Reynolds Consumer Products High Yield Bought on the Dip

2023.02.10 12:40

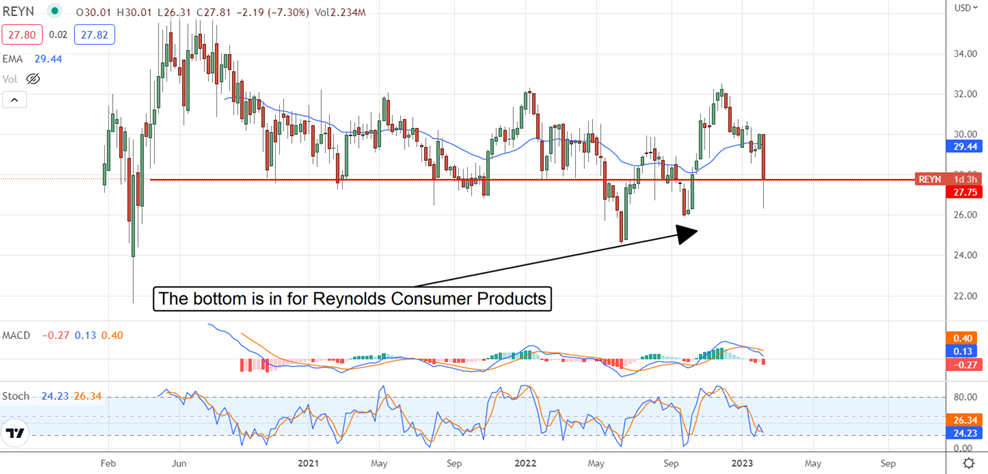

- Reynolds Consumer Products fell hard on weak results, but the bottom is already in.

- The institutions have been buying this stock and may be supporting it now.

- The dividend yields 3.35% and should be reliable in 2023.

Reynolds Consumer Products (NASDAQ:) share price has struggled to gain traction since the IPO, but one thing is certain. When the share prices drop below $27.75, someone in the market steps in and buys them, which is happening now. The Q1 guidance and outlook for the year are a little on the light side and have the share prices down hard from recent levels.

This has the market back in the “buy zone,” and it looks like the bottom is already in. The price action hit a 3-month low following the news and is already bouncing higher.

This buying signals to investors, specifically income investors, that this dividend is attractive. The stock is on the pricey side, trading at 20X earnings, but it yields a hefty 3.35%, and the payout appears safe enough. Leverage and debt are on the high side, but there is room to continue paying the distribution, although dividend increases should not be expected.

It doesn’t look like the analysts are buying the stock; they rate it a hold and are lowering their price targets in the wake of the Q4 results. The new targets assume the stock is fairly valued at the new levels near $27, so it must be someone else. The institutions are a good guess; they’ve been buying the stock all year and have netted more than $100 million in the last 12 months.

That’s about 1.75% of the market cap at these levels and has their interest up to about 30%. Assuming this , the bottom may not only be in, but the next upswing within the post-IPO trading range may start very soon.

Reynolds Has Mixed Quarter, Gives Light Guidance

The primary reason for Reyold’s fall is the and light guidance. The company reported revenue that was only aligned with expectations, while the earnings came in a bit light. The cause is weakness in the Baking and Cooking segment, which includes the core Reynolds Wrap brand and has been impacted by rising costs.

On a segment basis, 3 of the 4 operating segments produced growth and profitability akin to pre-pandemic levels. The Banking and Cooking segment is the only one to show weakness, primarily in its impact on the bottom line. The segment revenue fell by only 3%, which isn’t much given the surge in household spending seen during the pandemic’s peak.

The worst news is the bottom line, which contracted by 49%, but even that is mitigated by the cause the company plans. The company experienced some unplanned downtime that led to deleveraging, which will be addressed in the current and following quarters. The company’s plans include maintaining operational momentum to improve efficiency and profitability. These efforts are expected to aid results on an ongoing basis, suggesting the guidance may be cautious.

The company’s guidance for Q1 and FY 2023 is for flat to slightly higher revenue and earnings relative to 2022. This is 360 basis points below the consensus at the top line and 270 bps below the Marketbeat.com consensus on the bottom line, but it may be an easy bar to beat. The risk is that rising prices for products in other categories are dampening demand which is seen in lower volume sales. If this trend worsens, it could offset any benefit the company can achieve.

The Technical Outlook: Reynolds Consumer Products Is Range Bound

Reynolds Consumer Products stock fell hard on the Q4 news, but the selling is most likely over. The stock has been range bound since the IPO and will continue for the foreseeable future. The company has headwinds but also cash flow and pays a nice dividend, which will keep it moving sideways for now. If the institutions lose interest, share prices could fall to new lows.