S&P500 Update: Did 5th Wave Down Complete Last Week?

2022.10.17 16:42

[ad_1]

A week and a half ago, using the Elliott Wave Principle, I how the was at a crossroads:

“The index can now decide if it wants to complete five (5) waves [lower] or only three (3) waves. … The dividing line in the sand remains at the SPX 3886 level (bearish cut-off). Why? Because the fourth wave in an impulse cannot move into the price territory of the first wave. In this case, W-1 is the Sept. 6 low at SPX 3886.75. Thus, if the index’s price moves above that level as we advance without going below last Friday’s low, the path to SPX 4250-4700 opens. Conversely, if the S&P 500 stays below SPX 3886.75 and breaks below last Friday’s low [SPX 3584] (bullish cut-off), then SPX 3230-3335 can be expected.”

The index topped that same day at SPX 3807 and dropped to as low as SPX 3491 on hotter-than-expected CPI data last Thursday, only to reverse strongly and close 2.6% higher for the day. Go figure.

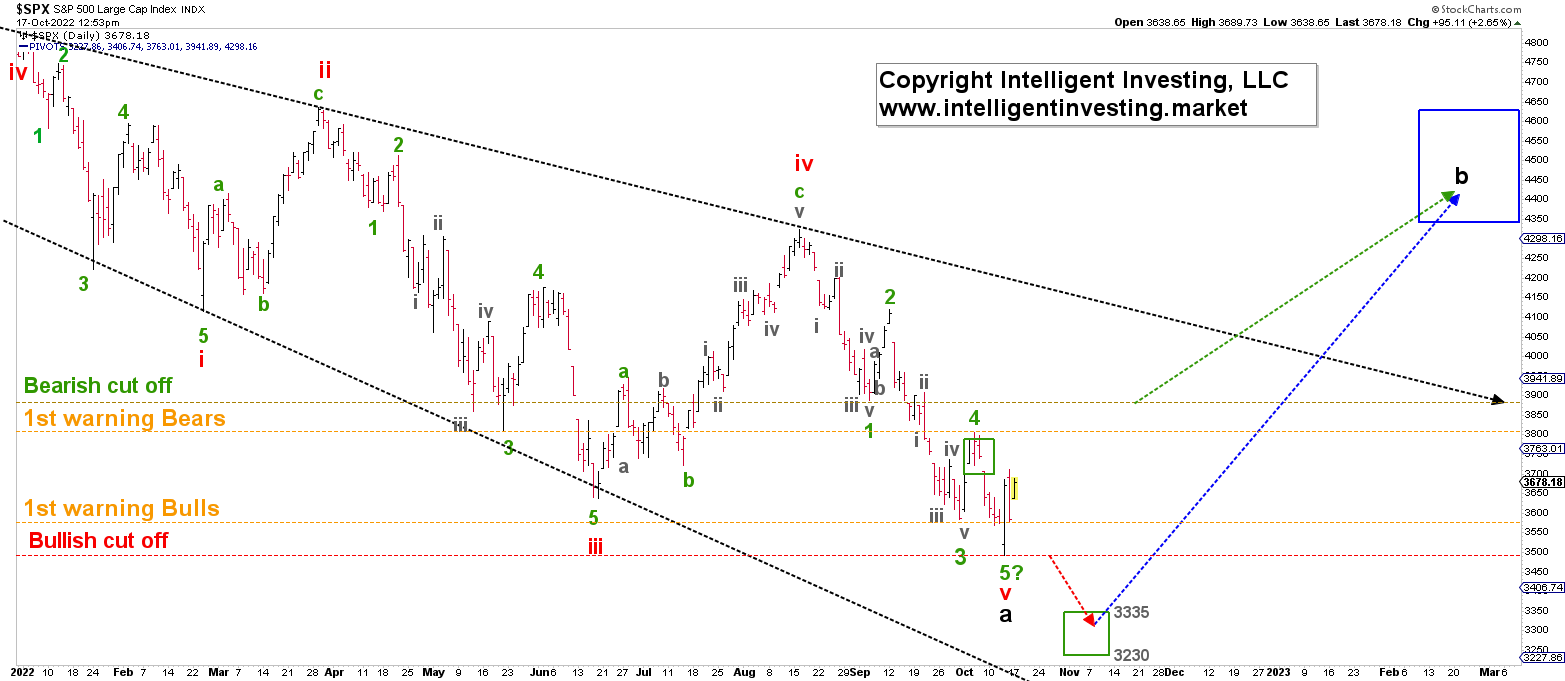

Regardless, SPX has now done enough waves to the downside, five, to consider the move from the mid-August high complete and the decline since the Jan. 3 all-time high. See Figure 1 below.

Figure 1. S&P 500 daily chart with detailed EWP count and several technical indicators:

However, the index did not reach the ideal downside target zone of SPX 3230-3335. The stock market does not owe us anything and, therefore, does not have to follow an ideal Fibonacci-based impulse path to the downside. However, although SPX 3491 vs. SPX 3335 is only off by 4.6%, considering green W-4 topped a mere 0.6% above the ideal target zone, I expect the index to do better than that.

