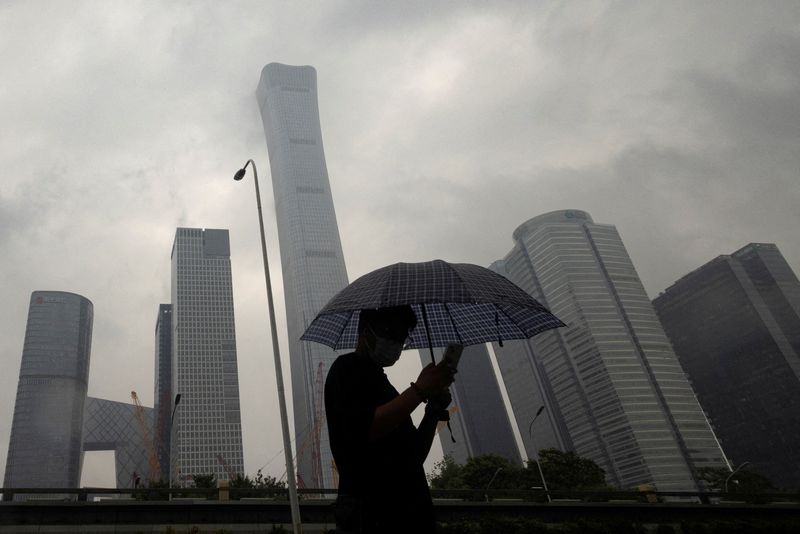

Reviving China’s stock market helps economic recovery, China Sec Journal says

2024.09.29 21:57

SHANGHAI (Reuters) – Reviving China’s stock market and boosting investor confidence will aid the country’s economic recovery by breaking a vicious cycle that has curbed investment and consumption, the official China Securities Journal said in an editorial on Monday.

Chinese stocks raced to their best week since 2008 last week after Beijing unveiled a volley of stimulus measures including interest rate cuts and a $114 billion war chest to boost the equity market.

“The capital market is not only a ‘barometer’ of the macro economy, but also a ‘thermometer’ of investor sentiment,” the editorial said.

“Revitalising the market is a key breakthrough to lift confidence … and improve economic expectations.”

China stocks had underperformed global markets for years dragged down by an economy bruised by a property crisis, weak consumption and geopolitical tensions.

“Investors worried about internal and external risks, resulting in stock market sluggishness, which in turn sapped investor confidence in a negative loop,” the China Securities Journal said.

Low risk appetite also made exit difficult for private equity investors, hurting the economy, so rejuvenating the capital market helps break the vicious cycle, the article said.

The newspaper said more policy announcements ahead will cement confidence further, helping to repair households’ balance sheet and reviving the economy.

($1 = 7.0110 yuan)