S&P 500 Going Sideways; Are We Approaching A Breakout?

2022.06.23 16:51

There’s still no clear direction as stock prices continue to fluctuate following their mid-June sell-off. So is this a bottoming pattern?

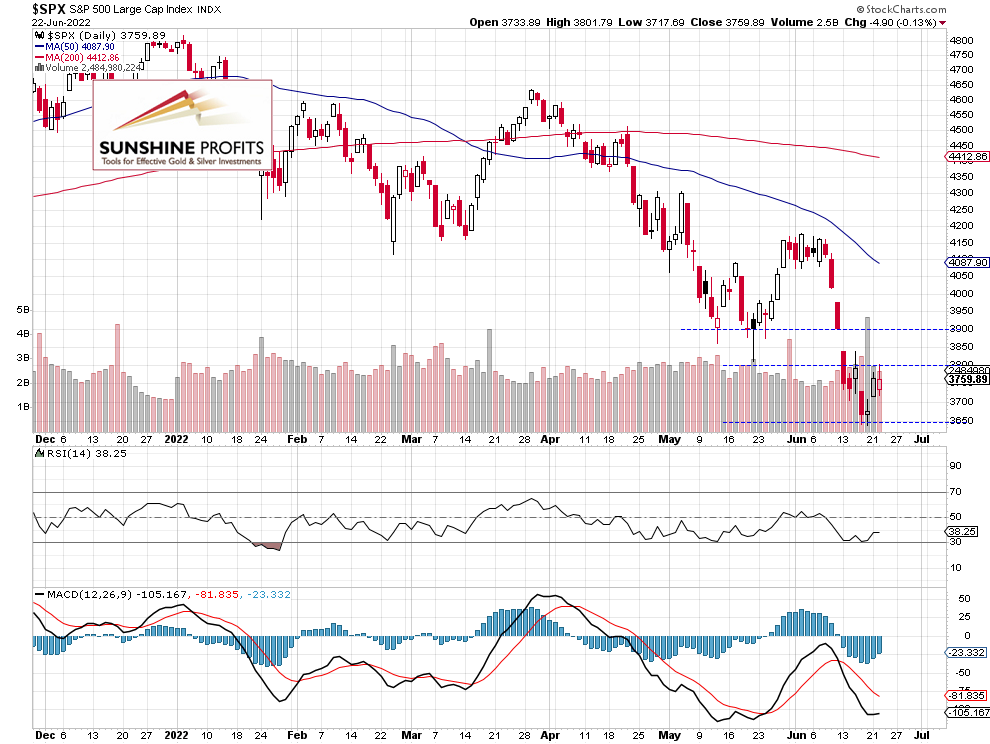

The S&P 500 index lost 0.13% on Wednesday as it continued to fluctuate below the 3,800 level. Earlier in the week, it retraced last week’s Wednesday’s-Friday decline to a new medium-term low of 3,636.87. On Friday, the market was 1,181.75 points or 24.5% below its Jan. 4 record high of 4,818.62. And on Tuesday, it bounced up to around 3,780. Yesterday buyers gave up at the 3,800 level, though.

There’s still a lot of uncertainty and worries about inflation data, tightening Fed’s monetary policy, and the Russia-Ukraine conflict.

The nearest critical resistance level is at around 3,800-3,850, marked by the previous support level. The resistance level is also at 3,900. On the other hand, the support level is at 3,650-3,700. The S&P 500 index trades within an over week-long consolidation, as we can see on the daily chart

S&P 500 Daily Chart

S&P 500 Daily Chart

Futures Contract Remains Below the 3,800 Level

Let’s take a look at the hourly chart of the {{8839|S&P 500 E-mini futures}

} contract. Last week it broke below the previous consolidation. The market reached new medium-term low on Friday, as it tumbled below the 3,700 level. This morning it is fluctuating slightly below the short-term resistance level of 3,800:

S&P 500 E-Mini Futures 1-Minute Chart

S&P 500 E-Mini Futures 1-Minute Chart

Conclusion

For now, the S&P 500 appears to be in a consolidation within a downtrend or a bottoming pattern.

Here’s the breakdown:

- The S&P 500 index continues to fluctuate within a consolidation following its mid-June decline

- We may see further attempts at breaking above short-term local highs.

* * * * *