Robinhood Faces Elliott Wave and Valuation Problems

2024.10.02 05:05

After facilitating the meme stock craze of early-2021, Robinhood (NASDAQ:) tried to take further advantage of it by becoming a meme stock itself with its late-July, 2021, IPO. The plan seemed to be working for a while as the stock more than doubled in just a few days. The rise of meme stocks like GameStop (NYSE:) and AMC Entertainment (NYSE:) was clearly unsustainable though, and as their market quotations fell, they took Robinhood down with them.

In less than a year between early-August 2021 and mid-June 2022, Robinhood stock crashed by 92% from an all-time high of $85 to as low as $6.81 a share. This is also the main reason why we’ve never written about Robinhood before. It is not easy to recognize a reliable Elliott Wave pattern in a “falling knife” selloff. But as the company and its stock price stabilized over the past two years, one seems to have finally emerged.

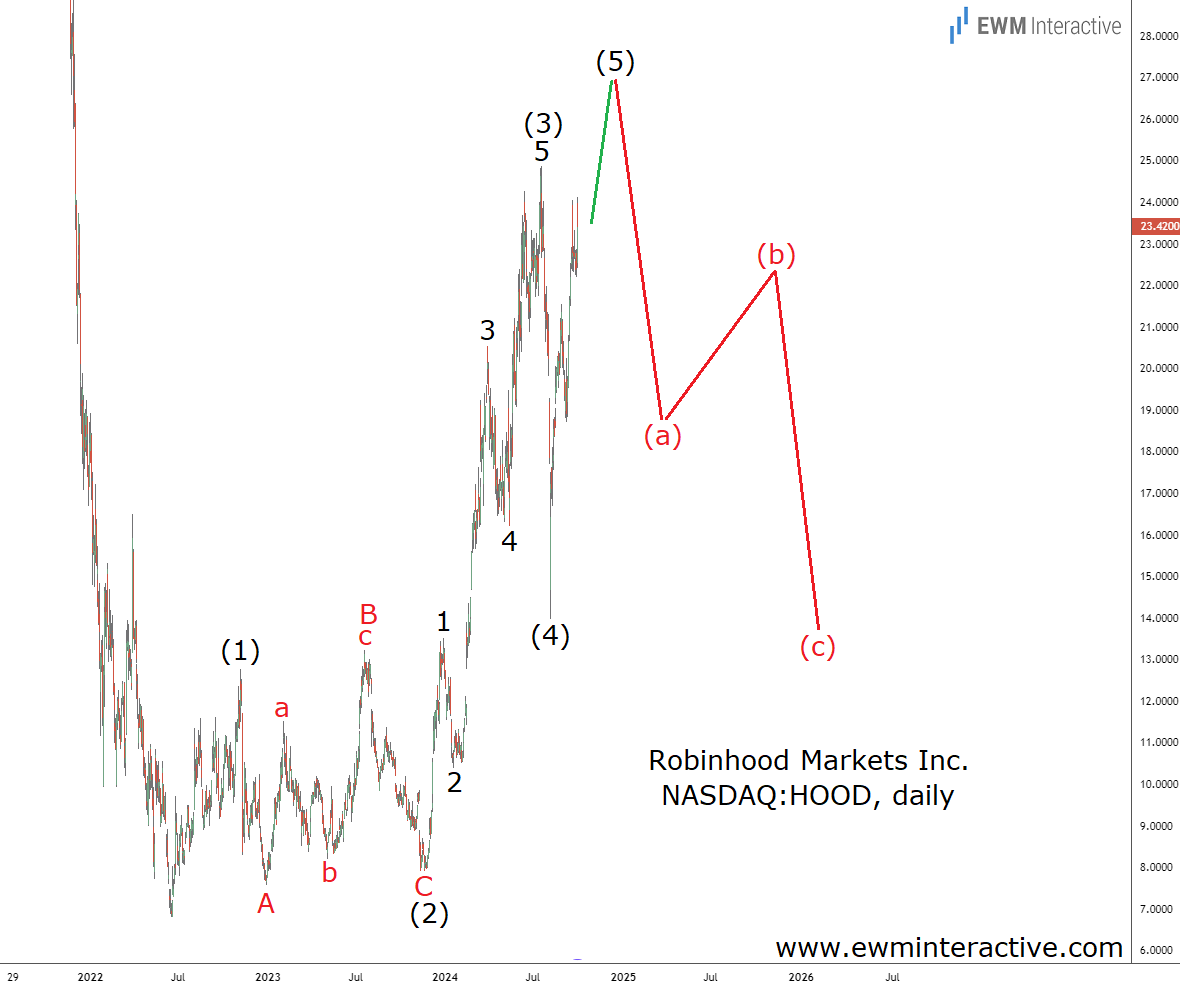

The recovery from $6.81 can be seen as an almost complete impulse pattern, marked (1)-(2)-(3)-(4)-(5), where the five sub-waves of wave (3) are visible, as well. The market has also taken the guideline of alternation into account. Wave (2) took the shape of a sideways-moving A-B-C running flat correction, while wave (4) was a deep and sharp selloff.

It wasn’t deep enough to touch the top of wave (1) and invalidate the impulse pattern, however. This makes us think that the current surge must be its fifth and final wave. According to the theory, not long after wave (5) exceeds the top of wave (3), a three-wave correction in the other direction should follow. Corrections usually erase most or all of the fifth waves, putting downside targets near $15 a share on the table. Given its rather high P/E ratio of 33, Robinhood’s valuation doesn’t offer investors much comfort, either.

Original Post