Russell 2000 a Rare Bright Spot as S&P 500, Nasdaq Break Below Key Levels

2023.10.27 03:28

For a change it wasn’t the taking the bear market highlight report, but the and instead.

It was always going to be hard for indexes trading near prior swing lows to hang on to those lows with the peer Russell 2000 () in freefall.

Today saw a decisive break of the 20-day MA for the Nasdaq, with only the (generally) light volume acting as some succor, while the S&P 500 registered a firm distribution day.

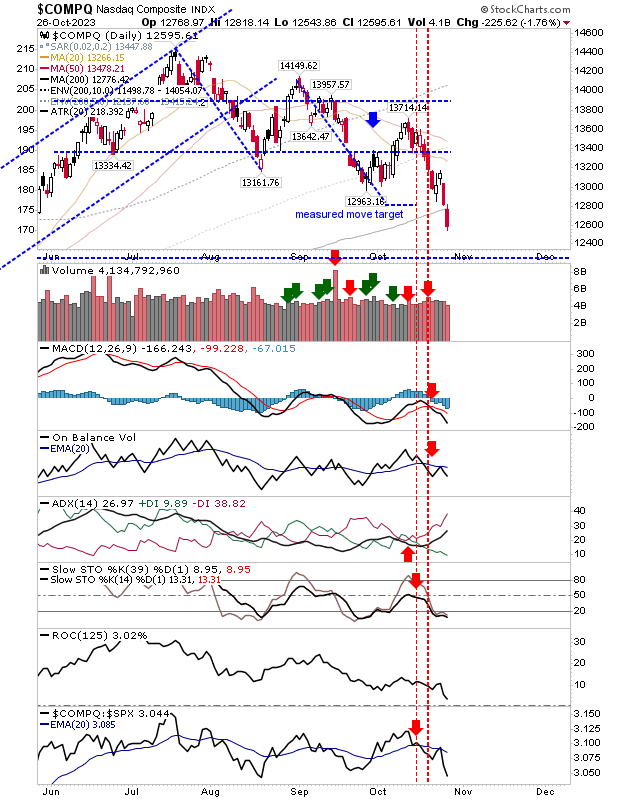

Nasdaq

Starting with the Nasdaq, the measured move target that had offered some support alongside the 200-day MA is no more.

We can now start tracking the percentage loss relative to this moving average before we get to a major swing low, although a loss greater than 10% against its 200-day MA is needed before we get to a period of historic weakness greater than 90% of past price action dating back to 1971.

COMPQ-Daily Chart

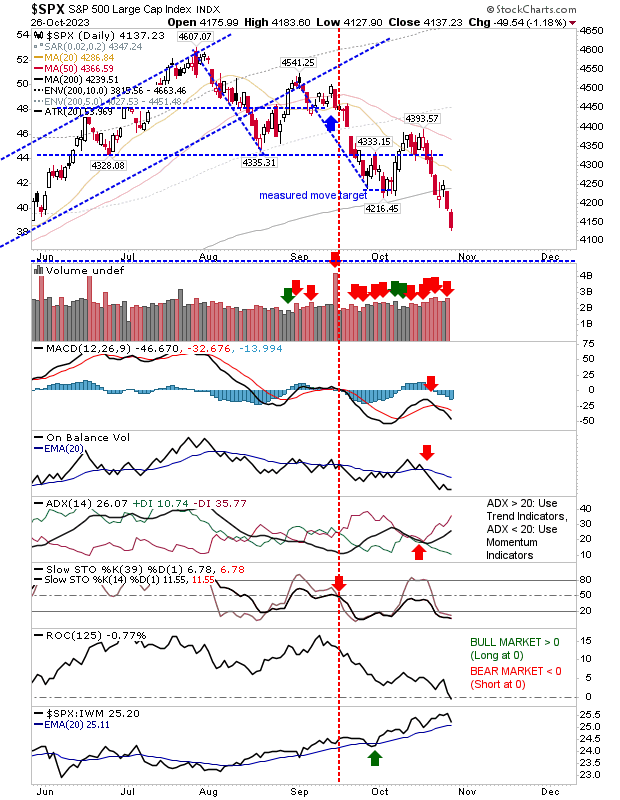

S&P 500

It’s looking tougher for the S&P 500. Today marked a clear distribution day after the Monday break of its 200-day MA.

