Roku Stock Is Down But Not Out

2022.09.22 02:01

[ad_1]

To say streaming platform and hardware provider Roku (NASDAQ:) stock is having a bad year down (69%) would be an understatement. The Company went from six consecutive quarters of triple-digit growth and record profits to mounting losses and slowing growth in dramatic fashion as its shares peaked at $490.76 at the end of July 2021 to crater to a low of $62 a year later. The Company has 63.1 million subscribers on its streaming platform utilizing the Roku OS either through a streaming device or smart TV. Roku is one of the largest streaming platforms, where viewers can view streaming content on their TVs. It’s important to distinguish between streaming services and networks that provide content like Netflix (NASDAQ:), Hulu, Comcast (NASDAQ:) owned Peacock, Warner Bros Discovery (NASDAQ:) owned HBO Max, Disney+ (NYSE:) and platforms that enable streaming the content to viewer like Roku, Amazon Fire (NASDAQ:), Apple TV (NASDAQ:), and Google (NASDAQ:) Chromcast. Roku admits the slowdown in TV advertising spend will continue to pressure its business for the near-term future. Inflationary pressures and the macro-economic environment has caused consumers to moderate discretionary spending and advertisers to “significantly curtail” spending in the ad scatter market in the latter half for Q2. The normalization back to pre-COVID levels is continuing to occur like air leaking out of a balloon. are growing slower while losses are growing larger. They missed their Q2 2022 EPS by (-$0.14) as well as revenues targets by (-$40 million) prompting them to withdraw their prior full-year 2022 revenue growth estimate of 35%. Needless to say, that sent shares crumbling after earnings only to regain its losses on a rebound but return back to those levels with the overall market sell-off.

Advertising Demand Shock

This demand shock from the sudden withdrawal of ad spending was also echoed in earnings misses by Meta Platforms (NASDAQ:), Snap (NYSE:) and even Alphabet. A survey by Advertiser Perceptions indicates that 47% of advertisers in the U.S. admit to making in-quarter pauses on ad spending in TV streaming, 44% on digital video and 42% on legacy pay TV. Like déjà vu, it mirrors the environment at the start of the 2020 pandemic. However, Roku was able to reach a milestone surpassing $1 billion in Upfront commitments from all seven major agency holding companies. The Company launched Shoppable Ads, which is an interactive option that enables users to purchase items by pressing “OK” on their Roku remote on a Shoppable Ad to seamlessly proceed to checkout complete with shipping and payment information supplied through their Roku accounts.

Reality Bites Roku

On July 28, 2022, Roku reported its fiscal Q2 2022 results for the quarter ending June 2022. The Company reported an earnings-per-share (EPS) loss of (-$0.82) versus consensus analyst estimates for a loss of (-$0.68), a (-$0.14) miss. Revenues grew 18.4% YoY to $764 million, missing analyst estimates for $804.64 million. The platform revenues increased 26% YoY to $673 million. Player revenues fell (-19%) YoY to $91.2 million. Active accounts grew to 63.1 million, up 1.8 million YoY. Average revenue per user (ARPU) rose 21% YoY to $44.10. Gross profits grew 5% YoY to $355 million. Streaming hours fell 0.2 billion hours from prior quarter to 20.7 billion hours.

It Doesn’t Get Better

The Company lowered its guidance for Q3 2022 revenues to come in around $700 million versus $902.66 consensus analyst estimates. Total gross profits are expected around $325 million, and adjusted EBITDA of (-$75 million).

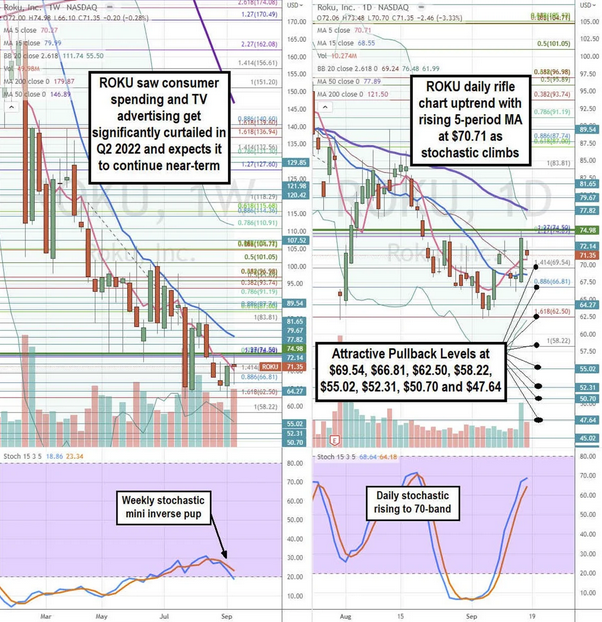

Roku Inc Chart

ROKU Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provide a precision view of the landscape for ROKU stock. The weekly rifle peaked near the $117.39 Fibonacci (fib) level before plunging on the failed weekly stochastic low band coil attempt. The weekly 5-period moving average (MA) resistance is slowing its descent at $99.20 followed by the weekly 15-period MA at $119 as the weekly stochastic attempts another cross up at the 10-band. The higher cross up this time sets up a potential weekly divergence bottom if it can bounce through market structure low (MSL) buy trigger level on a breakout through $110.56. The weekly 200-period MA is flat at $177.69. The weekly upper Bollinger Band (BB) sits at $251.85. The daily rifle chart downtrend is stalled as the daily 5-period MA flattens at $87.14 followed by the flattening 15-period MA at $94.30. The daily lower BBs sit at $71.71 with upper daily BBs at $122.68. The daily stochastic is attempting to coil off the 20-band. Prudent investors can watch for opportunistic pullback levels at the $86.39, $83.54 fib, $77.15 fib, $71.71 fib, $67.22, $61.12, $58.22 fib, $53.90, and the $46.39 fib level. Upside trajectories range from the $117.39 fib level up towards the $163.06 fib level.

ROKU Takeover Speculation (Again)

It seems every few months a new takeover rumor emerges for Roku. In June, it was rumored that Netflix was considering Roku for acquisition. Recently, shares spiked again on speculation of an impending buyout stemming from an 8-K filing amending severance benefits in the event of a change in control. This is somewhat standard language, but speculators took it as a sign of an impending buyout since co-founder Anthony Wood still retains 59% of the voting power held through Class B shares.

ROKU The Silver Lining?

The pullback in digital ad spending is affecting all the streaming services and social networks. If everyone is affected, then investors will eventually magnify achievements that differentiate better performance. Roku is still showing growth on its platform business which is 80% of the business while it’s legacy hardware player business continues to shrink. As long as the platform business which includes smart tv licensing, ad network, and the Roku Channel continues to show growth, the stock is not completely knocked out. The Roku Channel was again a top 5 channel on its platform in the U.S. The cutting the cord trend continues and will continue to be a tailwind driving more eyes to streaming channels and away from legacy pay TV. The Roku channel teamed with NBCUniversal to offer local news. Roku shares can recover with any hints of improvement in ad spend coming from any of the streaming services, platforms or social networks. There is always the potential for an acquisition assuming CEO Wood is onboard.

Original Post

[ad_2]

Source link