Risk-On Sentiment Prevails for 2025’s Debut, Fueled by US Stocks

2025.01.06 08:54

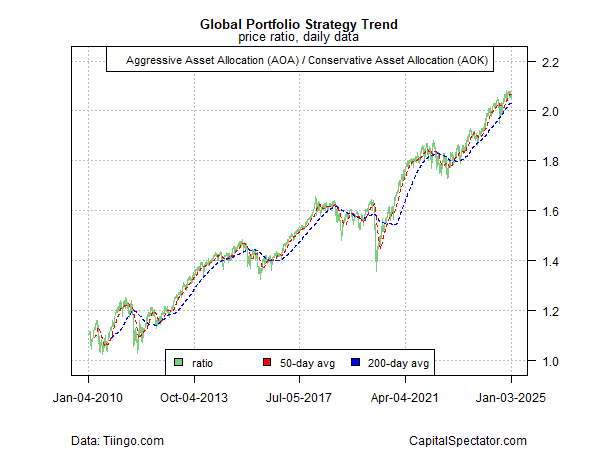

There are many reasons to question a bullish outlook at the start of the year, but the gravity-defying trend remains intact overall, based on a set of ETF pairs that track global asset allocation strategies through Friday’s close (Jan. 3). The analysis turns mixed, however, when analyzing markets on a more granular level. From a global top-down perspective, the bullish trend still looks solid.

Following a modest correction last summer, the ratio for an aggressive mix of global assets () vs. a conservative counterpart () continues to trend higher.

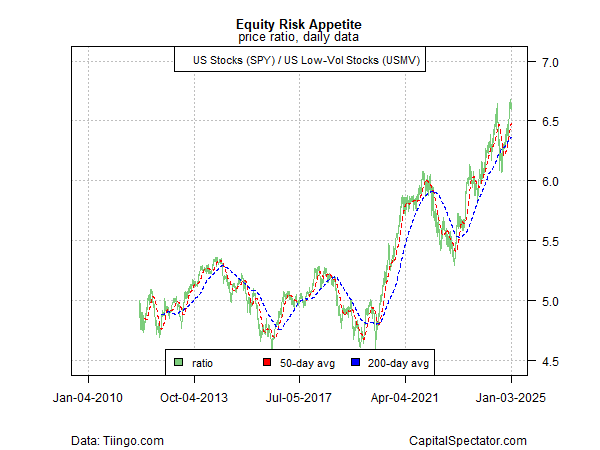

The risk appetite for US equities continues to rebound after the summer’s sharp correction, based on the ratio for a broad equities ETF () vs. a low-volatility portfolio of stocks ().

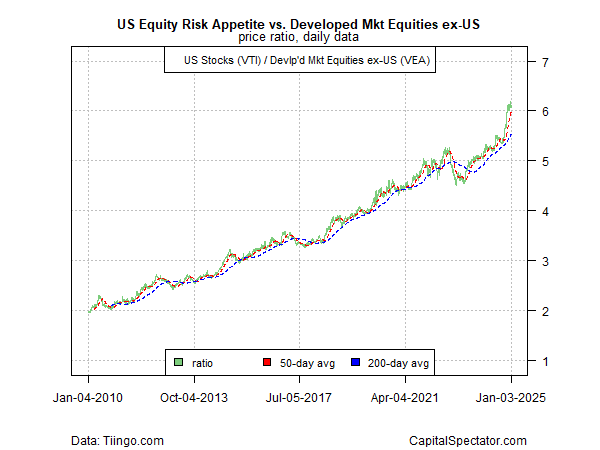

The caveat: the bullish momentum for equities is increasingly reliant on US shares — stocks ex-US, by comparison, are faltering. Consider, for instance, the bull run in US shares () relative to stocks in developed markets ex-US (). In recent weeks, the American premium for equities has surged, a trend that’s become extreme lately, as shown by the VTI:VEA ratio.

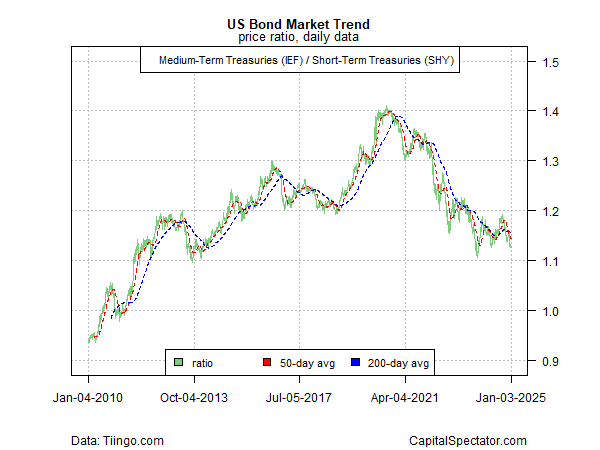

For US bonds, a risk-off trend persists, based on the ratio for medium-term Treasuries () vs. short-term maturities (). Despite several attempts to recover in recent years, the downside bias has resumed.

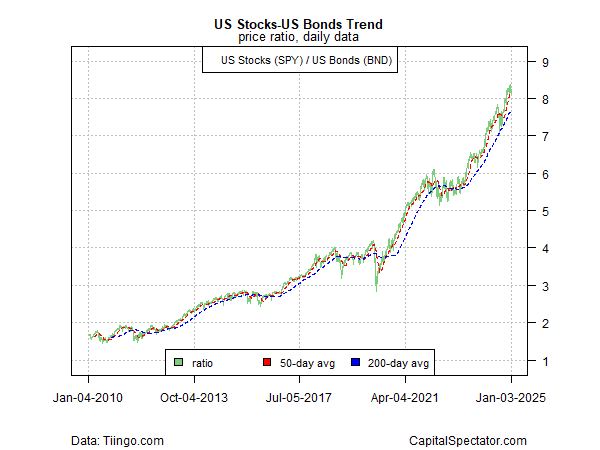

The sharp divergence in US stocks (SPY) vs. US bonds overall () tells a similar story: risk-on for equities dominates as fixed-income beta slumps.