketing automation, customer service & support, document management, analytics, and custom application development. It offers a technology platform for customers & developers to build and run business applications. Salesforce helps companies of every size & industry to connect with their customers through cloud, mobile, social, IoT & artificial intelligence (AI). There are two main revenue streams: Subscription & Support and Professional Services & Other. Subscription revenues comprise subscription fees from customers, accessing the company’s enterprise cloud computing services (Cloud Services), software licenses and subscription fees recognized from customers for additional support beyond the standard support lent by the company. Professional Services & Other revenues consist of fees that the company derives from consulting and implementation services and training.

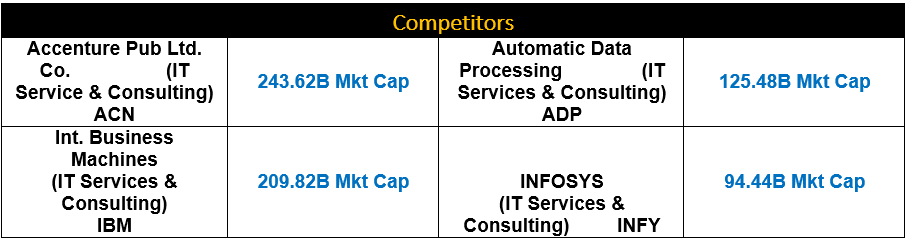

Competitors

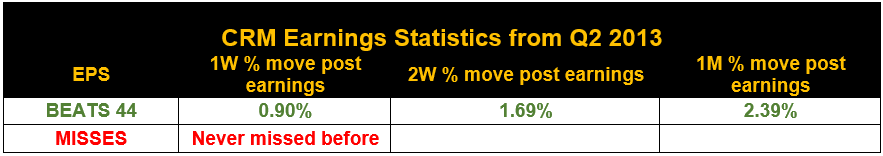

CRM Q3 2024 reports earnings at 4:00 PM ET Tuesday Dec 03, 2024

- 44 beats since Q2 2013

- 0 Misses since Q2 2013

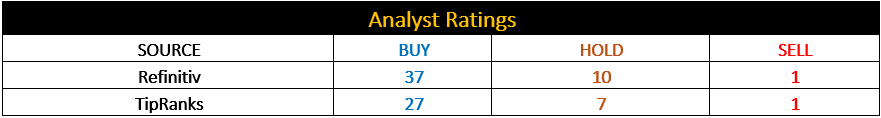

Analyst Ratings

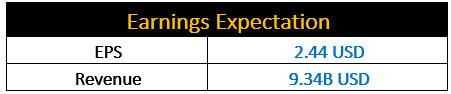

Earnings Expectation

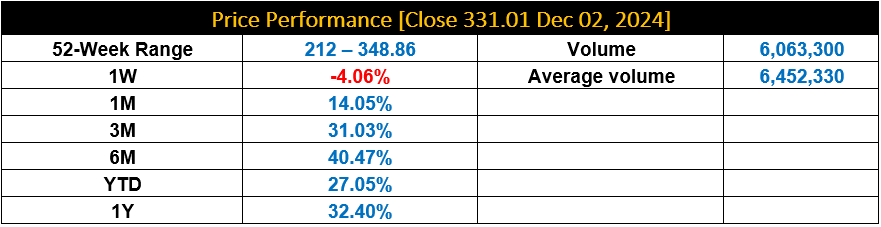

Price Performance

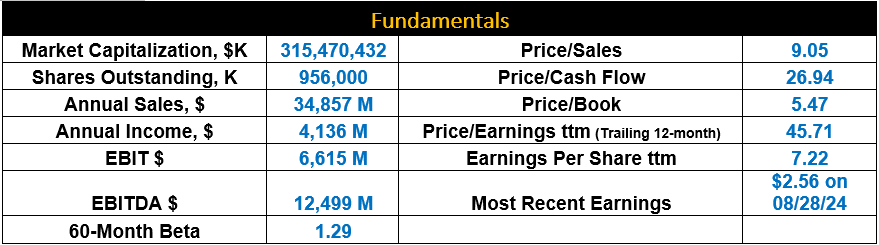

Fundamentals

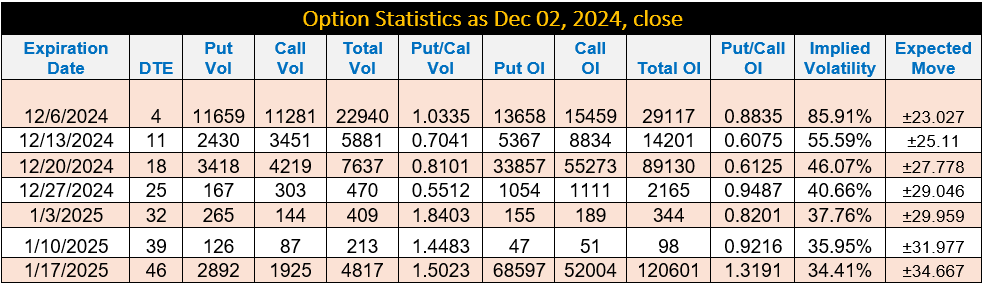

Option Statistics

- Put/Call ratio for Dec 06 expiry is 0.8835% more calls than puts which suggests the following three scenarios:

- With Put/Call ratio is around 0.8835 to 0.6125 for the next three upcoming expiries suggest that the traders are bullish.