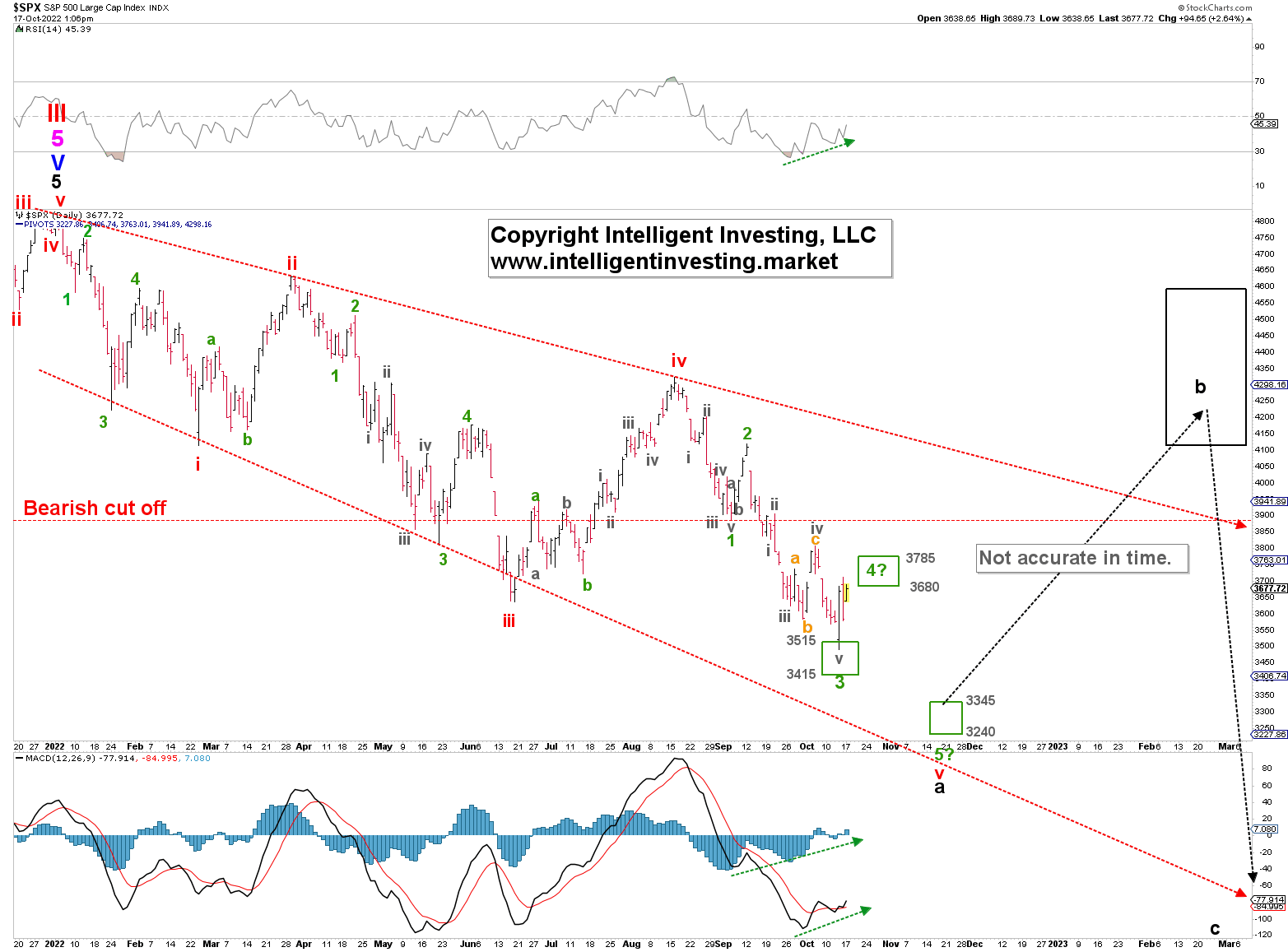

Thus, I must consider the possibility the index is still working on that green W-4. See Figure 2 below.

In this case, the Sept. 30 low at SPX 3584 was not grey W-v of green W-3, as initially thought, but it was orange W-b of an expanded irregular flat grey W-iv. An irregular flat consists of three waves, a-b-c, and in this case, W-b goes beyond the start of W-a. As such, the W-b can easily be interpreted as a fifth wave.

Figure 2. S&P 500 daily chart with detailed EWP count and several technical indicators:

Besides, at last Friday’s SPX 3491 low, the index bottomed much better in the ideal green W-3 target zone (SPX 3414-3515) and is now back again in the W-4 target zone. Moreover, this EWP count also follows the ideal Fibonacci-based impulse pattern more closely, the .

As such, SPX 3886.75 remains the dividing line. If the S&P 500 manages to rally above that level without dropping below last week’s low first, then the index completed five waves lower from the mid-August high. We then must content ourselves with a slightly unorthodox impulse wave, but as said, “the markets do not owe us anything.” I will then look for a multi-month rally to the SPX 4350-4650 target zone.

Conversely, a drop below SPX 3491 tells me that the last fifth wave to ideally SPX 3240-3345 has commenced following an ideal Fibonacci-based impulse pattern. From there, the anticipated multi-month rally can then start.

[ad_2]

Source link