Risk rally on pause, dollar rebounds as NFP report awaited

2024.01.03 09:35

- December jobs report not expected to upset markets

- Any slowdown in hiring could reinforce rate cut bets

- But dollar bulls anticipating a different outcome on Friday, 13:30 GMT

Markets vs the Fed

The soft landing narrative completely took hold of the markets towards the end of 2023, spurring a risk rally that pushed Treasury yields to multi-month lows and Wall Street to all-time highs. This renewed optimism for the US economic outlook came about from Fed officials flagging the possibility of a policy pivot in the not too distant future.

Not that the economy was in trouble to begin with. Much of the gloom for 2024 had been built on fears that central banks would keep interest rates at high levels for too long. But at the December FOMC meeting, Fed chief Powell signalled that if inflation continues to come down, then rates would need to be lowered accordingly to maintain policy at the same level of restrictiveness.

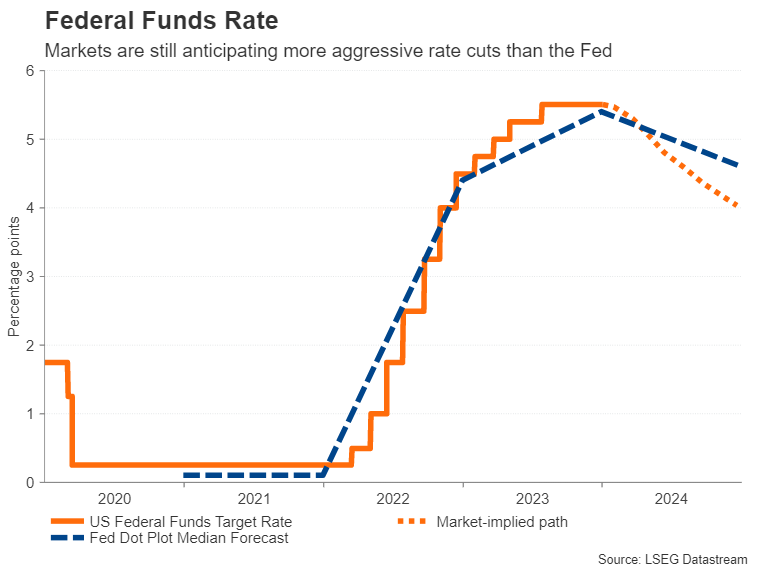

You could argue that this then justifies the exuberance in the markets. Well, only partially. The Fed’s own projection of three 25-bps rate cuts in 2024 sounds reasonable under this assessment. But investors’ view that lower inflation will warrant rate cuts by as much as 150 basis points carries a lot of risk. The main risk being that the US labour market has yet to show any real signs of cracks and could easily heat up just from modest rate cuts.

Will there be any surprises in December payrolls?

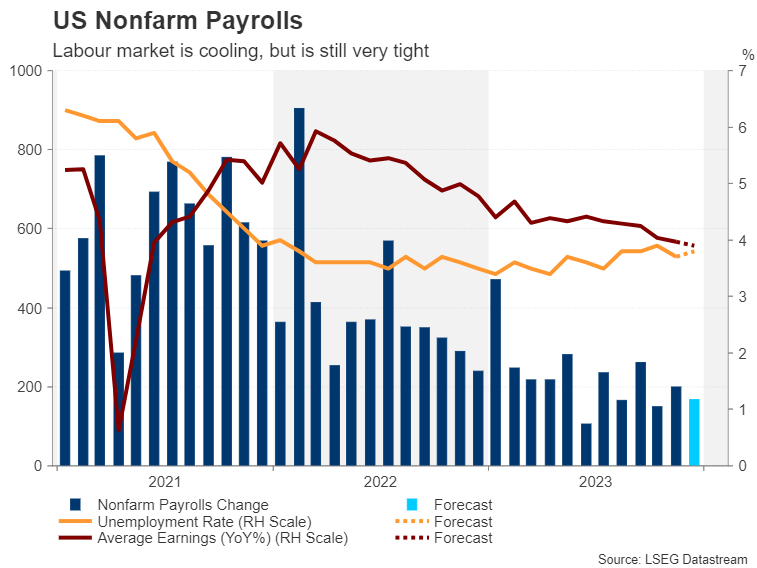

Whilst both hiring and wage growth have moderated in recent months, businesses are not laying off staff in significant numbers either. This picture likely sums up how the jobs market ended the year but it’s worth noting that the risk of an upside surprise is looking somewhat greater than a downside one as other indicators suggest hiring remained healthy in December.

Nonfarm payrolls are forecast to have increased by 168k in December, down from November’s 199k print. This slight cooling off is expected to have pushed up the unemployment rate from 3.7% to 3.8%, while average hourly earnings are seen rising 0.3% month-on-month and 3.9% year-on-year, easing marginally from 4.0% in the prior month.

Other data releases on Friday will include the ISM non-manufacturing PMI for December and factory orders for November.

Can the dollar extend its gains?

With rate cuts priced in so heavily by investors, a stronger-than-expected NFP report risks roiling markets at a time when some traders have already started to question their overoptimistic view on the Fed rate path. Stock markets have begun 2024 on a negative footing as rate cut bets are being scaled back somewhat, although a flare up in tensions in the Middle East is also contributing to the risk-off mood.

The US dollar, meanwhile, has been recouping some of its year-end losses and could continue to recover if the US economy adds more jobs than anticipated in December. Against the yen, the dollar is fast approaching its 200-day moving average (MA), located slightly above the 143.00 level. A break above 143.00 yen would open the way for the 23.6% Fibonacci retracement of the January-November 2023 uptrend at 146.09, while a bit higher is the 50-day MA at 146.84.

Are markets looking to consolidate?

However, the rebound attempt could suffer a setback if the jobs numbers either disappoint or underwhelm. The greenback could revisit the December 28 five-month low of 140.24 yen if the data points to rate cuts coming sooner rather than later. The 50% Fibonacci of 139.57 lies not too far below the December trough, with the 61.8% Fibonacci on standby to halt any further slide at 136.65.

Alternatively, if investors end up with a not too hot, not too cold jobs report, they might still decide to remain cautious, at least until a clearer trend starts to emerge as to what direction the economy is headed in. This would of course spoil Wall Street’s chances of benefiting from the January effect, while the dollar could enter a period of consolidation.