- Earning miss or lower guidance could trigger a short-lived sell-off followed by a quick rally.

- Earning and guidance in line or better than estimates may trigger a sharp rally.

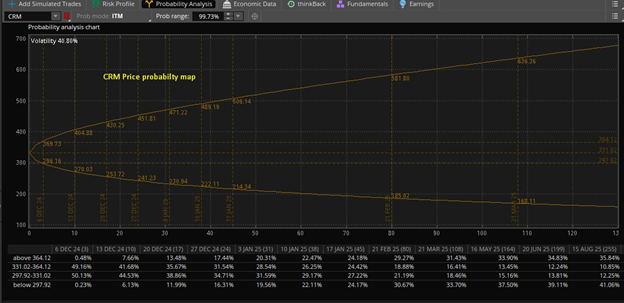

Probability Analysis Chart:

Key Highlights:

- CRM is going to benefit from growing AI demand. The company is continuously expanding generative AI.

- Salesforce has various SaaS (software as a service) applications and platforms to serve its focus area.

- The company has been active in making strategic acquisitions to expand its offerings.

- The company’s recent push to grow sales team may increase short-term expenses, which will pave a passage to long-term growth.

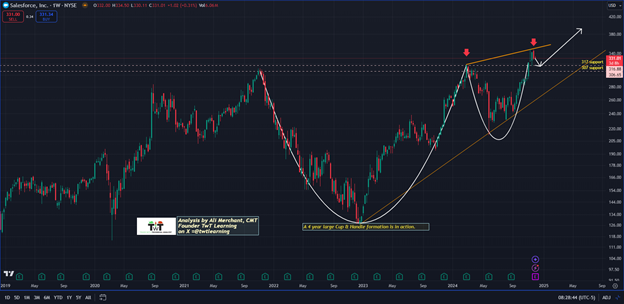

Technical Analysis Perspective:

- CRM is forming a 4-year-old large Cup & Handle formation from November 2021 to November 2024.

- The formation has bullish implications in the short to medium and long term.

- Prices may dip between 315/305 with more room to 295 pre or post earnings.

- CRM needs to hold 300/295 base post earnings to stage a fresh rally surpassing 347 high targeting 368 with more room to 391.50.

- A strong and sustained penetration below 295 would eye a deeper drop to 270/265 region.

CRM Weekly Chart:

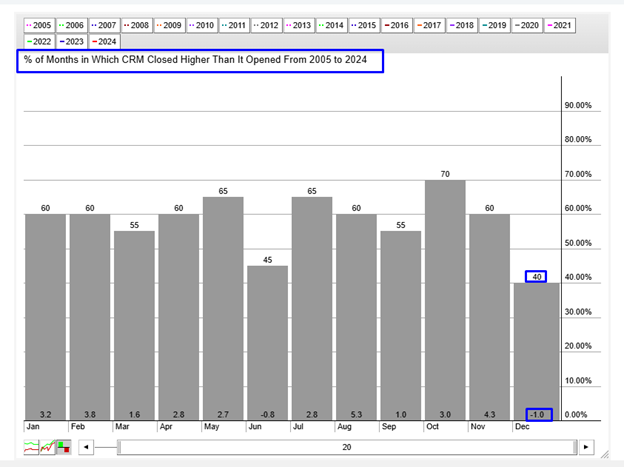

CRM Seasonality Chart:

- CRM closes -1.0 % lower in December 40% of the time since 2005.

Conclusion:

CRM is in a bullish mode targeting 347 (recent high) with additional rallies to 368 and 392.50 provided 300/295 holds on dip.

Motivational Quotes: A voice of a trader

The best chance to deploy capital when things are going down by Warren Buffet.