S&P 500, Nasdaq Eye Breakout Above Moving Average; Russell 2000 to Continue Higher

2024.04.30 07:21

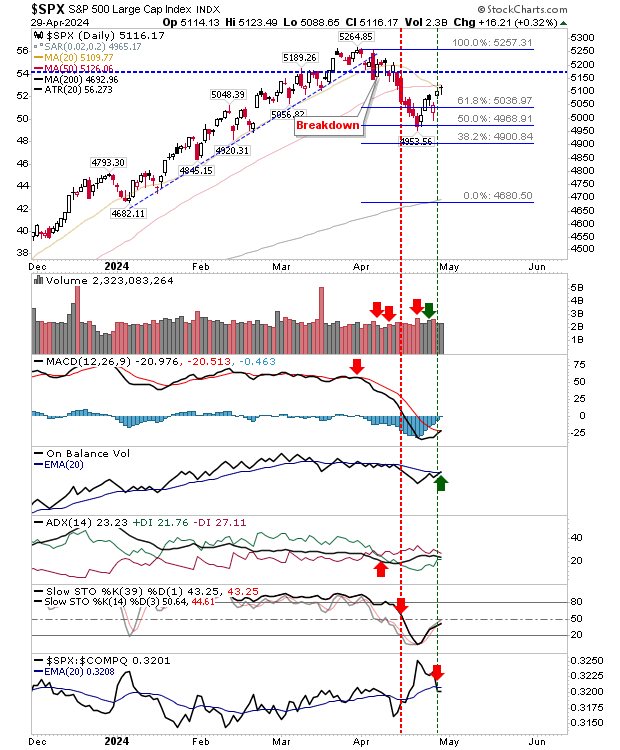

The was most affected by the presence of converged 20-day and 50-day MAs as it finished Monday with a neutral ‘doji’ just below these moving averages.

The small gain was enough to generate a new ‘buy’ trigger in On-Balance-Volume, but the critical mid-line in Stochastics continues to play as resistance, and this means the bearish outlook is favored.

For today, I will be looking for some downside, but if the S&P 500 can close with another neutral candlestick – and not a big red one (or something better) – then we may have a more bullish response by the end of the week.

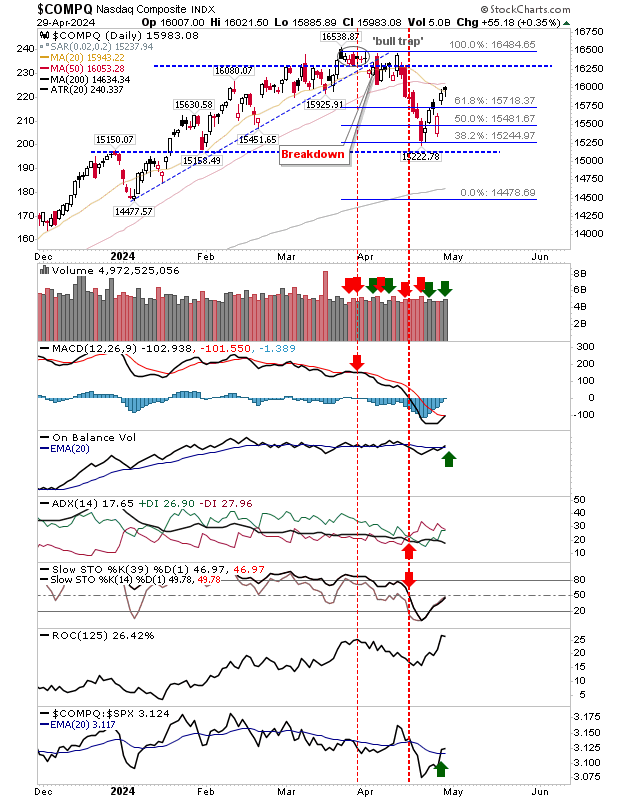

The had managed to do a little better, finishing above its 20-day MA, but not its 50-day MA. Yesterday’s buying volume was enough to register the day as one of accumulation, backed by a new ‘buy’ trigger in On-Balance-Volume.

However, it too remains below the mid-line Stochastic and the ‘black’ candlestick finish is one often associated with reversal when it appears at the end of a rally. Watching for a gap down at the open.

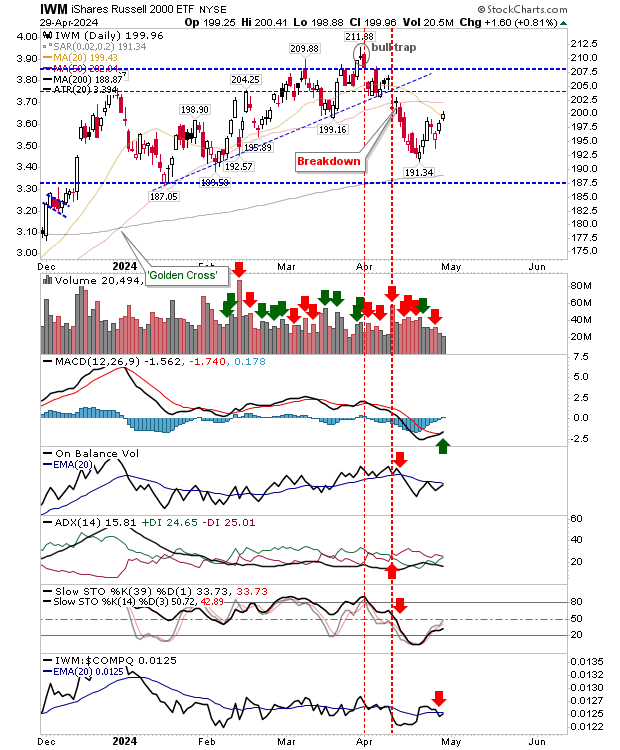

The () had the best of the day’s action. It closed with a small, bullish candlestick above its 20-day MA. It still has some room to run to its 50-day MA, and yesterday’s buying was enough to see a new ‘buy’ trigger in the MACD; although this signal occurred below the bullish zero line (so is not a strong buy signal).

Of the three indexes, it has the weakest Stochastics, although given stuck in a trading range since December 2023 this is not surprising. Relative buying volume was well below that of the Nasdaq and S&P 500.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

My expectation for today is one for selling. If we don’t see that, or even just a slightly lower close, then I would be optimistic for a break through the overhead 50-day MAs, opening up for a larger challenge of March highs. Let’s see what today brings.