Technicals are firmly in bear territory and the MACD trigger ‘sell’ below the bullish zero line is a harbinger of quick losses. The drop below 0% in Rate-of-Change is another marker of a longer-term bearish shift.

SPX-Daily Chart

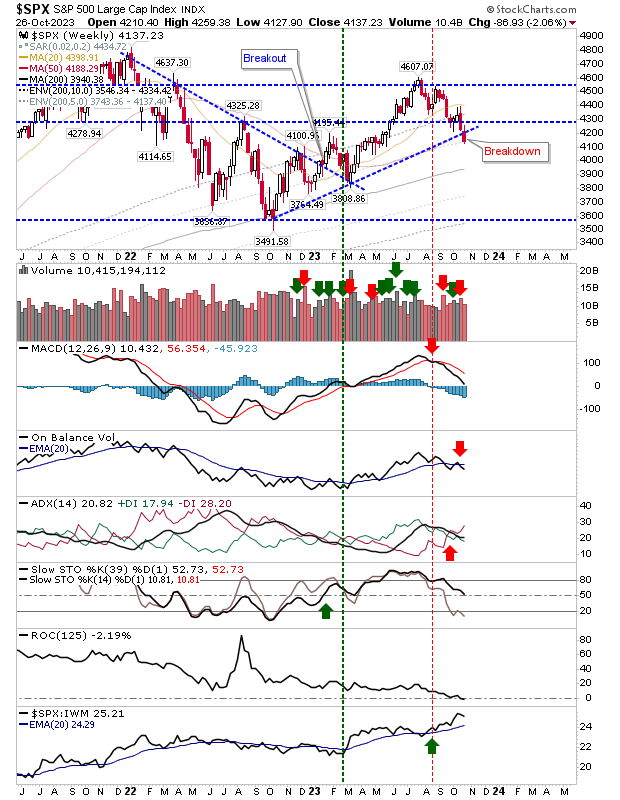

The daily chart for this index is looking ugly, although the weekly chart still has avenues for support but for how long is anyone’s guess.

SPX-Weekly Chart

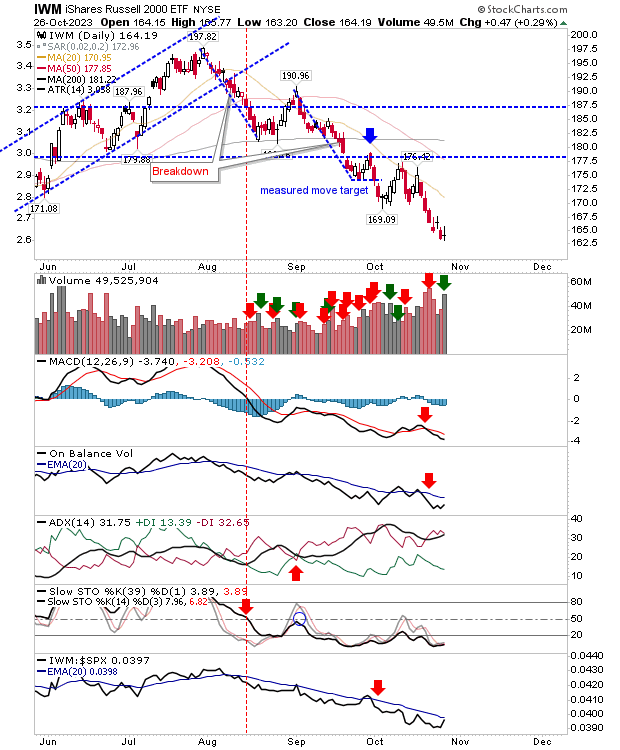

Russell 2000

The Russell 2000 (IWM) was a rare bright spot, churning on heavy volume on a neutral ‘doji’. There is the potential here for a swing low and with a stop below $163.20, with the risk/reward quite favorable (an initial target of the 20-day MA for starters).

However, with the book the S&P 500 and Nasdaq looking like they are still only in the early phase of a decline, it might be a hard buy.

IWM-Daily Chart

Conclusion

It felt inevitable that the S&P 500 and Nasdaq would follow the Russell 2000 ($IWM) lower. The question now is whether the selling in the Russell 2000 ($IWM) is done, or if the conditions for a crash are still in play?

While I like the daily picture in the Russell 2000 for a bottom, the weekly chart looks horrible.