Russell 2000, Nasdaq, S&P 500 Set to Test Resistance: What’s Next?

2023.08.24 03:50

Buyers make a reappearance after an extended period of selling. However, where in late spring and early summer, any gain helped fuel a rally, this time, sellers have control of the market so that any buying will raise doubts about its capability to dig the market out of its slump.

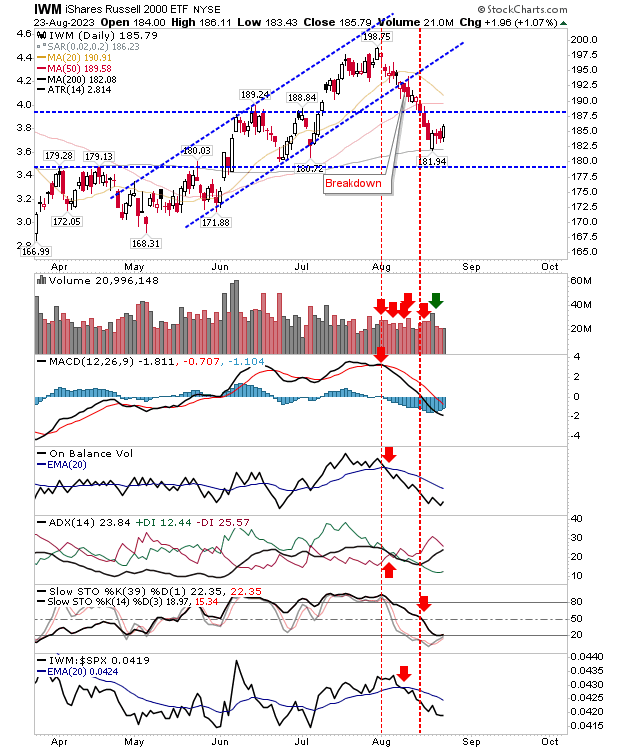

In the case of the (), we had a continuation of the bounce off the 200-day MA, although today’s gain came off lower volume.

The real killer is the relative underperformance of the index against the , although, in a six-month timeframe, it’s all a bit scrappy.

While bears have an advantage, I would see enough here for bulls to take the index into a test of (soon to be) converged 20-day and 50-day MAs.

IWM Daily Chart

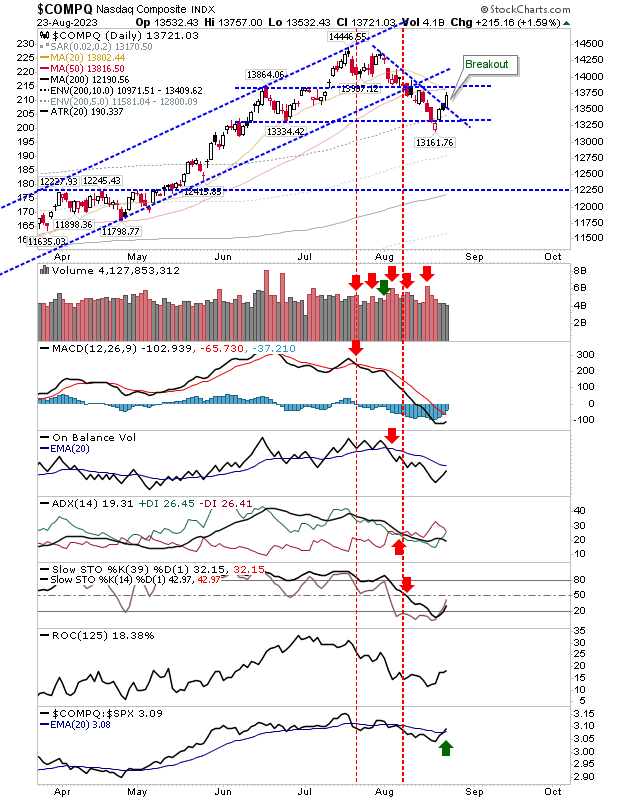

Speaking of the 20-day and 50-day MAs, the will soon be testing this key resistance in a preliminary challenge for the Russell 2000.

Of technicals, there is a relative outperformance of the index to both the S&P 500 and Nasdaq, but other technicals are still bearish. Watch how this test plays out, as today’s gain counts as a resistance breakout.

