Russia’s surging oil exports to China in Aug fail to keep Saudis down -data

2022.09.20 00:43

[ad_1]

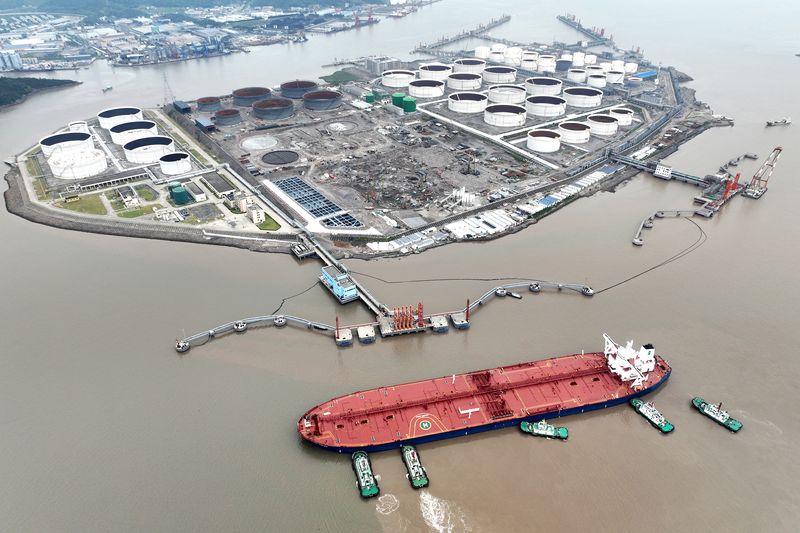

© Reuters. An aerial view shows tugboats helping a crude oil tanker to berth at an oil terminal, off Waidiao Island in Zhoushan, Zhejiang province, China July 18, 2022. cnsphoto via REUTERS

By Chen Aizhu

SINGAPORE (Reuters) – China’s imports from Russia in August surged 28% from a year earlier, data showed on Tuesday, but it handed back its top supplier ranking to Saudi Arabia for the first time in four months.

Imports of Russian oil, including supplies pumped via the East Siberia Pacific Ocean pipeline and seaborne shipments from Russia’s European and Far Eastern ports, totalled 8.342 million tonnes, data from the Chinese General Administration of Customs showed.

The August amount, equivalent to 1.96 million barrels per day (bpd), was slightly off May’s record of nearly 2 million bpd. China is Russia’s largest oil buyer.

Russian imports rose as Chinese independent refiners extended purchases of discounted Russian supplies that elbowed out rival cargoes from West Africa and Brazil.

China’s purchases have climbed in order to reap the benefits of a plunge in European buying just when Beijing needs it most as the Ukraine crisis pushes Moscow in search of alternative markets.

Still, imports from Saudi Arabia rebounded last month to 8.475 million tonnes, or 1.99 million bpd, 5% above the year ago levels.

Saudi Arabia also remains the biggest supplier on a year-to-date basis, shipping 58.31 million tonnes of oil from January to August, down 0.3% on the year, versus 55.79 million tonnes from Russia, which was up 7.3% from the year ago period.

China’s crude oil imports in August fell 9.4% from a year earlier, as outages at state-run refineries and lower operations at independent plants caused by weak margins capped buying.

The strong Russian purchases continued to weigh on competing supplies from Angola and Brazil, which fell in August by 34% and 47% year-on-year, respectively.

Customs reported no imports from Venezuela or Iran last month. State oil firms have shunned purchases since late 2019 for fear of falling foul of secondary U.S. sanctions.

However, Reuters reported that defense-focused China Aerospace Science and Industry Corp (CASIC) has moved 25 million barrels of Venezuelan crude into China since late 2020, which Chinese customs does not report.

Tuesday’s customs data also showed imports from Malaysia, often used as a transfer point in the past two years for oil originating from Iran, Venezuela and more recently Russia, nearly doubled from a year earlier, to 3.37 million tonnes, or 794,000 bpd.

China did not import any crude from the United States, data showed.

The table below shows imports by country, with volumes in metric tonnes and percentage change calculated by Reuters.

August y/y pct ytd y/y pct

change change

Saudi 5.16 58,305,841 -0.32

8,475,071

Russia 27.74 56,794,765 7.31

8,342,183

Iraq 4,317,672 -26.03 34,691,741 -5.23

Angola 2,172,622 -33.79 21,484,635 -17.80

Brazil 1,884,586 -46.89 15,912,380 -30.09

United 0 -100.00 4,585,464 -53.91

States

Malaysia 3,366,979 92.72 17,782,935 73.54

Iran 0 — 780,392 —

Venezuela 0 — 0 —

Oman 2,755,250 -16.22 26,548,047 -11.34

UAE 3,813,907 47.70 26,805,264 42.71

(Tonne = 7.3 barrels for crude oil)

[ad_2]

Source link