COMPQ Daily Chart

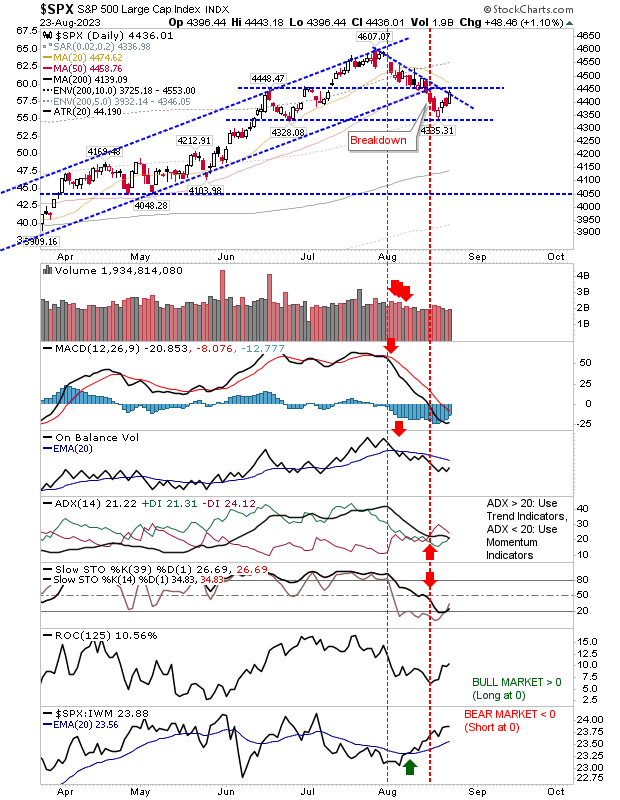

If the S&P 500 can follow the Nasdaq’s lead, then we should see a comparable breakout for this index.

As a leader, the S&P 500 is outperforming the Russell 2000 ($IWM), although not the Nasdaq, but the real challenge is the converged resistance of the June high and the 50-day MA.

SPX Daily Chart

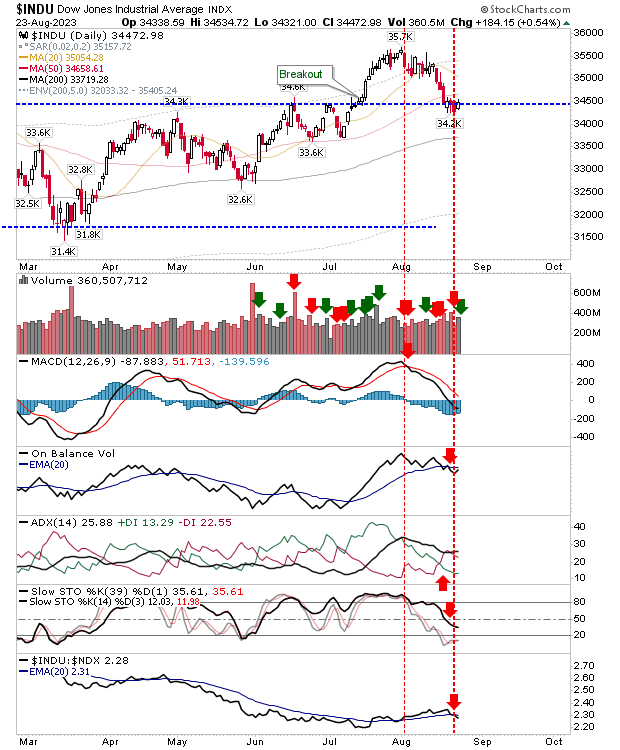

The has managed to hold on to breakout support despite the selling in other indexes. Again, this favors the bullish argument for 50:50 situations. This is still the best stock index to ‘buy.’

INDU Daily Chart

Bulls do need to be careful here. Stochastics [39,1] for many lead indexes and stocks have dropped below the mid-line, meaning those stocks and indexes have entered a more bearish alignment.

Because these drops have just started, we don’t have the oversold conditions that could bring a trade opportunity (although ideally, I like to see the bounce off the midline as the bull market dip ‘buy’).

With technicals moving net bearish (i.e., all in the red), we don’t have the cues to help time our signals, and this includes the ‘positive’ looking Dow Jones Industrial Index.